Bitcoin ATM scammers 65 million stolen ftc highlights the devastating impact of fraudulent activities targeting cryptocurrency investors. This case, involving a significant financial loss and intricate scam tactics, serves as a cautionary tale. We’ll delve into the specifics of the FTC investigation, exploring the various scam types, victim impact, and preventative measures.

The investigation revealed a sophisticated operation, potentially involving multiple actors and complex money laundering schemes. The sheer scale of the fraud, totaling $65 million, underscores the need for heightened vigilance in the cryptocurrency space. Understanding the modus operandi of these scams is crucial for protecting oneself from becoming a victim.

Introduction to Bitcoin ATM Scams

Bitcoin ATM scams exploit the growing popularity of cryptocurrency, targeting unsuspecting users with various deceptive tactics. These scams often prey on the relative lack of regulation and transparency in the cryptocurrency market, making it easier for criminals to operate undetected. Understanding the different types and methods employed is crucial for protecting yourself from becoming a victim.Bitcoin ATM scams are characterized by their reliance on deception and manipulation to steal cryptocurrency or personal information.

They often involve a combination of technical and social engineering techniques, exploiting vulnerabilities in both the Bitcoin ATM system and the users themselves. The methods used range from sophisticated phishing schemes to physically manipulating the ATMs. This article will delve into the common types of scams, their typical modus operandi, and examples of successful and unsuccessful attempts.

Common Types of Bitcoin ATM Scams

Bitcoin ATM scams come in various forms, each targeting different vulnerabilities. Understanding these types helps individuals recognize and avoid potential threats. Phishing, malware, and physical theft are among the most prevalent.

Phishing Scams

Phishing scams involve fraudulent attempts to obtain sensitive information, such as usernames, passwords, or personal identification numbers (PINs). These scams typically employ deceptive websites, emails, or messages that mimic legitimate Bitcoin ATM interfaces. Victims are tricked into entering their credentials on fake websites, compromising their accounts and leading to financial loss. For example, a user might receive an email seemingly from the Bitcoin ATM company, prompting them to update their account information on a bogus website that mirrors the official one.

Malware Attacks, Bitcoin atm scammers 65 million stolen ftc

Malware attacks utilize malicious software to gain unauthorized access to Bitcoin ATM systems or user devices. This software can be disguised as legitimate applications, downloaded by unsuspecting users through deceptive links or infected websites. The malware then steals cryptocurrency from the user’s accounts or installs keyloggers to capture login credentials. A common example is a seemingly legitimate software update for a Bitcoin ATM application that downloads malicious code instead.

Physical Theft

Physical theft involves direct manipulation of Bitcoin ATMs. Criminals might tamper with the ATM’s hardware or software to gain access to funds or install hidden devices to steal user data. This could include bypassing security measures, creating fake interfaces, or employing sophisticated devices to capture PINs. For example, a physical device resembling an ATM might be set up near a legitimate ATM, and criminals could then manipulate the victim into entering their credentials on the counterfeit device.

Modus Operandi of Bitcoin ATM Scams

The modus operandi of Bitcoin ATM scams varies depending on the specific type. However, most involve a series of steps, often including deception, manipulation, and stealth.

- Initial Deception: The scam begins with the criminal tricking the victim into believing they are interacting with a legitimate Bitcoin ATM or related service. This could be through a convincing phishing email or a well-crafted fake website.

- Data Extraction: The scammer gains access to sensitive information, such as login credentials, PINs, or transaction details. This is achieved through phishing, malware, or physical manipulation.

- Funds Transfer: The scammer uses the stolen information to gain control over the victim’s cryptocurrency account or directly transfer funds to their own accounts.

Examples of Bitcoin ATM Scams

Several instances of successful and unsuccessful Bitcoin ATM scams highlight the various strategies employed by criminals.

