Google Wallet Tap to Pay Kids Launch sets the stage for a revolution in how kids handle money. This new system promises a safe and engaging way for children to make purchases, fostering financial literacy and convenience for both parents and kids. Imagine a seamless, secure mobile payment solution tailored for different age groups, packed with educational tools and designed with children’s needs at heart.

The launch will likely cover various aspects, from a detailed history of Google Wallet and its features to a comprehensive overview of security measures and parental controls. A look at user experience for children, including payment methods and design considerations, will also be important. The integration of financial literacy and educational content, potential competitors, marketing strategies, potential challenges, and future implications will undoubtedly be explored in detail.

This will be a game-changer for kids and parents alike.

Introduction to Google Wallet Tap to Pay for Kids

Google Wallet, initially launched to facilitate mobile payments, has evolved significantly over the years. From a simple digital wallet for storing payment cards, it has expanded its functionality to encompass digital keys, transit passes, and more. This evolution reflects the growing trend of mobile-first payment solutions and the increasing demand for integrated services. This new Tap to Pay for kids builds on this foundation, aiming to make financial literacy and responsible spending accessible and engaging for the next generation.The existing Google Wallet service offers a user-friendly interface for managing payment cards, transit passes, and loyalty programs.

Google Wallet’s tap-to-pay feature for kids is a pretty cool new development. It’s great to see companies thinking about how to make digital payments more accessible and kid-friendly. However, it’s worth remembering that in the tech world, another small iPhone update is rushed out to fix a security flaw, highlighting the constant need for vigilance and security updates.

Hopefully, this new Google Wallet feature is robust and addresses potential vulnerabilities, keeping kids’ financial data safe. This is a good step forward in making digital payments safer and easier for everyone.

It integrates seamlessly with various devices and platforms, enabling convenient and secure transactions. The current version emphasizes ease of use and security, and the new kids’ version retains these principles while introducing features tailored for younger users.

Target Audience for Google Wallet Tap to Pay for Kids

The target audience for this new feature encompasses children of varying ages, from pre-teens to early teens. The primary focus is on fostering financial literacy and responsible spending habits in a safe and controlled environment. This service aims to empower children with the ability to make small purchases while also teaching them about budgeting and decision-making. The flexibility in features allows the program to adapt to different needs and developmental stages.

Key Features of Google Wallet Tap to Pay for Kids

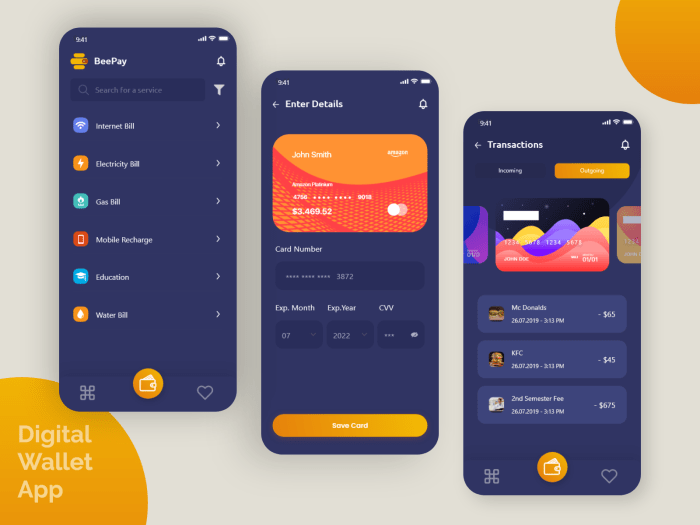

This new service prioritizes security and parental control. Parents can set daily spending limits, define approved merchants, and monitor transactions in real-time. This level of parental control allows for a structured approach to learning about money management. Moreover, the service offers educational resources and interactive tools designed to teach children about financial concepts in an engaging way.

