The future of cryptocurrency mining is a complex and multifaceted topic, brimming with technological advancements, energy concerns, and economic implications. This exploration delves into the key elements shaping the future of this dynamic industry, from the latest hardware innovations to the evolving regulatory landscape. We’ll examine how sustainability, decentralization, and cloud mining are reshaping the industry, while also considering the broader impact on blockchain technology and the global economy.

This detailed analysis covers technological advancements in mining hardware, exploring the evolution of ASIC chips and mining algorithms. It also examines the crucial balance between profitability and environmental responsibility, evaluating the energy consumption of different cryptocurrencies and potential solutions for sustainable mining practices. The role of decentralization, security, and the impact of cloud mining are also investigated, providing a comprehensive picture of the future of this exciting sector.

Technological Advancements in Mining

The cryptocurrency mining landscape is constantly evolving, driven by relentless technological advancements. These advancements are crucial for maintaining profitability and competitiveness in this dynamic market. Hardware improvements, specialized chips, and algorithmic changes all play a vital role in optimizing mining operations. This exploration delves into the specifics of these innovations, their impact, and potential future directions.The race to mine cryptocurrencies effectively hinges on maximizing computational power while minimizing energy expenditure.

Mining hardware has evolved significantly from the early days of CPUs and GPUs, to the specialized Application-Specific Integrated Circuits (ASICs) that dominate today’s market. This evolution reflects the constant pursuit of efficiency and profitability.

The future of cryptocurrency mining is looking pretty interesting, with new technologies constantly emerging. While we’re all excited about the potential for faster, more efficient mining, it’s also cool to see companies like Google acknowledging cultural moments like Hispanic Heritage Month. Google Pixel phones are getting exclusive wallpapers celebrating the month, a thoughtful touch, which is something I like to see in tech companies.

This demonstrates a forward-thinking approach to design and inclusion, a parallel to the innovation in cryptocurrency mining technology. Ultimately, the future of mining is tied to adapting to trends and reflecting inclusivity. google pixel phones get exclusive wallpapers hispanic heritage month is a perfect example of that.

Latest Hardware Advancements

Recent advancements in hardware have focused on increasing the processing power of ASICs. This has led to a significant increase in the computational speed and efficiency of mining rigs. Improvements in transistor density, circuit design, and cooling mechanisms are key factors behind these enhancements. The result is a substantial reduction in energy consumption per hash rate compared to earlier generations of mining equipment.

Specialized ASIC Chips and Efficiency

Specialized ASIC chips are now meticulously designed for specific mining algorithms, optimizing their performance. This tailoring significantly impacts mining efficiency. The design of these chips is closely tied to the algorithm they are optimized for, and advancements in chip manufacturing technologies allow for ever-more complex and efficient implementations. This has made ASICs the dominant force in modern mining, enabling miners to operate with a higher return on investment.

Comparison of Mining Algorithms

Various mining algorithms have shaped the history of cryptocurrency mining. Proof-of-Work (PoW) algorithms, such as SHA-256 used by Bitcoin, rely on complex mathematical computations. These algorithms are designed to be computationally intensive, deterring attackers. Alternative algorithms, like Proof-of-Stake (PoS), are emerging as viable alternatives. PoS systems generally require less computational power, leading to lower energy consumption.

The future of mining may see a shift towards these more energy-efficient models.

Evolution of Mining Hardware

| Era | Hardware | Impact on Energy Consumption | Key Innovations |

|---|---|---|---|

| Early Days (2009-2010) | CPUs, GPUs | High | Initial mining using readily available hardware. |

| Rise of ASICs (2010-2015) | Specialized ASICs | Moderate | Development of dedicated hardware, significant gains in efficiency. |

| Advanced ASICs (2015-Present) | High-performance ASICs | Decreased, but still high for some algorithms | Constant improvements in chip design, transistor density, and cooling systems. |

| Future | Quantum computing, neuromorphic computing | Potentially decreased or dramatically changed | Completely new paradigms of computation, requiring new strategies. |

Potential Future Hardware Innovations

Potential future innovations could involve the integration of specialized hardware components like field-programmable gate arrays (FPGAs) or even emerging technologies like quantum computing. This could revolutionize mining by drastically improving computational power.