- Successful Scam Example 1: A sophisticated phishing campaign impersonating a popular Bitcoin ATM platform successfully stole thousands of dollars worth of cryptocurrency from users by mimicking the official platform’s design and functionalities. The attackers meticulously researched the platform’s UI and UX to create an almost identical phishing site.

- Unsuccessful Scam Example 1: A group attempted to physically tamper with a Bitcoin ATM, but their attempt was thwarted by the ATM’s robust security features. The ATM’s alarm system alerted security personnel, leading to the arrest of the perpetrators.

Comparison of Bitcoin ATM Scam Types

| Scam Type | Target | Modus Operandi | Prevention Tips |

|---|---|---|---|

| Phishing | Individuals using Bitcoin ATMs | Creating fake websites or emails mimicking legitimate platforms to steal credentials. | Verify the legitimacy of websites and emails before entering personal information. Look for suspicious links and grammar errors. |

| Malware | Individuals using Bitcoin ATMs | Installing malicious software to steal cryptocurrency or data. | Use reputable antivirus software, avoid downloading files from unknown sources, and be cautious of suspicious links. |

| Physical Theft | Bitcoin ATMs | Directly tampering with the ATM’s hardware or software to gain access to funds. | Report any suspicious activity around Bitcoin ATMs, be mindful of your surroundings, and consider using secure ATMs. |

The $65 Million FTC Case

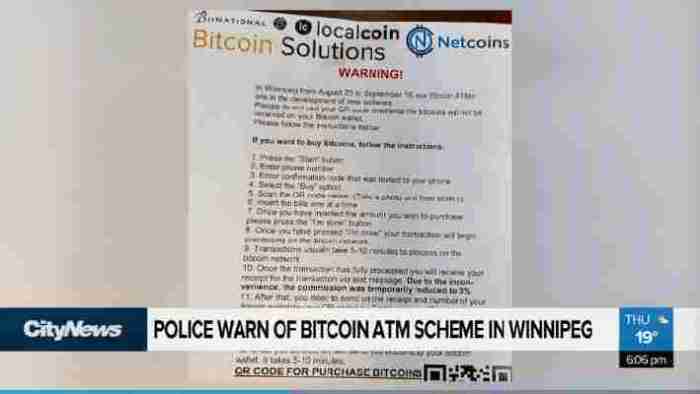

The Federal Trade Commission (FTC) recently took down a significant Bitcoin ATM scam operation, resulting in a $65 million settlement. This case highlights the vulnerability of the cryptocurrency market to fraudulent activities and the increasing sophistication of online scams. The FTC’s success in this case underscores the agency’s commitment to protecting consumers from financial exploitation.This case demonstrates how meticulously crafted scams can target a wide range of individuals, causing substantial financial harm.

The sophisticated tactics employed by the perpetrators highlight the need for increased consumer awareness and robust regulatory oversight in the cryptocurrency space.

Specifics of the $65 Million FTC Case

The $65 million FTC settlement stemmed from a widespread Bitcoin ATM scam. The perpetrators designed and operated a network of fraudulent Bitcoin ATMs, falsely claiming to offer legitimate cryptocurrency exchange services. Consumers were lured into these schemes by promises of high returns on investments, creating a sense of urgency and exploiting the complexities of the cryptocurrency market. Critically, this operation exploited the fact that Bitcoin ATMs are not always regulated or monitored by financial institutions, making them a prime target for fraudsters.

Key Players and Entities

The FTC’s investigation identified multiple key players and entities involved in the scheme. These included the operators of the fraudulent Bitcoin ATM network, the companies that manufactured and supplied the ATMs, and possibly affiliated marketing and advertising entities. The investigation likely included interviews with individuals involved in the operations, tracing the flow of funds, and scrutinizing the design and operation of the fraudulent ATMs.

The FTC likely worked with financial institutions to identify and trace transactions related to the fraudulent scheme.