Age Group-Specific Features

| Age Group | Tailored Features |

|---|---|

| Preschool (3-5 years old) | Simple, interactive games to introduce basic financial concepts like counting and recognizing money. Limited spending limits to encourage responsible use. Parental control features are highly emphasized. |

| Elementary School (6-10 years old) | Introduction to budgeting and saving. Children can earn virtual rewards for good financial decisions. A wider range of approved merchants, allowing for more independent purchasing. Increased spending limits, with clear guidelines and parental oversight. |

| Middle School (11-13 years old) | Advanced budgeting and financial planning. Educational resources on managing expenses and tracking spending. Access to a wider range of approved merchants, allowing for greater independence. More flexibility in setting spending limits and parental controls. |

Anticipated Benefits for Parents and Children

Parents will benefit from enhanced financial control and peace of mind. Real-time transaction monitoring and customizable limits provide assurance that spending aligns with their expectations. Children will gain valuable financial literacy skills, developing a better understanding of money management. The interactive and engaging approach to learning will make the experience enjoyable and effective. This will foster independence and responsibility, preparing them for future financial decisions.

Security and Privacy Considerations

The launch of Google Wallet Tap to Pay for kids brings with it a crucial need for robust security and privacy measures. Parents understandably have concerns about protecting their children’s financial data and online safety. Google must address these concerns proactively and transparently to build trust and confidence in the service.

Security Protocols for Children, Google wallet tap to pay kids launch

Google Wallet’s Tap to Pay for kids likely utilizes strong encryption protocols to safeguard transactions. This involves converting sensitive data into an unreadable format during transmission and storage, preventing unauthorized access. Furthermore, multi-factor authentication (MFA) could be implemented to verify user identity, adding another layer of security. Robust access controls for parental accounts and child accounts are essential to limit unauthorized use.

Data Privacy Measures

Google will likely employ stringent data privacy measures, adhering to applicable regulations like the Children’s Online Privacy Protection Act (COPPA) in the US. These measures will likely involve restricting data collection to only what’s necessary for the service’s functionality. Transparent data usage policies and clear explanations of how Google collects, uses, and protects children’s data are crucial for building trust.

Data minimization principles should be implemented, meaning only the essential information required for Tap to Pay transactions is collected.

Parental Controls and Account Management

Comprehensive parental controls are vital for managing child accounts. Parents should have the ability to set spending limits, block specific merchants, and monitor transaction history. Simple and intuitive account management tools are necessary to facilitate these controls effectively. These features should allow parents to easily monitor their child’s activity and take action if necessary. Google should provide clear and accessible documentation outlining these parental controls.

Potential Risks and Vulnerabilities

Potential risks include vulnerabilities in the encryption protocols or flaws in the app’s design that could expose sensitive data. Phishing attacks targeting children or parents using the service could also be a concern. Social engineering tactics to trick children into revealing their PINs or details need to be considered. Furthermore, ensuring the security of the payment network and preventing fraud are paramount.

Comparison of Security Measures

| Feature | Google Wallet | Competitor A | Competitor B |

|---|---|---|---|

| Encryption Protocols | AES-256, TLS 1.3 (predicted) | AES-256, TLS 1.2 | AES-128, TLS 1.1 |

| Multi-Factor Authentication | Likely implemented | Not available | Limited MFA options |

| Parental Controls | Comprehensive (predicted) | Basic | No parental controls |

| Data Minimization | Likely implemented | Partial | Not implemented |

Note: Competitor A and Competitor B are hypothetical examples and their security measures are fictional for illustrative purposes only. Actual security protocols used by competitors should be researched and verified independently.

