Apple Card vs Prime Visa: Navigating the world of credit cards can be overwhelming. This comprehensive comparison delves into the features, benefits, and potential drawbacks of both Apple Card and Prime Visa, helping you decide which card best fits your needs. From rewards and fees to security and customer support, we’ll cover everything you need to know.

Both cards offer unique advantages, so understanding their specific strengths and weaknesses is key to making an informed decision. This comparison will help you weigh the pros and cons of each card based on your spending habits, priorities, and lifestyle. We’ll analyze the historical context of each card, highlighting how their design and functionalities differ.

Apple Card vs. Prime Visa: Apple Card Vs Prime Visa

Apple Card and Prime Visa are two popular credit cards catering to different consumer needs. Apple Card, launched by Apple Inc., is a digital-only card integrated with Apple Pay, while Prime Visa, offered by Amazon, is a traditional credit card linked to Amazon Prime membership. Understanding their features, benefits, and target audiences is crucial for making an informed decision.

Key Features and Benefits of Apple Card, Apple card vs prime visa

Apple Card’s primary appeal lies in its innovative features and streamlined user experience. It’s integrated with Apple Pay, enabling seamless transactions. Its unique feature is the introduction of a daily interest rate, which dynamically adjusts depending on the account’s balance and spending behavior. This dynamic interest rate approach can lead to potential benefits for responsible users. Furthermore, it offers features like the ability to easily split purchases with friends and family, and generous rewards for Apple purchases.

The card’s digital-only nature also simplifies management and reduces physical card-related hassles.

- Dynamic Interest Rate: The daily interest rate on the Apple Card adjusts based on factors like the account’s balance and spending activity. This allows for a more flexible and potentially beneficial interest rate structure, but it also means the interest rate is not fixed and may vary depending on these factors.

- Apple Pay Integration: Seamless integration with Apple Pay allows for quick and secure transactions. This feature enhances the overall user experience and makes transactions easier to manage.

- Split Purchases: Users can easily split purchases with friends and family, promoting shared expenses and social financial interactions.

- Apple Rewards: Special rewards or discounts on Apple products and services are offered to cardholders.

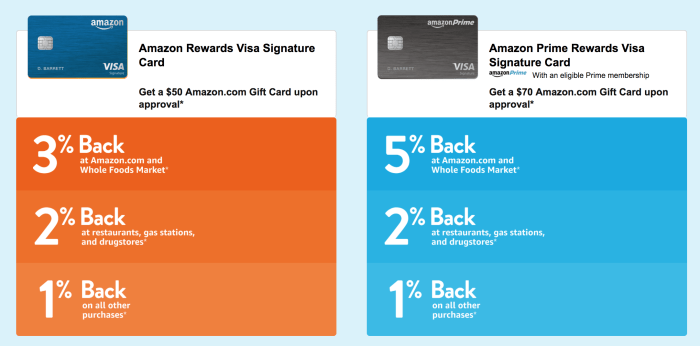

Key Features and Benefits of Prime Visa

Prime Visa, linked to Amazon Prime membership, leverages Amazon’s extensive ecosystem to provide exclusive benefits. These benefits include the ability to earn rewards on Amazon purchases and access exclusive deals and promotions. This card typically offers a straightforward, established rewards program, a staple feature for many traditional credit cards.

- Amazon Rewards: Prime Visa offers rewards on purchases made at Amazon, which often includes a wider range of products and services than the Apple Card.

- Prime Benefits: Cardholders often enjoy access to exclusive deals, promotions, and discounts offered through the Amazon Prime program, as well as other benefits tied to Amazon Prime membership.

- Traditional Rewards Program: Prime Visa typically features a standard rewards program, often offering points or miles redeemable for various goods and services.

Target Audience for Each Card

The target audience for each card differs based on the card’s unique features. Apple Card is designed for tech-savvy individuals who value digital transactions and Apple products, prioritizing ease of use and integration with Apple’s ecosystem. Prime Visa caters to Amazon Prime members who prioritize rewards and deals associated with Amazon’s extensive online retail platform. The cardholders are more likely to be frequent Amazon shoppers.

Historical Context of Both Products

Apple Card, launched in 2019, revolutionized the credit card market by introducing a digital-only, user-friendly experience. Prime Visa, on the other hand, has been in the market for longer and is part of Amazon’s broader ecosystem of services.