Energy Consumption and Sustainability

The allure of cryptocurrency, with its decentralized nature and potential for financial innovation, has brought forth a significant environmental concern: its energy consumption. Mining cryptocurrencies, the process of validating transactions and adding them to the blockchain, often requires substantial computational power, leading to substantial energy demands. This raises questions about the long-term sustainability of this technology. The energy footprint of different cryptocurrencies varies widely, necessitating a critical examination of their environmental impact.Mining operations, especially those for energy-intensive cryptocurrencies, can have a considerable impact on local ecosystems and contribute to greenhouse gas emissions.

This presents a challenge for the long-term viability of cryptocurrencies if their energy use remains unsustainable. Finding solutions to mitigate these environmental concerns is crucial for the acceptance and future of cryptocurrencies.

Environmental Concerns Surrounding Cryptocurrency Mining

The energy-intensive nature of cryptocurrency mining raises significant environmental concerns. Mining operations, particularly for cryptocurrencies like Bitcoin, often require vast amounts of electricity, leading to high carbon emissions and contributing to climate change. This reliance on fossil fuels further exacerbates environmental issues. The geographical concentration of mining operations in regions with readily available, but often unsustainable, energy sources adds another layer of complexity.

Comparative Analysis of Cryptocurrency Energy Consumption

Different cryptocurrencies exhibit varying levels of energy consumption during mining. Bitcoin, known for its high energy requirements, often receives the most scrutiny. However, other cryptocurrencies, such as Ethereum (prior to the transition to Proof-of-Stake), also demand substantial energy resources. The varying consensus mechanisms employed by different cryptocurrencies are a primary factor in this disparity. The choice of mining algorithm directly influences the energy intensity of the mining process.

This difference in energy consumption necessitates a critical evaluation of the environmental impact of each cryptocurrency.

Role of Renewable Energy Sources

Renewable energy sources offer a promising avenue for mitigating the environmental impact of cryptocurrency mining. By transitioning to renewable energy sources like solar, wind, and hydroelectric power, mining operations can significantly reduce their carbon footprint. Implementing renewable energy solutions not only reduces greenhouse gas emissions but also fosters energy independence and sustainability. Furthermore, the use of renewable energy can create new economic opportunities and jobs in the renewable energy sector.

For instance, mining operations in regions with abundant renewable energy sources could potentially become more environmentally friendly and economically viable.

Energy Consumption per Unit of Cryptocurrency Mined, The future of cryptocurrency mining

| Cryptocurrency | Approximate Energy Consumption (per unit mined) |

|---|---|

| Bitcoin | Significant |

| Ethereum (Pre-Merge) | Substantial |

| Litecoin | Lower than Bitcoin, but still considerable |

| Monero | Variable, depending on the specific mining setup |

| Solana | Lower than many other cryptocurrencies |

Note: Exact figures for energy consumption per unit mined are difficult to quantify precisely due to the variability in mining hardware, electricity costs, and geographical locations.

Strategies for Reducing the Environmental Impact of Mining

Several strategies can help reduce the environmental impact of cryptocurrency mining. These include the adoption of more energy-efficient mining hardware, the utilization of renewable energy sources, and the development of alternative consensus mechanisms that are less energy-intensive. The transition to Proof-of-Stake (PoS) consensus mechanisms in some cryptocurrencies reduces energy consumption compared to Proof-of-Work (PoW) systems. Improved mining techniques, optimized algorithms, and increased efficiency in energy use can significantly decrease the overall environmental impact of mining.

Moreover, collaborations between mining companies and renewable energy providers can foster a sustainable ecosystem for cryptocurrency mining.

The Role of Decentralization and Security

The future of cryptocurrency mining hinges on its ability to balance decentralization with robust security. While centralized mining pools offer economies of scale and efficiency, they present vulnerabilities. A truly secure and sustainable mining ecosystem requires a shift towards more decentralized models that distribute control and mitigate the risks of single points of failure. This shift necessitates exploring novel approaches to both mining protocols and security measures.The ongoing debate revolves around the optimal balance between efficiency and security.

Decentralization, while promoting resilience against attacks and censorship, can potentially lead to lower hashing power compared to centralized mining pools. Mining pools, while centralized, often offer attractive rewards and stability for miners. Therefore, the future of cryptocurrency mining likely involves a combination of strategies, with decentralized solutions playing a crucial role in mitigating risks associated with centralization.