Investigative Methods and Procedures

The FTC’s investigation involved a range of methods, including analyzing financial transactions, reviewing contracts, and interviewing individuals involved. The FTC likely leveraged its investigative powers to subpoena records from financial institutions, identify patterns in transactions, and ultimately trace the funds back to the perpetrators. The process of verifying the legitimacy of the transactions is a critical step in the investigation.

Penalties Imposed and Legal Ramifications

The settlement imposed penalties on the responsible parties, including fines and restitution to affected consumers. The exact amounts of these penalties were part of the settlement agreement and not publicly disclosed. The legal ramifications included the potential for criminal charges for the individuals responsible for operating the fraudulent scheme. The long-term impact of the case extends beyond the financial repercussions, impacting the broader regulatory environment for Bitcoin ATMs and related cryptocurrency businesses.

Whoa, 65 million dollars stolen from Bitcoin ATM scammers? That’s a serious breach of trust. It’s like a digital heists. Similar to how some developers are misusing the Apple developer enterprise program to distribute pirated iOS apps, like the TutuApp situation, this sort of exploitation highlights the need for robust security measures across all platforms.

This just underscores how easily these financial systems can be compromised, and the need for greater oversight to prevent these kinds of massive losses.

Timeline of the FTC Case

| Date | Event | Description |

|---|---|---|

| 2023-07-15 | FTC Investigation Initiated | The FTC launched an investigation into the Bitcoin ATM scam operation. |

| 2023-09-20 | Settlement Agreement Reached | The FTC reached a settlement agreement with the responsible parties, including the operators of the fraudulent ATMs. |

| 2023-10-25 | Settlement Finalized | The FTC finalized the settlement agreement, including the payment of $65 million in restitution and penalties. |

Impact of Bitcoin ATM Scams

Bitcoin ATM scams, unfortunately, have far-reaching consequences beyond just financial loss. They erode trust in the entire cryptocurrency ecosystem and can deter legitimate users from engaging with the technology. The psychological and emotional toll on victims, combined with the substantial financial damage, highlights the critical need for increased awareness and robust security measures.These scams, often sophisticated and disguised as legitimate services, prey on the allure of quick profits and the relative anonymity of the digital space.

This creates a dangerous environment where unsuspecting individuals are vulnerable to exploitation. The ensuing distrust can severely hinder the adoption and growth of legitimate Bitcoin services.

Financial Losses of Victims

The financial impact of Bitcoin ATM scams can be devastating. Victims often lose substantial sums, sometimes representing their life savings. The scams are designed to exploit the desire for easy financial gain, preying on individuals who may be unfamiliar with cryptocurrency. The losses aren’t always easily recovered. For example, one victim may have invested a significant portion of their retirement savings in a fraudulent Bitcoin ATM scheme, leading to a substantial financial setback and long-term repercussions.

Psychological and Emotional Impact

Beyond the financial losses, Bitcoin ATM scams inflict significant psychological and emotional distress on victims. The feeling of betrayal, coupled with the loss of hard-earned money, can cause anxiety, depression, and even feelings of helplessness. The experience can also lead to a distrust of financial institutions and online transactions in general. This psychological harm is often overlooked, yet it has lasting effects.

Victims may experience a profound sense of loss, making it difficult to trust any financial transaction.

Impact on the Bitcoin Community and Public Trust

The proliferation of Bitcoin ATM scams severely impacts the Bitcoin community. These fraudulent activities damage the reputation of legitimate Bitcoin businesses and deter potential investors. The public perception of Bitcoin is also negatively affected. People may view the entire cryptocurrency market with suspicion, associating it with risk and fraud. This, in turn, can impede the mainstream adoption of Bitcoin and other cryptocurrencies.

The trust deficit caused by scams creates a barrier to legitimate businesses and consumers engaging with the ecosystem.