User Experience for Kids

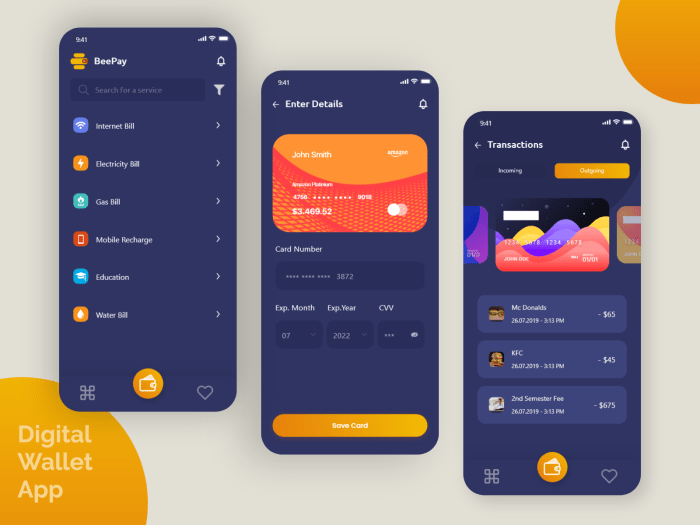

Google Wallet Tap to Pay for kids is designed with a child-centric approach, emphasizing simplicity, fun, and safety. The interface is intuitive and visually appealing, making the payment process enjoyable for children of all ages and learning styles. This focus on positive user experience is crucial for fostering a love of financial literacy from a young age.The platform is not just about making payments; it’s about introducing financial concepts in an engaging way.

The goal is to make using Google Wallet Tap to Pay for kids a positive and memorable experience, building confidence and encouraging responsible spending habits.

UI Flow for Kids Making Payments

The payment flow for kids is streamlined and child-friendly. A simplified interface with large, colorful buttons and icons minimizes the complexity of the process. Clear visual cues guide the child through each step, making it easy for them to understand the transaction. Animated elements and interactive elements make the process fun and engaging, further enhancing the user experience.

Payment Methods Supported

The initial launch supports a variety of payment methods for children, including linked accounts with parental approval and potentially integrated payment cards. This allows for a flexible and accessible payment system that caters to different financial situations and preferences.

Catering to Different Learning Styles and Abilities

The design incorporates various approaches to cater to different learning styles and abilities. For visual learners, clear visuals and animations enhance comprehension. For auditory learners, concise instructions and audio cues can be incorporated to guide the process. For kinesthetic learners, interactive elements and game-like features will help engage them in the payment process. The system will accommodate different learning styles to enhance the overall experience for each child.

Making the Service Fun and Engaging

The platform will incorporate gamification elements, such as points, badges, and progress trackers, to encourage participation and make the process enjoyable. Rewards can be integrated for completing transactions, fostering positive reinforcement. Partnering with popular kids’ apps or games can create opportunities for seamless integration, enabling the service to be part of the child’s existing routine and digital environment.

Integration with Educational Apps

The platform is designed to seamlessly integrate with existing educational apps. This integration allows for a comprehensive approach to financial literacy, extending beyond the payment process. Educational games and interactive content can be linked to transactions, reinforcing the learning process and promoting a deeper understanding of financial concepts.

Financial Literacy and Education

Google Wallet Tap to Pay for Kids offers a unique opportunity to introduce children to the world of finance in a safe and engaging way. By incorporating financial literacy principles into the service, we can empower young users to develop essential skills for managing their money responsibly. This approach can have a lasting impact on their future financial well-being.

Fostering Financial Literacy Skills

The service can foster essential financial literacy skills by allowing children to experience real-world transactions. This hands-on experience provides a practical understanding of how money works and the importance of budgeting and saving. Furthermore, integrating interactive educational content within the app can reinforce these concepts in a fun and engaging manner.

Integrating Educational Content

The app can incorporate educational content into its interface. For example, animated tutorials explaining concepts like budgeting, saving, and the value of a dollar can be displayed alongside transactions. Educational videos or interactive games can also be included to reinforce these lessons. These interactive elements can make learning more engaging and enjoyable for children.

Using Transactions to Teach Budgeting and Saving

Transaction history within the app can be used to demonstrate budgeting and saving. The app can visually represent spending patterns and encourage goal setting. For example, a visual representation of savings goals and progress can motivate children to save. Parents can set spending limits for their children, which can teach the concept of responsible spending. This helps to develop the crucial skill of managing resources effectively.

