Qualcomms phone to satellite service loses network partner – Qualcomm’s phone to satellite service loses network partner, a significant blow to the burgeoning space-based communication sector. This loss casts a shadow over the service’s future, potentially impacting its revenue, user experience, and overall market standing. The article will delve into the potential consequences, explore market implications, analyze possible causes, and examine alternative partnerships for Qualcomm.

The loss of a key network partner raises several critical questions. How will this impact Qualcomm’s current user base and the wider satellite phone service market? What are the financial implications for Qualcomm, and how might they respond? The following analysis provides a comprehensive overview of the situation, exploring various angles to understand the full scope of this disruption.

Impact on Qualcomm’s Satellite Phone Service

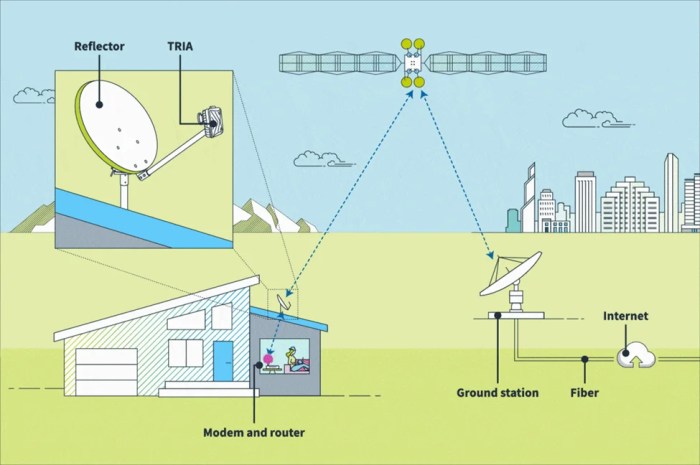

Qualcomm’s foray into satellite phone technology has faced a significant setback with the loss of a key network partner. This loss introduces a complex set of challenges, potentially impacting service availability, user experience, and the overall financial outlook for the project. Understanding these implications is crucial for assessing the future of Qualcomm’s satellite communication ambitions.The loss of this network partner directly affects Qualcomm’s ability to deliver a seamless and reliable satellite phone service.

This disruption necessitates a careful reassessment of the current infrastructure and a strategic pivot to ensure service continuity and quality.

Potential Consequences of Network Partner Loss

The loss of a network partner significantly impacts the service’s rollout and reliability. This loss could lead to reduced network capacity, impacting the number of users the system can support simultaneously. Furthermore, it could result in service disruptions, especially in areas where the partner’s network was crucial.

Financial Implications

Losing a network partner carries substantial financial implications. Revenue projections will likely be affected, as reduced network capacity translates directly to a smaller potential user base. Operational costs could also increase as Qualcomm seeks alternative solutions or adapts its existing infrastructure to accommodate the loss. Examples of similar situations in the telecommunications industry highlight the potential for substantial financial burdens associated with unforeseen disruptions.

For instance, a competitor experiencing similar network issues could see a dip in their stock price.

Impact on User Experience

The loss of a network partner could result in a less positive user experience. Reduced service availability or quality issues, such as slower connection speeds or increased latency, will impact user satisfaction. This could deter potential customers and lead to a loss of market share to competitors. Ultimately, the compromised user experience will affect Qualcomm’s reputation in the market.

Alternative Strategies for Qualcomm

To mitigate the impact of the partner loss, Qualcomm could explore several alternative strategies. One option is to negotiate agreements with alternative network providers to ensure continued service. This could involve establishing new partnerships with companies offering complementary technologies. Moreover, exploring technological solutions that enhance network redundancy could strengthen the service’s robustness. Finally, adjustments to pricing strategies might be required to compensate for potential operational costs and maintain competitiveness.

Qualcomm’s phone-to-satellite service is facing a setback after losing a key network partner. This isn’t great news, but perhaps the recent downturn in Chinese iPhone exports to the US, as reported in this article , might offer some clues as to why. Perhaps the shrinking market for these phones is impacting the demand for satellite services as well, potentially making it harder for Qualcomm to find new partnerships.

It’s a complex situation, but definitely something to keep an eye on.

Comparison to Competing Offerings

| Feature | Qualcomm Satellite Phone Service | Competitor A | Competitor B |

|---|---|---|---|

| Network Partner(s) | Reduced due to loss | Multiple, stable | Single, strong |

| Service Availability | Potentially reduced in affected areas | High and consistent | High, with minor regional fluctuations |

| Pricing | Potential adjustments needed | Competitive, stable | Competitive, with tiered options |

| Technology | Satellite-based, utilizing [specific technology] | Satellite-based, utilizing [alternative technology] | Satellite-based, utilizing [alternative technology] |

This table highlights the potential impact of the partner loss on Qualcomm’s satellite phone service compared to competitors. The table illustrates the vulnerabilities in the current setup and the need for proactive measures to maintain competitiveness and user satisfaction.