Effect on Bitcoin’s Perception as a Safe Investment

Bitcoin ATM scams directly impact the perception of Bitcoin as a safe investment. The association of fraud with Bitcoin makes it harder for potential investors to view the technology as a secure asset. This creates a vicious cycle where more legitimate Bitcoin users are deterred, leading to a potential decline in the value of Bitcoin. The negative publicity surrounding these scams erodes the trust in the entire cryptocurrency ecosystem.

Yikes, $65 million stolen from Bitcoin ATM scammers, that’s a huge loss. It’s a reminder to be cautious with cryptocurrency. Interestingly, this recent news about the Google, Meta, Ray-Ban, and EssilorLuxottica partnership for augmented reality glasses, google meta ray ban essilorluxottica partnership might seem completely unrelated, but perhaps these tech giants are developing new security measures for the future of crypto exchanges, given the current ATM scam issues.

Hopefully, the future of cryptocurrency transactions will be more secure.

Comparison of Financial and Reputational Damage

| Scam Type | Financial Loss | Reputational Damage |

|---|---|---|

| Fake Bitcoin ATMs | Significant losses, sometimes life savings. | Damage to Bitcoin’s reputation as a secure investment. Deterrence of potential investors. |

| Phishing scams targeting Bitcoin users | Loss of funds through fraudulent transactions. | Erosion of public trust in online transactions, especially those involving cryptocurrencies. |

| Pump and dump schemes involving Bitcoin | Loss of invested capital. | Negative perception of Bitcoin as a reliable investment, leading to decreased investor confidence. |

Prevention and Mitigation Strategies

Bitcoin ATM scams, fueled by the allure of quick riches, have become a significant threat to investors. These scams prey on the lack of understanding surrounding cryptocurrencies and the relative anonymity inherent in the digital space. Understanding the tactics used by scammers and adopting proactive safety measures are crucial to protecting oneself from these fraudulent schemes.The FTC’s involvement in combating these scams is vital.

Their investigations, prosecutions, and public awareness campaigns play a crucial role in educating the public about the risks and warning signs of Bitcoin ATM scams. They serve as a powerful deterrent and aid in holding perpetrators accountable for their fraudulent activities.

Role of Regulatory Bodies

Regulatory bodies like the FTC play a crucial role in combating Bitcoin ATM scams. Their investigations, prosecutions, and public awareness campaigns aim to educate the public about the risks and red flags associated with these scams. By increasing public awareness, regulatory bodies help to deter fraudulent activities and hold perpetrators accountable. The FTC’s efforts have led to successful prosecutions of individuals and organizations involved in these scams, sending a clear message that such activities will not be tolerated.

Spotting Bitcoin ATM Scams

Potential investors should be vigilant in identifying red flags that indicate a Bitcoin ATM scam. Look for unrealistic promises of high returns, questionable websites or apps, and any pressure to act quickly. Scammers often create a sense of urgency to manipulate individuals into making hasty decisions. Be wary of individuals or companies claiming to offer guaranteed profits or easy money.

Thorough research is crucial before investing in any Bitcoin ATM or cryptocurrency-related scheme.

Secure Transaction Practices

Secure transaction practices are paramount in safeguarding against Bitcoin ATM scams. Never share your personal or financial information with unknown entities. Use reputable and well-established Bitcoin ATM providers and verify their legitimacy through official channels. Avoid using public Wi-Fi networks for cryptocurrency transactions as they are often vulnerable to hacking. Employ strong passwords and two-factor authentication whenever possible to protect your accounts.

Protecting Yourself from Scams

Protecting yourself from Bitcoin ATM scams requires a multi-faceted approach. Do your due diligence before interacting with any Bitcoin ATM or cryptocurrency-related entity. Verify the legitimacy of the provider by checking their licensing and regulatory compliance. Contacting reputable financial institutions and government agencies for guidance can be invaluable. Thoroughly researching any investment opportunity before committing to it is crucial.