Comparison Table

| Feature | Apple Card | Prime Visa |

|---|---|---|

| Card Type | Digital | Traditional |

| Rewards Program | Apple Products & Services | Amazon Purchases |

| Integration | Apple Pay | Amazon Prime |

| Target Audience | Tech-savvy consumers | Amazon Prime members |

Rewards and Benefits

Apple Card and Prime Visa, while both offering financial tools, differ significantly in their reward structures and benefits. Understanding these nuances is crucial for choosing the card that aligns with your spending habits and financial goals. This section delves into the specific rewards, earning potentials, and perks associated with each card.Rewards programs are designed to incentivize spending and encourage responsible financial management.

They often involve earning points, miles, or cashback on various transactions. The value of these rewards, however, depends on the specific program and your spending patterns.

Apple Card Reward Structure

Apple Card’s rewards are primarily tied to its unique Daily Cash program. This program offers a tiered cashback structure. Essentially, users earn a percentage of their daily purchases, with the rate fluctuating based on spending habits. While the exact percentage isn’t publicly fixed, it is generally based on a sliding scale. For example, a user with higher average daily spending might receive a slightly higher daily cashback rate than a user with lower daily spending.

I’ve been pondering the Apple Card versus Prime Visa lately, and it’s got me thinking about all the cool tech deals out there. For example, check out these sweet deals on Bose QC35 II headphones, Xbox Game Pass Ultimate, Apple keyboards, and Instax cameras at bose qc35 ii headphones xbox game pass ultimate apple keyboard instax deal sale.

Ultimately, the best card for you will depend on your spending habits and rewards preferences, but I’m still leaning towards the Apple Card for its seamless integration with my Apple ecosystem. Weighing the pros and cons of each card is key when making a decision.

A key benefit is the potential for consistent rewards across all spending categories.

Prime Visa Reward Structure

Prime Visa, on the other hand, utilizes a points-based system, often linked to various partner merchants. These points can be redeemed for a range of rewards, such as travel, merchandise, or statement credits. Unlike the Apple Card’s daily cashback, Prime Visa’s rewards are usually tied to specific spending categories or partner programs. For example, significant travel discounts may be offered through airline or hotel partnerships.

The earning potential varies based on the specific spending category.

Earning Potential

The earning potential of each card depends heavily on individual spending habits. Someone who regularly shops at Amazon or travels frequently might find the Prime Visa’s point-based system more lucrative. Conversely, a user with consistent daily spending patterns could potentially maximize the Apple Card’s daily cashback program.

Perks and Privileges

Beyond the core reward programs, both cards offer additional perks. Apple Card, for instance, includes features like a built-in budgeting tool, while Prime Visa often comes with access to exclusive Prime benefits. These benefits can significantly enhance the overall value proposition of each card.

Reward Programs for Different Spending Categories

| Spending Category | Apple Card | Prime Visa |

|---|---|---|

| Groceries | Potentially high cashback based on daily spending patterns | Variable points based on partner merchant participation |

| Dining | Potentially high cashback based on daily spending patterns | Variable points based on restaurant partnerships |

| Travel | Potentially lower cashback; no specific travel rewards program | High earning potential via airline/hotel partnerships, significant points for travel purchases |

| Online Shopping | Potentially high cashback based on daily spending patterns | Variable points based on retailer participation |

| Entertainment | Potentially high cashback based on daily spending patterns | Variable points based on entertainment venue partnerships |

Note: The specific cashback percentages and point values for each card are subject to change. It is advisable to review the latest terms and conditions from the respective card issuers for precise details.

Fees and Charges

Understanding the fees associated with credit cards is crucial for responsible financial management. Different cards come with various charges, impacting the overall cost of borrowing and using the card. This section details the fees for both Apple Card and Prime Visa, enabling a comprehensive comparison.Apple Card and Prime Visa cards both aim to provide value and benefits to users.

However, understanding the nuances of their respective fee structures is essential to determine which card best suits your financial needs.

Annual Fees

Apple Card, in its standard form, typically does not have an annual fee. This is a significant advantage compared to some other credit cards, which may charge a fee every year for the privilege of using the card. Prime Visa cards may also have no annual fee, but this can vary depending on the specific terms and conditions.