Market Implications of the Partner Loss

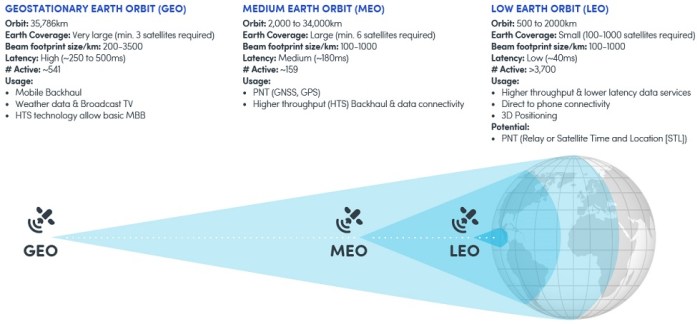

Qualcomm’s recent loss of a key network partner for its phone-to-satellite service has significant implications for the satellite communication market. This disruption, while potentially challenging, also highlights the evolving dynamics within the industry and the crucial role partnerships play in commercializing innovative technologies. The market response will depend on several factors, including the extent of the lost partner’s market share and the ability of Qualcomm to adapt and potentially secure new partnerships.The satellite communication industry is experiencing a surge in interest and investment, driven by factors like increased demand for reliable connectivity in remote areas and the growing adoption of satellite-enabled devices.

This expansion presents both opportunities and challenges for companies like Qualcomm, requiring them to proactively address potential market shifts and maintain a competitive edge.

Overall Market Trends in Satellite Phone Services

The global satellite phone market is experiencing substantial growth, with rising demand for reliable connectivity in underserved areas and increasing adoption of satellite-enabled devices. This surge is being driven by factors like enhanced mobile data needs in remote regions and the growing recognition of satellite communications as a backup or primary connectivity solution. The increasing demand is being met by an array of services, including specialized satellite phone plans and integration into various consumer devices.

Potential Shifts in the Competitive Landscape

The loss of a partner inevitably creates a vacuum in the market, potentially allowing competitors to capture market share. Existing competitors, already present in the satellite communication market, could leverage this disruption to expand their offerings and gain a foothold in regions previously served by the lost partner. New entrants may also emerge, capitalizing on the opportunity to fill the gap in the market.

Lost Partner’s Market Share and its Impact

Quantifying the lost partner’s exact market share within the broader satellite phone market is crucial to assessing the impact on Qualcomm’s service. Without precise figures, it’s difficult to predict the immediate market response. However, if the lost partner held a substantial portion of the market, Qualcomm will need to strategize to retain existing customers and attract new ones.

This requires a thorough understanding of the lost partner’s customer base and the reasons for their dissatisfaction.

Qualcomm’s phone-to-satellite service just took a hit losing a key network partner. This kind of setback is unfortunately common in tech, especially when you consider the similar legal battles, like the one where Google countersued Fortnite maker Epic for breaching the Play Store contract, here’s a look at that case. It’s a reminder that even major tech companies can face challenges in the fast-paced world of communication.

This setback for Qualcomm’s satellite service is quite significant in the current tech landscape.

Influence on Consumer Demand for Satellite Phone Services

Consumer demand for satellite phone services is likely to remain robust, especially in regions with limited or unreliable terrestrial networks. The growing need for backup or primary connectivity options in remote areas will continue to drive demand. Qualcomm will need to effectively communicate the resilience and value proposition of its service to maintain consumer confidence and retain its market position.

Potential Competitors and Their Strategies

| Competitor | Strategies | Impact of Qualcomm’s Partner Loss |

|---|---|---|

| Globalstar | Focusing on cost-effective, broad-coverage solutions. | May attempt to capture market share vacated by the lost partner. |

| Iridium | Maintaining a global satellite network with established partnerships. | Likely to remain a significant competitor, potentially expanding into regions previously served by the lost partner. |

| Other satellite providers | Developing innovative features and services to attract users. | Could be an opportunity to increase their presence in the market. |

Potential Causes for the Partner Loss

Qualcomm’s phone-to-satellite service, a crucial component of future mobile communication, has experienced a setback with the departure of a key network partner. Understanding the reasons behind this partnership dissolution is essential to assessing the potential impact and formulating strategies for future success. This analysis delves into the possible causes, ranging from operational challenges to disagreements over strategic directions.The loss of a network partner in a burgeoning technology sector like satellite communication can have significant consequences.