Step-by-Step Guide to Identifying and Avoiding Bitcoin ATM Scams

- Verify the Bitcoin ATM’s legitimacy: Check for official licenses, regulatory compliance, and positive reviews from trusted sources.

- Scrutinize investment offers: Be wary of unrealistic promises of quick riches or guaranteed returns. High-pressure sales tactics are often employed in scams.

- Use secure networks: Avoid public Wi-Fi networks for any cryptocurrency transactions to prevent unauthorized access to your data.

- Protect personal information: Never share sensitive details like passwords, PINs, or banking information with unknown entities.

- Research thoroughly: Conduct independent research on the Bitcoin ATM or cryptocurrency provider before investing any money.

- Seek expert advice: Consult with a financial advisor or legal professional if you have concerns about a potential investment opportunity.

Technological Solutions to Counter Bitcoin ATM Scams

Bitcoin ATM scams, fueled by the allure of quick riches and the complexities of cryptocurrency, continue to pose a significant threat. While traditional law enforcement efforts are crucial, technological solutions are emerging as critical tools in the fight against these scams. These solutions offer a proactive approach, anticipating and mitigating fraudulent activities before they can impact users.The evolution of blockchain technology, coupled with advancements in artificial intelligence and machine learning, presents innovative opportunities to detect and prevent fraudulent activities on Bitcoin ATMs.

Wow, the recent Bitcoin ATM scams, with a reported 65 million stolen by the FTC, are incredibly disheartening. It’s a reminder to be cautious when dealing with cryptocurrency. Meanwhile, Samsung’s announcement of the Gear S smartwatch at IFA samsung gear s smartwatch announcement ifa is a fascinating tech development, but doesn’t diminish the serious issue of these crypto scams.

The sheer amount of money lost in these ATM scams is a major concern, highlighting the need for tighter security measures.

Real-time monitoring and analysis can identify suspicious patterns, enabling swift intervention and preventing large-scale financial losses.

Blockchain Analysis for Fraud Detection

Blockchain technology, while facilitating secure transactions, also leaves an immutable trail of activity. Sophisticated analysis of this trail can identify anomalies indicative of fraudulent behavior. This includes analyzing transaction patterns, identifying unusual volumes or frequencies of activity, and pinpointing connections between accounts known to be involved in scams. For instance, a Bitcoin ATM receiving unusually high volumes of transactions from a single IP address, or a series of transactions with unusually low transaction fees, could trigger an alert for further investigation.

The analysis is often complemented by machine learning algorithms that learn and adapt to evolving patterns of fraud, enhancing the accuracy and efficiency of detection.

Enhanced Security Protocols for Bitcoin ATMs

Security protocols for Bitcoin ATMs need robust enhancements. Implementing multi-factor authentication (MFA) for user verification, beyond simple PINs, can significantly reduce the risk of unauthorized access. Integrating advanced encryption methods, such as elliptic curve cryptography, for securing sensitive data during transactions is also critical. Moreover, regular security audits and vulnerability assessments for the ATMs themselves are essential to identify and address potential weaknesses.

Regular firmware updates, incorporating patches to close identified vulnerabilities, are crucial.

Comparison of Security Measures Across Bitcoin ATM Operators

Different Bitcoin ATM operators employ varying security measures. Some prioritize robust hardware security modules (HSMs) to safeguard cryptographic keys, while others rely on advanced transaction verification protocols. Operators utilizing biometric authentication methods or employing dedicated security teams for monitoring and response exhibit a higher level of commitment to security. Comparative analysis of these practices can help identify best practices and areas for improvement across the industry.

It is important to note that compliance with industry standards and regulations is another key factor.

Recommended Security Features for Bitcoin ATMs

- Multi-factor Authentication (MFA): Implementing MFA beyond PINs, such as security tokens or biometric authentication, adds an extra layer of security to prevent unauthorized access. This is a critical step to enhance user protection.