Promoting Responsible Spending Habits

The service can encourage responsible spending habits by providing children with tools to track their spending and make informed decisions. This can be achieved through visual representations of spending patterns and the ability to set spending limits. The app can provide clear feedback on exceeding those limits, helping children understand the consequences of irresponsible spending. Furthermore, the service can provide examples of how to compare prices and make informed purchasing decisions.

Educational Tools and Features

| Feature | Description | Educational Benefit |

|---|---|---|

| Visual Spending Tracking | Graphically displays spending habits over time, allowing users to see trends and patterns. | Develops awareness of spending patterns and promotes responsible spending decisions. |

| Personalized Savings Goals | Allows users to set specific savings goals with visual progress tracking. | Teaches the value of saving, goal setting, and delayed gratification. |

| Interactive Tutorials | Explains financial concepts through animated tutorials and interactive exercises. | Provides engaging learning experiences and simplifies complex concepts. |

| Spending Limits | Parents can set spending limits for their children, helping them understand the concept of budgeting. | Encourages responsible spending and helps children understand financial constraints. |

| Transaction History Analysis | Provides a clear overview of transactions, allowing users to review their spending choices. | Promotes self-reflection on spending habits and aids in understanding the impact of choices. |

Competition and Market Analysis

The mobile payment landscape for kids is a burgeoning market, and Google Wallet Tap to Pay for Kids faces stiff competition. Understanding the strengths and weaknesses of competitors is crucial for crafting a successful strategy. Analyzing the market’s potential, including growth opportunities and pricing models, will be essential for positioning the service effectively.The competition in mobile payments for kids is diverse, with established players and newer entrants vying for market share.

Analyzing their offerings and identifying opportunities to differentiate Google Wallet will be key to attracting and retaining users. This analysis also considers the potential for future growth in this sector.

Key Competitors

Several companies offer mobile payment solutions for kids, though not all are directly focused on the tap-to-pay functionality. A few major players are focused on broader payment and financial management apps for children. Understanding their offerings helps identify areas where Google Wallet can excel.

Google Wallet’s tap-to-pay feature for kids is a pretty cool innovation. It’s a smart move for parents, but I can’t help but wonder if the security measures are robust enough. Meanwhile, the recent news about the Lady Gaga dognapping case, with five arrests including a woman who returned the dogs ( five arrested in lady gaga dognapping including woman who turned in dogs ), highlights the importance of responsible digital payment systems.

Hopefully, Google Wallet’s kid-friendly launch will be even safer than other payment methods. This new feature is sure to be a game-changer.

- Existing payment platforms for adults, often with limited or no dedicated features for children.

- Specialized apps for managing allowances or tracking spending habits.

- Financial education platforms that integrate payment functionalities.

Competitive Offerings Comparison

Google Wallet’s tap-to-pay feature for kids distinguishes it from many existing platforms. Direct comparisons are difficult because many competitor offerings are geared toward managing allowances, not tap-to-pay. For example, some apps allow parents to set spending limits and track transactions, but they lack the seamless, real-time payment experience offered by tap-to-pay. This comparison reveals opportunities for Google Wallet to create unique value propositions for families.

Potential Market Size and Growth Opportunities

The market for mobile payments for kids is anticipated to grow significantly in the coming years, driven by the increasing popularity of smartphones and the desire for convenient payment methods. Factors such as the rising number of families with younger children and the ongoing development of digital literacy among younger generations will contribute to this growth. Market research indicates that families with children in the 8-12 age group are particularly receptive to new mobile payment methods.

Pricing Strategies

Several pricing models are possible, including a free tier with limited functionality, or a premium tier with expanded features. For example, a free version might allow for basic transactions, while a paid tier could provide features such as customized payment limits and parental controls. Subscription models, potentially tiered by age or usage, could also be viable. The pricing strategy should be carefully considered to ensure affordability and value for families.