The partner’s departure might reveal underlying issues within the service’s infrastructure, market positioning, or contractual agreements. Understanding these factors is crucial for evaluating the long-term viability of the service and mitigating future risks.

Possible Conflicts Over Pricing and Market Share

Disagreements regarding pricing models and market share allocation are common causes for partnership breakdowns in the telecommunications industry. Differences in perceived value, cost structures, and revenue projections can lead to disputes between partners. For instance, a partner might feel that the proposed pricing model does not adequately reflect the costs associated with their services, or that the allocated market share does not accurately represent their contributions to the project.

These disagreements can ultimately strain the relationship and result in the partner’s withdrawal.

Operational Challenges and Infrastructural Limitations

Operational challenges and limitations within the partner’s infrastructure or capabilities could have contributed to the partnership’s termination. The complexity of integrating satellite communication systems can create significant operational hurdles, particularly when dealing with infrastructure maintenance, technical support, or network management. For example, unforeseen technical difficulties or a lack of skilled personnel could hamper the partner’s ability to effectively execute their responsibilities, ultimately leading to a decision to withdraw from the service.

Furthermore, if the partner experienced significant financial constraints, this could also be a critical factor.

Contractual Aspects and Clauses for Withdrawal

Contractual agreements often contain clauses that allow for the termination of the partnership under specific circumstances. These clauses could pertain to breaches of contract, financial performance indicators, or material changes in the market conditions. For instance, a clause allowing for withdrawal in the event of significant operational disruptions, or a failure to meet specific financial targets, could be part of the contractual agreement.

It’s important to review the specific contractual terms to understand the conditions that might have triggered the partner’s withdrawal.

Disagreements Regarding Future Projections and Strategic Directions

Discrepancies in long-term strategic visions and future projections can also strain partnerships. Differing opinions on the service’s future development, market positioning, or expansion plans might cause conflicts. For example, one partner might favor a more aggressive growth strategy, while the other might prioritize profitability and stability. Such divergent perspectives can create significant tension and ultimately lead to a decision to disengage from the collaboration.

Alternative Network Partnerships for Qualcomm

Qualcomm’s satellite phone service faces a significant hurdle with the loss of a key network partner. This necessitates a swift and strategic approach to securing alternative partnerships. Finding suitable replacements that can support the service’s technical needs and market expansion is crucial for its future success. The choice of new partners will significantly impact the service’s rollout, pricing, and global reach.Finding new partners requires a deep understanding of the current market landscape and the specific requirements of Qualcomm’s satellite phone service.

The ideal partner will possess robust satellite communication infrastructure, a strong global presence, and a proven track record of delivering reliable services. A thorough evaluation process, including assessing technical capabilities, financial stability, and market reach, is essential.

Potential Candidates for New Network Partners

Several companies possess the technical expertise, financial resources, and global footprint that could make them suitable partners. Potential candidates include established satellite operators, telecommunications giants with satellite divisions, and even specialized companies focusing on satellite internet or communication services.

Strengths and Weaknesses of Different Potential Partners

A detailed analysis of potential partners’ strengths and weaknesses is vital for a successful partnership. This involves evaluating their technical capabilities, such as the bandwidth, latency, and coverage of their satellite networks. Financial stability is another critical factor; a financially sound partner can provide long-term support and investment in the project. Finally, market reach is essential for successful global deployment.

Partners with established distribution channels and a presence in key markets will greatly enhance Qualcomm’s reach.

Steps Involved in Seeking Out New Network Partnerships

The process of identifying and securing new network partners involves several key steps. Initial research and market analysis are essential to identify potential partners. Next, a thorough due diligence process is required to evaluate the technical, financial, and operational capabilities of the identified candidates. Formal proposals and negotiations are critical for reaching mutually beneficial agreements. Lastly, ongoing monitoring and evaluation of the partnership are necessary to ensure its continued success.

Qualcomm’s phone-to-satellite service just lost a major network partner, which is a bummer. While this might seem unconnected to things like Fortnite, it actually impacts how we might play games like Fortnite Festival local multiplayer, especially in remote areas. If you’re curious about how local multiplayer is changing the game, check out this article about fortnite festival local multiplayer.

Ultimately, this loss of a partner could slow down the development of reliable satellite connectivity for mobile devices, which could potentially hinder the experience for all gamers in the future.