Foreign Transaction Fees

Foreign transaction fees apply when using a card outside of your home country. These fees typically involve a percentage of the transaction amount. Apple Card and Prime Visa cards have different approaches to foreign transaction fees. Apple Card may have a foreign transaction fee, while the Prime Visa card might have a lower fee or no fee at all.

Careful review of the fine print for both cards is recommended to avoid unexpected charges.

Late Payment Fees

Late payment fees are charged when a cardholder fails to make a payment on time. Both cards specify late payment policies, which can vary significantly in the amount of the fee and the circumstances under which it’s levied. The terms and conditions of these policies are crucial for understanding the financial implications of potential late payments.

Balance Transfer Fees

Balance transfers involve moving an existing balance from one credit card to another. Both Apple Card and Prime Visa cards may charge a balance transfer fee, and this fee is usually expressed as a percentage of the transferred amount. It’s crucial to examine the terms and conditions of the specific card offers and compare them to identify the best balance transfer option.

Annual Percentage Rate (APR)

The APR, or Annual Percentage Rate, is the interest rate charged on outstanding balances. Different spending categories often have varying APRs. Apple Card and Prime Visa cards likely offer different APRs for various spending categories, such as everyday purchases, balance transfers, or cash advances. Knowing the APRs for different spending categories is important for calculating the total cost of borrowing.

How Fees Affect Overall Cost

Fees can significantly impact the overall cost of using a credit card. For example, a high annual fee can negate the benefits of rewards or other perks. A high foreign transaction fee might make international travel less cost-effective. Late payment fees can accumulate quickly and damage your credit score. By thoroughly examining the fee structures of both cards, you can make an informed decision about which card aligns best with your spending habits and financial goals.

Security and Protection

Protecting your financial information is paramount, especially when choosing a payment card. Both Apple Card and Prime Visa offer robust security measures, but the specifics differ. Understanding these differences is crucial for making an informed decision.

Security Features of Each Card

Apple Card leverages Apple’s integrated security infrastructure, which includes features like two-factor authentication and a robust fraud detection system. The Prime Visa, relying on a different network, utilizes a separate fraud prevention and protection system. These systems vary in their specific functionalities, but both aim to safeguard cardholders from unauthorized transactions.

Fraud Protection and Dispute Resolution

Both cards provide fraud protection, but the specifics of their policies and procedures differ. Apple Card’s fraud protection typically involves a rapid response to potential fraudulent activity, often utilizing machine learning to identify and flag suspicious transactions. Prime Visa, similarly, has a fraud prevention system, but its approach and response times may vary depending on the individual cardholder’s account and the specific circumstances of the alleged fraudulent activity.

Dispute resolution procedures are generally Artikeld in each card’s terms and conditions, and include steps for initiating a dispute and the expected timeframe for resolution. Customers should familiarize themselves with these procedures.

Lost or Stolen Card Reporting

Prompt reporting of lost or stolen cards is essential. Apple Card provides various reporting methods, including the Apple Wallet app and online portals. Prime Visa also offers similar reporting options through their website and mobile applications. It’s crucial to follow the specific steps Artikeld by each card issuer for the most efficient and effective process.

Figuring out the best credit card, like Apple Card vs. Prime Visa, can be tricky. But, if you’re looking for a way to easily track your belongings, the Tile Ultra UWB tracker ( tile ultra uwb tracker ios android ) is a game-changer. Ultimately, the best card for you will depend on your spending habits and priorities, and remembering where you put your stuff shouldn’t be a major factor.

Still, navigating the various perks and potential benefits of Apple Card versus Prime Visa remains a crucial financial decision.

Personal Data Protection

Both Apple Card and Prime Visa adhere to industry standards for protecting cardholder data. They employ encryption technologies and secure servers to safeguard sensitive information. However, the exact methods and levels of encryption may differ. Cardholders should review the privacy policies of each card to understand the specific measures taken to protect their personal data.