Potential for Decentralization in Mining

Decentralized mining, by distributing computational power across a wider network of miners, reduces reliance on a few large entities. This dispersion of control makes the system more resistant to attacks and censorship. This distributed approach, in theory, enhances the overall security and resilience of the network. Miners operating independently or in small groups can form decentralized pools, thus avoiding the centralized control of a single pool.

This can improve security, but potentially at the cost of efficiency.

Security Implications of Different Mining Strategies

Centralized mining pools, while offering efficiency, create a single point of failure. A malicious actor compromising a significant pool could disrupt the network’s security. The concentration of hashing power in a few hands also creates an opportunity for manipulation. This can include a potential decrease in mining rewards for miners who are not part of the larger pools.Decentralized models, however, distribute the risk.

An attack on one miner is less likely to cripple the entire network. The challenge with decentralized models lies in ensuring fairness and coordinating mining efforts across numerous participants. The security benefits come from the dispersion of power, but the practical challenges remain.

Future Developments in Decentralized Mining Protocols

Future developments in decentralized mining protocols will likely focus on enhancing coordination and security. Innovative consensus mechanisms and cryptographic techniques will be crucial. The development of new cryptographic algorithms that offer greater resistance to attacks and vulnerabilities is likely to play a significant role in this area. New protocols may emerge that leverage blockchain technology and smart contracts to automate and enforce fair distribution of rewards.

Comparison of Mining Pools and Their Influence on Decentralization

| Mining Pool Type | Influence on Decentralization | Example |

|---|---|---|

| Large Centralized Pools | Reduces decentralization; high efficiency, but centralized control. | Pool.Name |

| Decentralized Pools | Enhances decentralization; distributed control, but potential efficiency trade-offs. | DistributedPool.Name |

The choice between centralized and decentralized mining pools directly impacts the level of decentralization in the network. Centralized pools offer efficiency but reduce the resilience of the network. Decentralized pools aim to balance efficiency with enhanced security by distributing mining operations.

Evolution of Security Measures in Mining

Security measures in mining have evolved significantly over time. Early protocols were often vulnerable to various attacks, but the evolution of cryptography and consensus mechanisms has improved resilience. This evolution includes the introduction of more sophisticated cryptographic algorithms and protocols. The use of multi-signature transactions and improved security audits helps to combat fraud and theft.

“Security in cryptocurrency mining is an ongoing process of adapting to new threats and vulnerabilities.”

Early mining practices were often characterized by vulnerabilities, which were addressed over time. The adoption of advanced security protocols, such as multi-factor authentication and robust transaction verification, are vital to the development of a secure and sustainable ecosystem.

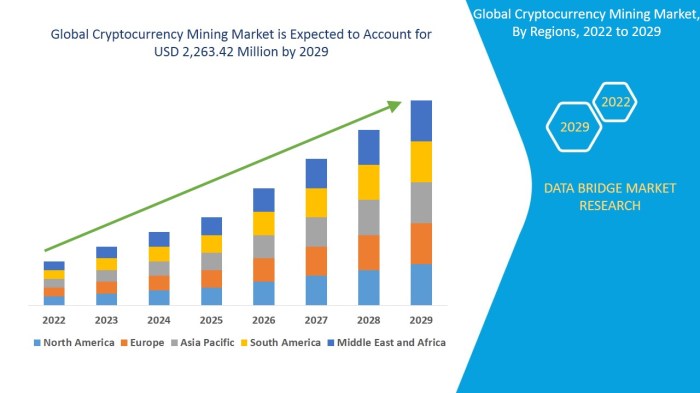

Economic and Financial Implications

Cryptocurrency mining, while seemingly a niche activity, has profound economic implications for individuals, businesses, and the global economy. From the initial investment costs to the potential returns and the influence on other industries, mining’s impact is far-reaching. Understanding these implications is crucial for anyone interested in the future of cryptocurrencies.

Economic Implications for Individuals and Businesses

The entry barrier for individual participation in cryptocurrency mining is significant. Initial investment costs can range from a few hundred dollars for small-scale setups to tens of thousands or more for substantial operations. Profitability depends heavily on factors like the chosen cryptocurrency, the mining hardware’s efficiency, and the electricity costs in the mining location. Businesses, on the other hand, face more complex considerations.

They need to evaluate the operational costs, including electricity, maintenance, and personnel. The potential return on investment (ROI) is also influenced by the scalability of their mining operations and market conditions. This investment can be very risky.