Potential Benefits and Risks of Pursuing New Partnerships

Securing a new partnership presents significant benefits, including access to expanded network infrastructure, a broader global presence, and potentially lower costs. However, risks also exist. The new partner may not align perfectly with Qualcomm’s service objectives, and there might be integration challenges between the two systems. Additionally, unforeseen circumstances, such as changes in market conditions or the partner’s financial status, can affect the long-term viability of the partnership.

Comparison of Potential Partners

| Partner | Technical Capabilities | Financial Stability | Market Reach |

|---|---|---|---|

| Globalstar | Established satellite network with global coverage, though potentially limited bandwidth. | Financially stable, with a proven track record in the satellite communications industry. | Strong presence in North America and some international markets. |

| Iridium | Extensive satellite network with high bandwidth capabilities, suitable for data-intensive applications. | Strong financial position with a history of successful satellite operations. | Wide global coverage, including remote areas. |

| OneWeb | Emerging satellite network with potential for high bandwidth and future expansion. | Financially supported by large investors. | Growing global reach, particularly in regions with limited existing infrastructure. |

| Other Telecommunication Giants (e.g., T-Mobile, Vodafone) | Potentially significant resources and distribution networks, but satellite expertise might be limited. | Generally financially stable and experienced in telecommunications. | Extensive market reach through their existing infrastructure. |

Future of Qualcomm’s Satellite Phone Service: Qualcomms Phone To Satellite Service Loses Network Partner

Qualcomm’s satellite phone service faces an uncertain future following the loss of a key network partner. The departure necessitates a strategic reassessment of the service’s trajectory, market penetration strategy, and overall investment plan. This shift presents both challenges and opportunities for Qualcomm to redefine its position in the satellite communication market.The loss of this partnership forces Qualcomm to recalibrate its approach, potentially impacting the service’s rollout timeline and feature set.

The company must carefully weigh the costs and benefits of alternative partnerships, new product development, and adjusted investment strategies to ensure long-term viability.

Potential Future Trajectory

Qualcomm’s satellite phone service trajectory will depend significantly on its ability to secure new partnerships and adapt its offerings to market demands. The service’s success will be measured not only by subscriber growth but also by its ability to provide reliable, affordable, and feature-rich connectivity in underserved regions. Factors such as the service’s integration with existing cellular networks, the pricing model, and the availability of device options will be crucial determinants of its long-term success.

Strategies for Enhancing Market Share

Securing new partnerships with established satellite operators or developing an independent infrastructure will be vital. This involves evaluating potential partners, understanding their strengths and weaknesses, and crafting mutually beneficial agreements. Furthermore, aggressively targeting specific market segments, such as remote workers, outdoor enthusiasts, and emergency responders, could provide a significant boost to market share. The service must offer compelling value propositions tailored to these segments, including competitive pricing, robust connectivity, and specialized features.

A strong marketing campaign highlighting the advantages of the service, including its integration with existing mobile devices, is crucial for generating awareness and driving adoption.

New Product Development Plans

Potential new product development should focus on addressing the identified gaps in the current service. This might include exploring new device designs for enhanced functionality and user experience. Integration with existing cellular networks for hybrid connectivity could also enhance the service’s appeal. Prioritizing development of robust emergency communication capabilities, tailored for specific user groups, will be crucial.

The development of a streamlined, user-friendly interface for both novice and expert users will also be essential.

Influence on Future Investments

The loss of a partner could influence future investments in the satellite phone sector. Qualcomm may need to allocate more resources to building its own infrastructure or securing alternative partnerships. The company will need to carefully evaluate the risks and potential returns associated with various investment strategies. Focus on creating a more resilient and independent network infrastructure could be a key consideration.

Timeline of Potential Actions

A realistic timeline for recovery from this event is complex and dependent on several factors, including the speed of securing new partnerships and the complexity of developing new infrastructure. A detailed timeline of potential actions would need to consider the following phases:

- Phase 1 (Immediate): Assessing the impact of the partner loss, identifying potential alternative partners, and initiating discussions with key players. This initial phase will likely span a few weeks to a couple of months.

- Phase 2 (Short-Term): Securing agreements with alternative partners or developing strategies for independent infrastructure development. This phase is expected to take a few months to a year.

- Phase 3 (Medium-Term): Implementing new strategies, developing new products, and refining the service to meet market demands. This phase could take several months to a year or more, depending on the complexity of the new product development.

- Phase 4 (Long-Term): Monitoring the market response, adapting to evolving trends, and investing in ongoing research and development to maintain a competitive edge. This is a continuous phase, potentially spanning years.