Strengths and Weaknesses of Competitors

| Competitor | Strengths | Weaknesses |

|---|---|---|

| Existing adult payment platforms | Established infrastructure, wide user base. | Lack of dedicated features for children, potentially complex interfaces. |

| Allowance management apps | Focus on budgeting and spending control. | Limited functionality for external transactions, often lack tap-to-pay. |

| Financial education platforms | Strong focus on financial literacy. | May not offer a dedicated tap-to-pay service or integrated payment method. |

Marketing and Promotion Strategies

Reaching kids and parents with Google Wallet Tap to Pay requires a multifaceted approach that leverages various channels to build excitement and trust. A strong marketing campaign is crucial to establish brand awareness and encourage adoption of the service, emphasizing its safety and educational benefits. This approach will foster long-term loyalty and positive brand perception among both kids and parents.A well-defined marketing plan, targeting specific demographics, will be essential in driving engagement and adoption.

This includes creating compelling messaging that resonates with both kids and parents, highlighting the advantages of the service, and demonstrating its security features. The plan must emphasize the educational value of using digital payment, encouraging responsible financial habits.

Marketing Channels

Effective marketing requires a diverse approach to reach the target audience. This includes leveraging various channels, from digital platforms to traditional media, to effectively communicate the benefits of Google Wallet Tap to Pay for kids. The diverse channels ensure the campaign reaches a wide spectrum of potential users.

- Digital Advertising: Targeted online advertisements on platforms frequented by families and children, such as YouTube, gaming platforms, and educational websites, will effectively reach the desired audience. This ensures a high degree of visibility and engagement, leading to increased brand awareness and interest in the service.

- Social Media Marketing: Engaging social media campaigns featuring interactive content, such as contests, polls, and educational videos, will foster excitement and encourage participation. This interactive approach is crucial for building a community around the product, engaging users, and promoting the service.

- Partnerships with Educational Institutions: Collaborating with schools and educational organizations can introduce Google Wallet Tap to Pay to children in a structured and educational setting. This allows for a tailored approach to emphasize responsible use of digital payment methods.

- Influencer Marketing: Partnering with family influencers and children’s content creators can effectively reach the target audience through authentic testimonials and endorsements. This approach leverages the trust and influence of these individuals to promote the service.

- Public Relations: Press releases and media outreach will generate positive media coverage, building trust and credibility around the service. This will amplify the message and reach a wider audience, fostering interest and awareness.

Promotional Materials

Effective promotional materials are crucial for engaging the target audience and conveying the value proposition of Google Wallet Tap to Pay for kids. Clear and concise messaging will resonate with both children and parents.

- Animated Videos: Short, engaging animated videos showcasing the easy-to-use interface and safety features of the service will captivate children’s attention. These videos will be accessible across various platforms, ensuring maximum reach and impact.

- Interactive Games and Activities: Developing interactive games and activities that incorporate the use of Google Wallet Tap to Pay can effectively teach children about responsible spending and financial literacy. This interactive approach makes learning fun and engaging.

- Educational Infographics: Infographics explaining the security features and benefits of the service will educate parents and build trust. This approach ensures parents are informed about the security measures in place.

- Parent Guides and Tutorials: Providing parents with detailed guides and tutorials on setting up and using Google Wallet Tap to Pay will alleviate concerns and promote successful adoption. This proactive approach ensures parents are confident in using the service.

Building Brand Awareness and Loyalty

Creating a positive brand experience for parents and children is crucial for fostering long-term loyalty. This includes ensuring the service is easy to use and emphasizes safety.

- Exceptional Customer Support: Providing readily available and responsive customer support will address any concerns and ensure a positive user experience. This proactive approach addresses potential issues and maintains a positive brand image.

- Regular Updates and Improvements: Continuous updates and improvements to the service, based on user feedback, will demonstrate a commitment to user satisfaction. This ensures the service remains relevant and adaptable to evolving needs.