Impact on the Global Economy

Cryptocurrency mining’s impact on the global economy is multifaceted. It influences energy consumption patterns, potentially contributing to carbon emissions in regions with less sustainable energy grids. The competition for electricity can also impact other industries that rely on the same grid, such as manufacturing and agriculture. On the positive side, mining can create new jobs and spur innovation in areas like specialized hardware and software development.

It also potentially introduces new tax revenue streams for governments.

Financial Aspects of Mining

The financial aspects of cryptocurrency mining are crucial for assessing its viability. Investment costs vary widely based on the chosen mining hardware (e.g., ASICs, GPUs) and the scale of the operation. Profitability is heavily reliant on electricity costs, hardware efficiency, and the chosen cryptocurrency’s market price and difficulty. The potential return on investment is highly variable and depends on several external factors.

Calculating the ROI involves careful consideration of all these variables.

Potential Return on Investment (ROI)

Determining the precise ROI is challenging due to the volatile nature of cryptocurrency markets. However, a general idea can be gleaned from historical data and current trends. The following table provides a potential ROI range for various mining setups, highlighting the dependence on factors such as electricity prices, hardware efficiency, and market conditions. This is not a guarantee.

| Mining Setup | Estimated Initial Investment | Estimated Monthly Electricity Costs | Estimated Monthly Revenue (assuming favorable market conditions) | Potential ROI (annualized) |

|---|---|---|---|---|

| Small-scale GPU mining (10 GPUs) | $500 – $1000 | $100 – $200 | $50 – $150 | 10% – 30% |

| Medium-scale ASIC mining (10 ASIC miners) | $5000 – $10,000 | $500 – $1000 | $200 – $500 | 20% – 50% |

| Large-scale ASIC mining (100 ASIC miners) | $50,000 – $100,000 | $5000 – $10,000 | $2000 – $5000 | 20% – 60% |

Economic Models for Regulating Cryptocurrency Mining

Various economic models for regulating cryptocurrency mining are emerging. These models range from minimal intervention to comprehensive regulation, each with its own implications for the industry and the wider economy. Some models consider energy consumption and sustainability standards, while others focus on taxation and market stability. A crucial aspect is ensuring a regulatory framework that balances the potential benefits of cryptocurrency mining with its environmental and social impacts.

This involves a careful consideration of potential market distortions and economic externalities.

Regulation and Legal Landscape

The burgeoning cryptocurrency mining industry faces a complex and evolving regulatory landscape. Governments worldwide grapple with balancing the potential benefits of this technology, such as innovation and economic growth, with the inherent risks, including environmental concerns and financial instability. This dynamic environment requires a nuanced approach to regulation, one that fosters responsible innovation while protecting investors and the broader financial system.The future of cryptocurrency mining hinges significantly on the clarity and consistency of regulatory frameworks.

Uncertainty surrounding legal interpretations and enforcement can hinder investment, discourage innovation, and create a less predictable operating environment for miners. This underscores the importance of proactive and well-defined regulations that facilitate responsible development and operation within the industry.

Current Regulatory Landscape

The current regulatory landscape surrounding cryptocurrency mining is fragmented and inconsistent across jurisdictions. Many countries are still in the early stages of developing comprehensive frameworks. Some nations have embraced a more laissez-faire approach, allowing the market to regulate itself, while others have adopted a more cautious stance, imposing stricter rules and limitations.

Potential Future Regulations

Several potential regulatory approaches for cryptocurrency mining are under consideration. These include licensing requirements for mining operations, environmental impact assessments, and energy efficiency standards. Furthermore, there might be restrictions on the use of specific energy sources, such as hydroelectric power, to prevent undue strain on existing infrastructure. The imposition of taxes on mining profits is also a potential avenue of future regulation.

The future of cryptocurrency mining is looking pretty interesting, especially with the rising energy costs. While the Genesis G80 electrified luxury EV reveal ( genesis g80 electrified luxury ev reveal ) showcases a sleek, sustainable future for vehicles, the question remains: will more efficient mining methods emerge to offset these rising energy demands? Ultimately, the energy landscape for cryptocurrency mining is sure to change dramatically in the coming years.