Illustrative Case Studies of Similar Events

Losing a key network partner can be a significant setback for any telecommunications company, particularly those operating in emerging markets. This disruption can impact service availability, customer experience, and overall profitability. Analyzing similar situations faced by other companies provides valuable insights into potential strategies and lessons learned.Examining how companies have navigated such challenges offers valuable case studies for Qualcomm, enabling them to formulate a comprehensive response plan.

This section will illustrate scenarios of companies encountering similar problems, their respective responses, and the potential implications for Qualcomm’s satellite phone service.

Examples of Companies Facing Similar Challenges

Several companies have faced the challenge of losing a critical network partner, often impacting their service offerings. These disruptions can stem from various factors, such as disagreements on contractual terms, shifting market priorities, or even financial difficulties of the partner.

- Telecom Provider X: A major telecom provider in a developing nation lost its primary mobile network provider due to financial instability. The company swiftly sought alternative providers, ultimately finding a suitable replacement with comparable infrastructure and technology. This swift action helped maintain service continuity, minimizing customer churn.

- Satellite Internet Provider Y: A satellite internet provider lost a crucial ground station operator. This resulted in service interruptions and a temporary decline in user satisfaction. The provider responded by implementing a phased rollout of additional ground stations and optimizing its existing network to mitigate the impact. They also invested in proactive customer communication and support.

- Mobile Device Manufacturer Z: A mobile device manufacturer that relied heavily on a specific chip supplier experienced delays in production due to a sudden supplier departure. The company diversified its supply chain by engaging with other chip manufacturers, which required adjustments to manufacturing processes and potentially some cost increases. This strategic shift, though challenging, allowed the manufacturer to maintain its production schedule and customer commitments.

Strategies Adopted by These Companies, Qualcomms phone to satellite service loses network partner

The strategies employed by these companies demonstrate various approaches to mitigating the impact of partner departures. These include:

- Swift Action and Contingency Planning: Rapidly identifying and engaging with alternative partners is crucial. Proactive contingency plans are essential to minimize disruption during the transition period. Companies should have predefined processes and timelines for engaging with potential replacements. This should include clear communication protocols with stakeholders.

- Diversification of Partnerships: Establishing multiple partnerships reduces reliance on any single provider. This can be achieved through contracts with several network providers or multiple ground station operators. This strategy is important for mitigating risks from any single partner’s departure.

- Optimized Existing Infrastructure: Leveraging existing network infrastructure to offset the loss of a partner can significantly reduce the disruption to service. Implementing optimized network configurations and enhancing operational efficiency can help the company bridge the gap until a new partnership is in place. Focus should be on enhancing existing capacity.

Comparison with Potential Strategies for Qualcomm

Qualcomm’s strategy for managing the partner departure should consider the unique aspects of its satellite phone service. These include the specialized nature of satellite communications, the need for global coverage, and the potential impact on existing customers.

- Speed of Response: Qualcomm’s response must be swift to minimize the negative impact on service availability. Speed and efficiency are crucial to maintaining customer trust and preventing significant disruption.

- Global Coverage: Qualcomm’s service relies on a global network. The alternative partner must be able to provide similar or better global coverage. The search should prioritize redundancy and scalability.

- Customer Impact Mitigation: Qualcomm should proactively communicate with customers about the transition. This communication strategy should address potential service interruptions and provide assurances about the long-term sustainability of the service.

Lessons Learned from the Cited Examples

The case studies highlight the importance of proactive planning, diversification, and efficient contingency procedures. Companies that successfully navigate these challenges often prioritize communication and collaboration with customers and partners.

| Case Study | Key Takeaways | Potential Solutions for Qualcomm |

|---|---|---|

| Telecom Provider X | Swift action and alternative provider identification are crucial. | Develop and implement rapid response protocols for identifying and vetting potential partners. |

| Satellite Internet Provider Y | Optimized infrastructure and proactive communication minimize disruption. | Assess and enhance existing satellite infrastructure to provide backup capabilities. Develop a clear customer communication plan. |

| Mobile Device Manufacturer Z | Diversification of supply chains is critical to mitigating risks. | Diversify satellite network providers and ground station operators to minimize reliance on a single partner. |

End of Discussion

Qualcomm’s recent setback with its satellite phone service partner highlights the complex and competitive nature of the space-based communications market. While the loss presents challenges, it also underscores the dynamic nature of the industry and the need for adaptability and strategic resilience. This event compels Qualcomm to re-evaluate its strategies, potentially leading to innovative solutions and further shaping the future of satellite phone technology.

The long-term impact will depend on how quickly Qualcomm can secure a new partner and adapt its service to maintain market competitiveness.