Comparison of Security Features

| Feature | Apple Card | Prime Visa |

|---|---|---|

| Two-Factor Authentication | Yes, integrated into Apple ecosystem | Potentially available through associated bank |

| Fraud Detection System | Machine learning-based, rapid response | Traditional fraud detection methods |

| Lost/Stolen Card Reporting | Multiple channels, including app and online portal | Website and mobile app reporting |

| Data Encryption | Strong encryption protocols | Strong encryption protocols |

| Dispute Resolution | Clearly defined process in terms and conditions | Clearly defined process in terms and conditions |

Customer Service and Support

Navigating the world of credit cards often involves seeking assistance when issues arise. Understanding the customer service options available for different cards can significantly impact your experience. This section delves into the customer service channels, response times, and overall effectiveness for both the Apple Card and the Prime Visa.

Apple Card Customer Service

Apple Card boasts a user-friendly approach to customer support. The primary channels for assistance include phone support, email, and online resources. The support team is typically readily available to address questions and resolve issues. Apple’s emphasis on streamlined processes often leads to quicker resolution times.

- Phone Support: Apple Card offers phone support for users to connect directly with a representative. This allows for real-time interaction and immediate assistance with complex problems. Expect the process to be efficient and resolve many issues promptly.

- Email Support: Apple Card also provides email support for less urgent inquiries or those that can be addressed asynchronously. Responses to email inquiries are typically processed within a reasonable timeframe. This option is useful for gathering information or seeking clarification.

- Online Support: Apple Card’s website often provides a comprehensive knowledge base or FAQ section to help users resolve common issues independently. This self-service option is ideal for quickly finding answers to straightforward questions.

Prime Visa Customer Service

Prime Visa, as a product of Visa, offers a variety of customer service options. Their support channels are readily available to assist users with their needs. Visa’s extensive network often translates to efficient responses.

- Phone Support: Prime Visa customers can reach out via phone to connect with a support representative. This approach provides direct interaction and prompt assistance, particularly for urgent issues. The support staff is generally well-trained.

- Email Support: Email support is also available to address inquiries or resolve issues. This channel is convenient for asynchronous communication and allows users to follow up on their questions. The typical response time to email support is generally within a reasonable time frame.

- Online Support: Visa’s website features a dedicated customer service section. This resource often includes FAQs and self-service tools to help customers find answers to common problems independently. These online tools can be valuable for quick resolutions.

Comparison of Support Options

| Feature | Apple Card | Prime Visa |

|---|---|---|

| Phone Support | Direct and efficient; often quick resolutions | Direct and efficient; generally well-trained representatives |

| Email Support | Reasonable response times | Reasonable response times |

| Online Support | Comprehensive knowledge base; self-service options | Dedicated customer service section; self-service tools |

| Accessibility | Easy access to support channels | Easy access to support channels |

Ease of Use and Technology

The Apple Card and Prime Visa, while both offering convenient payment options, differ significantly in their underlying technology and user experiences. Understanding these differences is crucial for choosing the card that best suits your needs and digital preferences. This section delves into the user interfaces, specific features, and overall convenience of each card.The Apple Card leverages Apple’s ecosystem to provide a seamless integration with other Apple devices.

Conversely, the Prime Visa, while offering robust features, relies on a more traditional banking structure, resulting in a slightly different user experience. This comparison highlights the nuances of each platform’s design and functionality.

Apple Card User Interface

The Apple Card app boasts a clean, intuitive design, mirroring Apple’s aesthetic. Navigation is straightforward, and users can quickly access key information such as account balances, transactions, and payment schedules. The app seamlessly integrates with other Apple devices, enabling easy syncing and data access. The emphasis on visual clarity and simplicity makes managing the card a pleasant experience for most users.

Prime Visa User Interface

The Prime Visa user interface is generally straightforward, but it often leans towards more traditional banking design elements. While functionality is present, it may not offer the same level of visual polish and streamlined integration as the Apple Card app. Navigating the platform often requires more explicit steps, especially when compared to the Apple Card’s intuitive design.

Technology-Specific Features

The Apple Card’s technology integration is a significant differentiator. The app often allows for personalized budgeting tools and financial insights that are tied to Apple’s ecosystem, such as integration with other financial apps. The Prime Visa, while not lacking in features, relies more on traditional banking technology, which may result in less seamless integration with other platforms.