Comparison of Mining Regulations Across Countries and Regions

| Country/Region | Regulatory Approach | Key Features |

|---|---|---|

| United States | Fragmented | Different states have varying regulations regarding energy consumption, environmental impact, and licensing. |

| China | Suppressive | Complete ban on cryptocurrency mining in 2021, highlighting the volatility of regulatory environments. |

| Canada | Evolving | Navigating the intersection of environmental concerns and economic opportunities, with ongoing debates about the energy intensity of mining. |

| Europe | In Development | Efforts to establish harmonized regulations across member states, aiming for a balanced approach. |

This table demonstrates the diverse regulatory approaches worldwide, reflecting the ongoing debate on how to best address the unique challenges posed by cryptocurrency mining.

Legal Challenges and Opportunities

The legal challenges facing cryptocurrency mining are multifaceted. Defining the legal status of cryptocurrencies, classifying mining operations, and determining the appropriate tax treatment are just a few of the key issues. However, these challenges also present opportunities. The development of clear legal frameworks can foster transparency, build investor confidence, and attract investment. Furthermore, it can incentivize innovation and responsible development practices within the industry.

Potential Legislative Frameworks

Potential legislative frameworks for the future regulation of cryptocurrency mining could include:

- Environmental Impact Assessments: Mandating thorough environmental impact assessments for mining operations to ensure responsible energy consumption and minimize negative environmental effects.

- Energy Efficiency Standards: Establishing energy efficiency standards for mining equipment and operations to reduce the industry’s carbon footprint and encourage sustainable practices.

- Licensing Requirements: Implementing licensing requirements for mining operations, ensuring compliance with environmental and safety regulations.

- Taxation Frameworks: Developing clear and transparent taxation frameworks for mining profits, addressing concerns about tax evasion and ensuring fairness within the industry.

These legislative frameworks aim to create a more predictable and stable environment for the cryptocurrency mining industry, fostering responsible growth and innovation. Such frameworks will also help establish trust and legitimacy within the sector.

The Impact of Cloud Mining

Cloud mining services are rapidly changing the landscape of cryptocurrency mining, offering a more accessible and potentially profitable entry point for both individual and institutional investors. This shift towards cloud-based solutions has introduced new opportunities and challenges, impacting the overall mining ecosystem. The ease of entry and reduced upfront capital requirements are compelling factors, but a thorough understanding of the nuances is crucial for successful participation.Cloud mining platforms leverage the computational power of numerous machines hosted in data centers, allowing users to mine cryptocurrencies without the need for expensive hardware or specialized expertise.

The future of cryptocurrency mining is looking pretty interesting, with new technologies constantly emerging. Security is a key concern for miners, and that’s where a system like the simplisafe smart lock alarm system synergy comes in. This system offers enhanced security measures, potentially improving the overall security posture for mining operations, which could then lead to a more sustainable and profitable future for the industry.

This accessibility democratizes the industry, potentially attracting new players and fostering innovation. However, the potential for significant risks and opaque operations also necessitates careful consideration before investing.

Role of Cloud Mining Services in the Future

Cloud mining services are poised to play a significant role in the future of cryptocurrency mining. Their ability to provide access to powerful mining rigs without significant upfront investment makes them attractive to both individual and institutional investors. This accessibility has the potential to drive further innovation and expansion within the cryptocurrency mining industry.

Advantages of Cloud Mining for Individual Investors

Cloud mining presents a range of advantages for individual investors. Lower barriers to entry, minimal upfront capital requirements, and potential for passive income generation are attractive aspects. The ability to mine from anywhere in the world using a web browser provides flexibility and convenience. However, the potential for hidden fees and operational risks needs to be addressed.

Advantages of Cloud Mining for Institutional Investors

Cloud mining offers significant advantages for institutional investors. The scalability of cloud mining solutions enables large-scale mining operations, potentially increasing profits. The ability to leverage the computational power of a large network of miners can yield substantial returns for institutional investors. The potential for diversification into cryptocurrency mining without the burden of infrastructure management is a key advantage.

Disadvantages of Cloud Mining for All Investors

Cloud mining, despite its advantages, presents potential drawbacks for both individual and institutional investors. The risk of scams and unreliable platforms is a significant concern. The lack of transparency regarding the actual hashing power used and the mining efficiency of the platform can be a major disadvantage. Profitability is often dependent on the specific cryptocurrency and market conditions.

Security and Operational Considerations

Security and operational considerations are paramount when choosing a cloud mining platform. The security of user funds and the platform’s operational reliability must be assessed thoroughly. Transparency in reporting and the use of verifiable metrics is critical for assessing the platform’s credibility. Regulatory compliance and licensing are essential for avoiding legal issues.