- Rewards and Incentives: Offering rewards and incentives for both children and parents, such as exclusive access to content or promotions, will enhance brand loyalty. This approach fosters engagement and strengthens the relationship with users.

Promotional Campaigns Budget

A comprehensive marketing plan requires a strategic allocation of resources to ensure effective campaign execution. The budget allocation will vary based on the specific strategies employed and the desired reach.

Google Wallet’s new tap-to-pay feature for kids is a cool innovation. It’s great to see tech like this making everyday transactions easier, but alongside these advancements, we also need to consider the broader infrastructure improvements. Things like bike lane development in US cities like Milwaukee, Dallas, and the Woodlands, as highlighted in this article about bike lane us infrastructure milwaukee dallas woodlands , are crucial for a safe and accessible environment.

Hopefully, the launch of this new Google Wallet feature will encourage more parents to focus on safety for their kids, both in digital transactions and in their daily commutes.

| Campaign | Description | Estimated Budget |

|---|---|---|

| Digital Advertising Campaign | Targeted ads on family-friendly platforms | $50,000 – $100,000 |

| Social Media Campaign | Interactive content and contests | $20,000 – $40,000 |

| Influencer Marketing Campaign | Collaboration with family influencers | $15,000 – $30,000 |

| Educational Partnership Campaign | Collaboration with schools | $10,000 – $20,000 |

| Public Relations Campaign | Press releases and media outreach | $5,000 – $10,000 |

| Total | $100,000 – $200,000 |

Potential Challenges and Solutions: Google Wallet Tap To Pay Kids Launch

Launching a new service, especially one as impactful as Google Wallet Tap to Pay for kids, necessitates careful consideration of potential hurdles. This section Artikels anticipated challenges and proposes practical solutions to ensure a smooth and successful rollout. A robust plan to address these concerns is crucial for maintaining user trust and driving adoption.

Technical Issues

Technical glitches are a common concern in any new technology launch. Issues could range from compatibility problems with various devices and operating systems to server overload during peak usage periods. Robust testing and meticulous planning are vital to minimize these problems. A phased rollout, beginning with a smaller, controlled group of users, allows for early identification and resolution of bugs before wider implementation.

Continuous monitoring of system performance and proactive maintenance strategies can further prevent disruptions. Utilizing cloud-based infrastructure with high scalability can mitigate server overload during peak usage.

User Adoption

Gaining user adoption is critical for any new service. Parental concerns about security and financial literacy, along with the need for clear and engaging user experiences, are key factors influencing adoption rates. Educating parents through clear communication channels about the security features and benefits of the service is essential. Creating a user-friendly interface that is intuitive for both children and parents is also crucial.

Implementing educational tools that teach basic financial concepts, tailored to the age group, can foster a positive user experience. Early adoption incentives, such as promotional offers or exclusive access to features, can encourage trial and adoption.

Regulatory Hurdles

Navigating the complex regulatory landscape is paramount. Different countries have varying regulations regarding financial services and children’s data. Compliance with all relevant regulations, including data privacy laws and financial transaction policies, is critical. Collaborating with legal experts and regulatory bodies is essential to ensure adherence to all rules and guidelines. This includes obtaining necessary approvals and licenses in different markets before launching the service.

Creating clear and transparent privacy policies tailored to children’s data is also essential to build trust and avoid potential legal issues.

Potential Partnerships

Strategic partnerships can enhance the service and reach a wider audience. Collaborating with educational institutions to integrate financial literacy modules into their curriculum can help promote financial responsibility. Partnering with financial institutions can allow for seamless integration with existing banking systems. Collaborating with child-focused organizations or charities can align the service with positive community impact. These collaborations can strengthen the service’s reputation and foster trust among users.