Mobile App Features and Functionalities

Both cards provide mobile app access to account information, transaction history, and payment management. However, the Apple Card app frequently offers features tailored to Apple’s ecosystem, such as quick access to other Apple services or personalized budgeting insights. The Prime Visa app typically provides similar functionalities but without the same level of deep integration with other platforms.

Comparison of User Interfaces

| Feature | Apple Card | Prime Visa |

|---|---|---|

| App Design | Clean, intuitive, visually appealing, mirroring Apple’s aesthetic. | Straightforward, traditional banking design elements. |

| Navigation | Effortless, quick access to key information. | Often requires more explicit steps. |

| Integration with Apple Ecosystem | Seamless integration with other Apple devices and services. | Limited integration with other platforms. |

| Personalization | Personalized budgeting tools, insights, and financial recommendations. | Limited personalization options. |

| Overall User Experience | Streamlined, easy-to-use, and visually appealing. | Functional, but may not be as intuitive as Apple Card. |

Alternatives and Competition

Choosing between the Apple Card and Prime Visa often comes down to personal priorities and spending habits. However, a wider range of credit cards exists in the market, each with its own set of benefits and drawbacks. Understanding these alternatives is crucial for making an informed decision. This section explores potential competitors and highlights factors differentiating them from the Apple Card and Prime Visa.

Potential Alternatives to Apple Card and Prime Visa

Several credit cards offer comparable rewards and benefits, often with different features and pricing. These alternatives may cater to specific needs, such as travel rewards, cash back, or specific spending categories.

Competitors in the Credit Card Market

The credit card market is highly competitive, with numerous issuers offering diverse card types. Major players include established banks, credit unions, and specialized fintech companies. Each strives to attract customers with appealing rewards programs, low interest rates, and user-friendly interfaces. Examples include Discover, Chase, American Express, and various bank-issued cards tailored to different demographics and financial goals.

Factors Differentiating Apple Card and Prime Visa from Other Options

Apple Card and Prime Visa stand out due to their unique features. Apple Card, for instance, integrates seamlessly with Apple Pay and other Apple services. Prime Visa, linked to Amazon Prime membership, offers exclusive access to Prime benefits. Other cards might focus on travel rewards, cash back, or other financial incentives. These unique selling propositions influence customer choices.

Strengths and Weaknesses of Alternative Cards

Different cards excel in different areas. A travel-focused card might offer substantial rewards on flights and hotels but lack significant cash back options. Conversely, a cashback card might provide generous rewards for everyday purchases but lack premium travel perks. Assessing individual needs and spending habits is key to identifying a suitable alternative.

Comparative Analysis of Apple Card, Prime Visa, and Alternative Cards

| Feature | Apple Card | Prime Visa | Discover It Cash Back | Chase Sapphire Preferred |

|---|---|---|---|---|

| Rewards | Cashback, potentially high APR | Amazon Prime benefits, travel rewards | Cash back on everyday purchases | Travel points, bonus categories, high annual fee |

| Fees | Low or no annual fee | No annual fee | No annual fee | High annual fee |

| Ease of Use | Excellent integration with Apple ecosystem | Simple interface, linked to Prime | Intuitive rewards system | Comprehensive rewards system |

| Security | Strong security measures | Standard security protocols | Standard security protocols | Strong security measures |

This table provides a simplified comparison, highlighting key differences. Specific features and terms may vary based on individual circumstances and account conditions. For instance, APR (Annual Percentage Rate) can change based on creditworthiness.

Specific Use Cases

Choosing between the Apple Card and Prime Visa hinges on your spending habits and financial goals. Both offer compelling benefits, but understanding their strengths in different scenarios is crucial for making the right choice. This section explores ideal use cases for each card, highlighting when one might outperform the other.

Ideal Scenarios for the Apple Card

The Apple Card shines when convenience and rewards for everyday spending are prioritized. Its straightforward rewards structure and integration with Apple ecosystem tools are powerful assets.

- Everyday Spending and Budgeting: The Apple Card’s straightforward rewards structure and its seamless integration with Apple Pay and budgeting tools are excellent for those who want a streamlined approach to daily transactions and managing their finances.

- Apple Ecosystem Users: For those deeply embedded in the Apple ecosystem, the Apple Card’s seamless integration with other Apple services enhances its value. This integration simplifies transactions and budgeting.