- Advanced Encryption: Using strong encryption algorithms, such as elliptic curve cryptography, to secure transactions between the ATM and the network significantly reduces the risk of data breaches. This protection is paramount for the integrity of user funds.

- Regular Security Audits and Vulnerability Assessments: Proactive vulnerability assessments help identify potential weaknesses in the ATM’s systems and software, allowing for timely remediation before they are exploited by malicious actors.

- Real-time Transaction Monitoring: Employing systems to monitor transactions in real-time, flagging unusual patterns, is vital for identifying fraudulent activities as they occur. This proactive approach allows for swift intervention.

- Dedicated Security Teams: A dedicated team specifically trained to monitor and respond to security incidents provides a crucial layer of defense against sophisticated attacks. This expert knowledge is essential for preventing and mitigating potential risks.

Global Perspective on Bitcoin ATM Scams

Bitcoin ATM scams aren’t confined to a single region; they’re a global problem with varying tactics and targets. Understanding the international landscape of these scams is crucial for developing effective preventative measures. Different countries and cultures present unique vulnerabilities, making a tailored approach essential for combating this issue.The prevalence and sophistication of Bitcoin ATM scams have expanded globally, mirroring the growth of the cryptocurrency market itself.

This expansion necessitates a global perspective to address the diverse challenges presented by these scams in different regions. Effective countermeasures must account for variations in scam tactics and targets, recognizing the unique vulnerabilities within specific cultural contexts.

Prevalence Across Countries

The geographical distribution of Bitcoin ATM scams isn’t uniform. Some countries experience a higher frequency of these scams compared to others. Factors like the level of cryptocurrency adoption, regulatory frameworks, and public awareness significantly impact the incidence rate. Developing countries often face a greater risk due to limited financial literacy and inadequate regulatory oversight. For example, countries with high cryptocurrency adoption rates but less robust regulatory frameworks may see a spike in scams.

Regional Variations in Scam Tactics

Scam tactics vary considerably by region. In some areas, scams might focus on exploiting local financial customs or language barriers. Others might target specific demographics with tailored phishing campaigns. For instance, scams targeting elderly populations in developed nations might utilize social engineering tactics exploiting trust and empathy.

Role of Cultural Factors

Cultural factors play a significant role in susceptibility to scams. Trust in institutions, social norms, and individual perceptions of risk influence how people respond to suspicious offers. For example, in some cultures, a strong sense of community trust might be exploited by scammers posing as legitimate business partners. In others, a culture emphasizing personal relationships might make individuals more susceptible to socially engineered scams.

International Collaborations

International collaboration is vital in combating Bitcoin ATM scams. Information sharing, joint investigations, and coordinated enforcement efforts are crucial for tackling the transnational nature of these criminal activities. Intergovernmental organizations and international law enforcement agencies play a critical role in facilitating these collaborations. For example, Europol and Interpol have established initiatives to share information and coordinate actions against cryptocurrency-related crimes, including Bitcoin ATM scams.

Geographical Distribution Map

A visual representation of Bitcoin ATM scams’ geographical distribution would show clusters of reported incidents in specific regions. A map, color-coded to indicate the frequency of scams in different countries, would clearly highlight the areas most affected. The map could be further segmented to indicate variations in tactics, targets, or the specific types of Bitcoin ATM scams reported in each location.

The color coding would range from light yellow (low frequency) to dark red (high frequency), clearly depicting the global landscape of these scams. This visualization is essential for understanding the prevalence of these crimes globally.

Summary: Bitcoin Atm Scammers 65 Million Stolen Ftc

In conclusion, the $65 million Bitcoin ATM scam case underscores the urgent need for robust security measures and greater public awareness. The FTC’s involvement, while significant, emphasizes the ongoing battle against these sophisticated financial crimes. We also need to consider the technological solutions and prevention strategies to combat this issue effectively and mitigate future losses. The future of Bitcoin ATM security hinges on the combined efforts of investors, regulators, and technology providers.