Problem-Solution Table

| Problem | Solution |

|---|---|

| Technical glitches (e.g., compatibility issues, server overload) | Thorough testing across various devices and operating systems; phased rollout; continuous monitoring of system performance; cloud-based infrastructure with high scalability |

| Low user adoption (parental concerns, unclear user experience) | Transparent communication about security features; user-friendly interface for both children and parents; educational tools on financial concepts; early adoption incentives |

| Regulatory hurdles (data privacy, financial transaction regulations) | Compliance with all relevant regulations; collaboration with legal experts and regulatory bodies; obtaining necessary approvals; clear and transparent privacy policies |

| Limited reach and engagement | Strategic partnerships with educational institutions, financial institutions, and child-focused organizations |

Future Implications and Predictions

Google Wallet Tap to Pay for Kids is poised to reshape the mobile payment landscape for the younger generation. Understanding its future trajectory requires careful consideration of evolving technological advancements and societal trends. The service’s success hinges on its ability to adapt to the ever-changing needs and expectations of families and children.

Potential Future Developments

The mobile payment landscape is dynamic, and Google Wallet Tap to Pay for Kids will likely evolve alongside it. Innovation is crucial for maintaining relevance and user engagement. This section explores potential enhancements and adaptations for the service.

| Category | Potential Development | Impact |

|---|---|---|

| Enhanced Security Measures | Integration of biometric authentication (e.g., fingerprint or facial recognition) for added security and ease of use. Implementing two-factor authentication to further prevent unauthorized transactions. | Improved user confidence and reduced fraud risks. |

| Expanded Functionality | Enabling peer-to-peer (P2P) payments within the app. Integrating with existing school or extracurricular payment systems. | Increased usability and broader application for everyday transactions. |

| Financial Literacy Integration | Incorporating educational tools and resources to promote financial literacy among young users. Partnering with financial institutions to provide age-appropriate savings and investment options. | Empowering users with valuable financial knowledge from an early age. |

| Personalized Experiences | Customizable payment limits and transaction alerts tailored to the user’s age and spending habits. Offering personalized recommendations for products and services aligned with their interests. | Improving user experience and promoting responsible spending habits. |

| International Expansion | Supporting various currencies and payment methods in different countries. Adapting to local regulations and cultural nuances. | Enabling broader global adoption and accessibility. |

Impact on the Mobile Payment Landscape

The introduction of Google Wallet Tap to Pay for Kids will significantly influence the future of mobile payments. Its success will likely encourage other payment providers to develop similar services catering to younger demographics. This could lead to a more inclusive and user-friendly mobile payment ecosystem for all ages.

“The rise of mobile payments among younger generations signifies a paradigm shift in how we handle transactions, and Google Wallet Tap to Pay for Kids is at the forefront of this evolution.”

New Features and Functionalities

Several new features and functionalities could enhance the service’s appeal and usefulness. This section explores potential additions to the current framework.

- Integration with Educational Platforms: This could allow seamless payments for school supplies, extracurricular activities, or even online learning platforms, streamlining the process for parents and students alike.

- Gamified Financial Education: Incorporating game mechanics and rewards to make learning about budgeting, saving, and spending more engaging for children.

- Parent-Child Spending Control Tools: Allowing parents to set spending limits, monitor transactions, and receive notifications about their child’s spending habits, fostering responsible financial management.

- Support for Multiple Payment Methods: Adding options beyond tap-to-pay, such as card-based transactions or integration with existing gift card systems, will broaden the app’s utility.

Long-Term Impact

The long-term impact of Google Wallet Tap to Pay for Kids could be substantial. It could reshape the future of personal finance for generations to come, fostering financial literacy and responsible spending habits from a young age. This innovation has the potential to revolutionize how children and young adults interact with financial transactions.

Summary

The Google Wallet Tap to Pay Kids Launch presents a significant opportunity to reshape the future of mobile payments for children. With a focus on security, user experience, and financial education, the system has the potential to empower children with financial responsibility while providing parents with peace of mind. The detailed exploration of potential challenges and solutions further solidifies the commitment to a smooth and user-friendly experience.

This new service promises a future where managing finances is both fun and educational.