- Users Seeking Simple Rewards: The straightforward rewards structure, without complex calculations, makes the Apple Card attractive to users who prefer a clear and easy-to-understand reward system.

- Individuals Prioritizing Budgeting and Spending Tracking: The tight integration with Apple’s financial tools facilitates robust budgeting and spending tracking. This feature is invaluable for those who prioritize controlling their finances.

Ideal Scenarios for the Prime Visa Signature Card

The Prime Visa Signature card stands out for its broad range of rewards and benefits, making it a suitable choice for specific spending patterns and travel needs.

- High-Value Purchases and Travel: The Prime Visa Signature card’s travel benefits, including points accrual and potential travel perks, make it advantageous for frequent travelers and those making substantial purchases. These perks can significantly reduce travel expenses and make large purchases more rewarding.

- Frequent Flyers and Travelers: Points earned on the Prime Visa can be redeemed for travel, flights, and hotel stays, making it an attractive option for frequent travelers who want to maximize their rewards and minimize costs.

- Extensive Shopping and Spending: The Prime Visa Signature card offers a wide array of rewards on various purchases, potentially offering significant value for users with substantial spending habits across different categories.

Comparing Spending Patterns

The effectiveness of each card depends significantly on how you spend your money. A consistent user of Apple products might find the Apple Card’s benefits outweigh the Prime Visa’s. Conversely, a frequent traveler or someone with large purchase needs may find the Prime Visa’s travel rewards more beneficial.

| Spending Pattern | Apple Card | Prime Visa Signature |

|---|---|---|

| Frequent small purchases | Excellent – simple rewards and easy budgeting | Adequate, but potential rewards are less clear |

| High-value purchases (e.g., electronics, travel) | Average – rewards are less substantial than the Prime Visa | Excellent – significant rewards on high-value purchases |

| International travel | Limited benefits | Significant benefits – travel points and potential perks |

| Emphasis on budgeting and expense tracking | Excellent – tight integration with Apple’s financial tools | Good, but less integrated |

Potential Pitfalls

Choosing between the Apple Card and a Prime Visa involves careful consideration of potential drawbacks. Both cards offer compelling advantages, but each has limitations and potential downsides that could impact your financial well-being. Understanding these potential pitfalls is crucial for making an informed decision.Analyzing the potential pitfalls of each card allows for a more balanced perspective, enabling you to select the card that aligns best with your financial needs and lifestyle.

This section will delve into the specific drawbacks, risks, and limitations associated with each option, providing a comprehensive comparison for a clearer understanding.

Figuring out the best credit card, like the Apple Card vs. Prime Visa, can be tricky. While comparing those cards, it’s worth considering how fast your data transfer needs to be, especially if you’re frequently transferring large files. This directly relates to portable SSDs like the Samsung T7, and a great resource for understanding the speed and price differences between various models like the T5 is this comparison article.

Ultimately, the best card for you depends on your specific spending habits and priorities, but knowing the different factors can help you make the best choice. So, back to the Apple Card vs. Prime Visa debate, which card truly fits your needs?

Apple Card Potential Pitfalls

The Apple Card, while known for its user-friendly interface and unique features, presents certain limitations. A major concern lies in the potential for fluctuating rewards and benefits. The card’s rewards structure may not always align with your spending habits or financial goals. This could lead to a less favorable return on investment compared to alternative options.

- Limited Spending Flexibility: The Apple Card’s rewards system, while straightforward, might not cater to diverse spending patterns. For instance, if your spending is not concentrated in areas where the card’s rewards are most beneficial, you might not maximize the potential value.

- Limited International Usage: International transactions might incur higher fees or less favorable exchange rates compared to cards specifically designed for global travel or business. This can significantly impact your spending when traveling abroad.

- Limited Customer Service Options: While Apple’s reputation for customer service is generally positive, the specific channels for Apple Card support might not always offer the level of personalized assistance that other financial institutions provide. This could be especially important during times of financial hardship or when encountering complex issues.

Prime Visa Potential Pitfalls

The Prime Visa, as a part of Amazon’s ecosystem, offers numerous benefits, but these benefits are not without limitations.

- Rewards Structure: While the rewards structure is generally consistent, it might not always align with your individual spending preferences. For instance, a user primarily spending on non-Amazon goods might not derive maximum value from the Prime Visa’s rewards program.