Future Developments and Innovations in Cloud Mining Services

Potential future developments in cloud mining services include the integration of artificial intelligence and machine learning for enhanced efficiency and profitability. Advanced security protocols and improved transparency in platform operations will likely become crucial. Innovative payment models and diversified investment opportunities could further enhance the cloud mining landscape.

Comparison of Cloud Mining Platforms

| Platform | Features | Pricing Model |

|---|---|---|

| Platform A | High hashing power, transparent reporting, secure infrastructure | Tiered pricing based on hashing power |

| Platform B | Diverse selection of cryptocurrencies, flexible investment options | Percentage-based revenue sharing |

| Platform C | Focus on environmentally friendly mining, renewable energy sources | Fixed monthly fees based on chosen package |

This table provides a basic comparison of different cloud mining platforms. Each platform presents a unique set of features and pricing models, and investors should thoroughly research each platform before making an investment decision. Factors such as platform reputation, security measures, and transparency are critical to consider.

Mining and the Future of Blockchain Technology: The Future Of Cryptocurrency Mining

Cryptocurrency mining, while often perceived as solely focused on generating cryptocurrency, plays a crucial role in the broader blockchain ecosystem. It’s more than just a process for creating new coins; it’s a driving force behind innovation and evolution within blockchain technology itself. This interconnectedness suggests a dynamic future where mining continues to shape the development and applications of blockchain.Mining acts as a fundamental validation mechanism within blockchain networks.

The computational power employed in mining secures the network, preventing fraudulent transactions and ensuring the integrity of the ledger. This security is paramount for the trust and reliability of blockchain-based systems. The very act of solving complex mathematical problems by miners contributes directly to the resilience and stability of the blockchain ecosystem.

The Interplay Between Mining and Blockchain Development

Mining directly influences the evolution of blockchain technology by pushing for advancements in cryptographic algorithms and computational efficiency. The constant need to discover new solutions and maintain network security fosters innovation in areas such as algorithm design, hardware development, and energy efficiency. These advancements benefit not only cryptocurrency but the broader blockchain landscape. The demand for faster transaction speeds and higher network security drives ongoing research and development in blockchain technology, impacting the way blockchains are designed and implemented.

Potential Applications Enabled by Mining

The computational resources harnessed by mining can be leveraged for various blockchain applications beyond cryptocurrency. For instance, decentralized data storage, using blockchain for secure and transparent data management, is a burgeoning field. Mining infrastructure, with its ability to handle massive data volumes, can facilitate the storage and retrieval of data across decentralized networks. Similarly, mining resources can be used to power the validation of smart contracts, enabling more efficient and secure decentralized applications (dApps).

Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, are now utilized in various domains, and mining plays a vital role in verifying and executing these contracts.

Innovation in Blockchain Applications via Mining

Mining facilitates innovation in blockchain applications through the provision of significant computational power. This power allows for more complex smart contracts, higher transaction throughput, and greater scalability. For example, the ability to handle large volumes of data within decentralized storage networks is greatly enhanced by the computing power available through mining operations. As a result, blockchain applications can be developed that were previously impossible due to the limitations of the underlying technology.

The development of novel applications that leverage the computational capabilities of mining is an ongoing process.

The Future of Blockchain and Mining Interactions

The future of blockchain technology and cryptocurrency mining is closely intertwined. As blockchain technology evolves, new types of mining will likely emerge, requiring different computational approaches. This could involve advancements in quantum computing or other emerging technologies that could potentially alter the mining landscape. The need for secure and efficient blockchains will continue to drive innovation in mining and the related infrastructure.

The continuous evolution of blockchain will require an equally dynamic response from mining operations to ensure the ongoing security and reliability of the technology. Mining will remain a cornerstone of blockchain development, adapting to the evolving demands of the blockchain ecosystem.

Final Wrap-Up

In conclusion, the future of cryptocurrency mining hinges on a delicate balance between technological innovation, environmental sustainability, and responsible regulation. The industry faces significant challenges, but also incredible opportunities. The integration of renewable energy, decentralized mining protocols, and innovative cloud solutions could pave the way for a more sustainable and secure future for cryptocurrency mining. Ultimately, the evolution of this sector will profoundly impact the broader blockchain ecosystem and global economy.