- Limited Rewards Redemption Options: The redemption options for Prime Visa rewards might not always be as extensive or flexible as other cards with more diverse reward programs. This could restrict your ability to leverage rewards for specific purchases or experiences.

- Potential for High Fees: Certain Prime Visa cards may come with higher annual fees or transaction fees for international usage or certain types of transactions, which could diminish the value of the rewards and benefits.

Comparative Table of Potential Pitfalls

| Feature | Apple Card | Prime Visa |

|---|---|---|

| Rewards Flexibility | Potentially limited due to a focused rewards structure | Potentially limited due to rewards program focus on Amazon purchases |

| International Usage | Potential for higher fees or less favorable exchange rates | Potential for higher fees or less favorable exchange rates, depending on the card type |

| Customer Service | Potentially limited support channels compared to other financial institutions | Customer service channels might be limited or not as personalized |

| Spending Flexibility | Limited spending flexibility, may not suit diverse spending patterns | Limited spending flexibility, might not suit diverse spending patterns |

Conclusion (Summary)

Choosing between the Apple Card and the Prime Visa depends heavily on individual spending habits and priorities. Both cards offer unique benefits, and the “best” option is highly personalized. Understanding the strengths and weaknesses of each is crucial for making an informed decision.Ultimately, the value proposition of each card hinges on how closely your spending aligns with the rewards and features offered.

A meticulous evaluation of your financial needs and preferences is essential before committing to either card.

Key Differences

The Apple Card and Prime Visa, while both credit cards, cater to distinct needs and reward structures. Apple Card emphasizes simplicity and integration with Apple ecosystem services, whereas the Prime Visa offers broader rewards and perks.

- Apple Card prioritizes ease of use and budgeting tools, appealing to users seeking seamless integration with their Apple devices. Its reward structure, although simple, is tied to everyday spending, potentially attracting users who value this direct approach.

- Prime Visa, on the other hand, offers broader rewards and benefits, often in the form of travel, dining, or cash back, appealing to those who value flexibility and extensive reward programs. This structure may attract users who actively utilize these specific reward categories.

Advantages and Disadvantages

Both cards have advantages and disadvantages. Understanding these aspects helps in tailoring the decision to individual needs.

| Feature | Apple Card | Prime Visa |

|---|---|---|

| Rewards | Simple, straightforward rewards based on spending; potential for high cashback rates on certain purchases. | Extensive rewards program, including travel points, cash back, and dining benefits. Flexibility in reward redemption. |

| Fees | Potentially lower annual fees compared to some other cards. | Annual fee varies depending on the specific Prime Visa card. |

| Ease of Use | Exceptional ease of use, seamless integration with Apple ecosystem, and intuitive budgeting tools. | Ease of use varies, but the card is generally user-friendly. |

| Customer Service | Customer service may be limited to Apple support channels. | Customer service is typically provided through multiple channels. |

| Security | Emphasizes security measures and features to prevent fraud. | Offers standard security measures for credit card transactions. |

Value Proposition

The value proposition of each card depends significantly on the user’s needs.

- For users seeking simplicity, seamless integration with Apple ecosystem, and robust budgeting tools, the Apple Card might be the better choice. Its intuitive design and focus on straightforward rewards make it attractive to tech-savvy individuals.

- On the other hand, the Prime Visa provides a wider range of rewards and benefits, appealing to users who value flexibility and multiple redemption options. The broad reward structure caters to diverse spending patterns.

Individual Needs

Ultimately, the best choice hinges on individual priorities. Consider spending habits, desired rewards, and preferred customer service channels when making the decision.

- A user who frequently travels might prioritize the Prime Visa’s travel rewards. In contrast, a user who primarily shops online and uses Apple products may find the Apple Card more suitable.

Conclusion

In conclusion, choosing between Apple Card and Prime Visa hinges on individual priorities. Apple Card shines with its user-friendly interface and unique rewards structure, while Prime Visa offers a broader range of perks and benefits for frequent travelers or those seeking extensive rewards programs. Carefully consider your spending patterns and financial goals to determine the optimal card for your situation.

Ultimately, understanding the intricacies of each card will empower you to make the best choice for your personal financial journey.