Android Pay UK announced, signaling a significant move in the UK’s mobile payment landscape. This new service promises to offer a seamless and secure way to pay for goods and services, potentially revolutionizing how Brits interact with their phones. Initial details highlight key features and potential impacts on the UK market, but also raise questions about its competitiveness with existing options like Apple Pay and Google Pay.

Will Android Pay truly capture a substantial market share, or will it struggle to gain traction in a crowded field? Let’s delve deeper into the details.

The announcement details the key features, such as user interface design and security measures. It also considers the target market, the technical specifications of the service, and potential challenges. We will examine these aspects and consider how Android Pay compares with existing services, discussing potential advantages and disadvantages for users and businesses.

Introduction to Android Pay UK Launch: Android Pay Uk Announced

Android Pay’s UK launch marks a significant step in the evolution of mobile payments in the country. This announcement signals a convergence of digital technology and traditional retail, promising a smoother and more convenient payment experience for consumers. The service, expected to integrate seamlessly with existing Android devices, is poised to reshape the way people interact with commerce.The key features unveiled in the announcement highlight a focus on user experience and security.

The platform is designed to offer a secure, straightforward, and intuitive way to make payments, addressing common pain points associated with traditional methods. This initiative is likely to drive substantial adoption within the UK’s mobile payment ecosystem.

Key Features of Android Pay UK

The announcement emphasized several key features, aimed at enhancing the user experience and bolstering consumer trust. These features include:

- Secure Payment Processing: Android Pay utilizes advanced encryption protocols to safeguard user financial data. This ensures a high level of security for transactions, mirroring the security measures found in other mobile payment systems. This is crucial for fostering consumer confidence in the service.

- Seamless Integration with Existing Android Devices: The service is designed to integrate seamlessly with a wide range of Android smartphones and tablets, allowing users to leverage existing technology. This ease of integration will likely accelerate adoption rates, especially amongst users already familiar with Android devices.

- Support for Diverse Payment Methods: Android Pay UK supports a range of payment methods, including credit cards, debit cards, and potentially other forms of digital wallets. This breadth of support addresses the needs of a diverse consumer base.

Potential Impact on the UK Mobile Payment Market

The launch of Android Pay in the UK is anticipated to significantly impact the existing mobile payment landscape. It could potentially drive further adoption of mobile payment methods, creating a more competitive environment and potentially leading to lower transaction fees for consumers. Competition from established players, such as Apple Pay and other digital wallets, will also influence the market.

- Increased Competition: The introduction of Android Pay is expected to intensify competition within the mobile payment market. This increased competition could lead to innovative features and lower prices for consumers.

- Enhanced Consumer Choice: With the addition of Android Pay, consumers in the UK will have more choices when it comes to mobile payment options. This increased variety could lead to a more dynamic and innovative mobile payment ecosystem.

- Improved Merchant Adoption: As more consumers adopt mobile payment methods, merchants will likely see a greater incentive to accept these forms of payment. This could lead to a more comprehensive and user-friendly payment experience for both consumers and businesses.

Benefits for Users and Businesses

Android Pay offers various advantages for both consumers and businesses. These benefits are crucial in driving adoption and encouraging a shift towards digital transactions.

- Convenience for Users: The platform simplifies the payment process, allowing users to make transactions quickly and efficiently. This is particularly beneficial for users who value speed and ease of use in their daily transactions.

- Enhanced Security for Users: The emphasis on security measures protects users’ financial data from unauthorized access. This is vital in an increasingly digital world where online security is a primary concern.

- Efficiency for Businesses: Android Pay can streamline payment processing for businesses, reducing the need for handling physical cash and minimizing errors. This improved efficiency can lead to cost savings and reduced labor costs.

Target Audience and Market Positioning

Android Pay’s UK launch presents a compelling opportunity to capture a significant share of the mobile payment market. Understanding the target audience and crafting a tailored marketing strategy are crucial for success. This involves identifying key demographics, behavioral patterns, and developing effective messaging to resonate with potential users.The UK mobile payment landscape is evolving rapidly, and Android Pay needs to position itself strategically to attract and retain customers.

A clear understanding of the competitive environment, coupled with a well-defined marketing approach, will be essential to achieve significant market penetration.

Potential User Base in the UK

The UK mobile payment market boasts a diverse and tech-savvy population. Potential Android Pay users likely encompass a wide range of ages, incomes, and lifestyles. This diverse user base demands a multifaceted approach to marketing, catering to various interests and needs.

Android Pay’s UK launch is a big deal, offering a convenient alternative to traditional payment methods. Meanwhile, news of Apple acquiring another AI startup, like apple has acquired another ai startup , suggests a growing trend in AI integration across various tech sectors. This could potentially influence the future of mobile payments, making Android Pay even more interesting to watch in the UK market.

Demographics of Target Users

Android Pay’s target audience encompasses various demographics. Millennials and Gen Z, known for their comfort with technology, represent a significant portion of potential users. Furthermore, individuals who frequently utilize smartphones for everyday transactions are also prime targets. Older generations, accustomed to digital transactions, but potentially needing simpler interfaces, also represent a significant demographic.

Behavioral Patterns of Target Users

Users with a history of using digital wallets, or those who frequently make online purchases, are likely to be attracted to Android Pay. Users seeking seamless and convenient payment options, particularly those who value the speed and security of mobile transactions, will be potential adopters. Understanding the specific pain points and needs of these users will be critical in developing targeted marketing campaigns.

Marketing Strategies for Reaching Target Users

A multi-channel marketing approach is crucial to effectively reach the target audience. This involves leveraging online platforms, social media campaigns, and partnerships with key retailers. Highlighting the ease of use, security features, and unique value proposition of Android Pay is vital in attracting potential users.

Marketing Campaign Strategy

A comprehensive marketing campaign should target various channels, encompassing both digital and traditional methods. The campaign should emphasize the seamless integration of Android Pay with existing mobile devices, demonstrating the convenience and speed of the service. Collaborating with key retailers and businesses will increase visibility and drive adoption. A robust social media presence will help generate buzz and encourage user engagement.

Partnerships with relevant influencers, known for their credibility and reach within specific demographics, will further enhance brand awareness. A strong emphasis on user testimonials and positive reviews will instill confidence in potential customers.

Technical Aspects and Infrastructure

Android Pay’s UK launch hinges on robust technical specifications and secure infrastructure. This ensures seamless user experience and builds trust among merchants and consumers. The system must support a wide range of devices, payment networks, and security protocols to function efficiently and effectively in the UK market. It also requires a smooth integration process for businesses, minimizing disruption and maximizing adoption.The intricate network of technical components, security protocols, and merchant integration are critical to the success of Android Pay in the UK.

These components must work in concert to create a secure, reliable, and user-friendly payment system. A comprehensive understanding of these elements is essential for ensuring a smooth transition and broad adoption.

Technical Specifications

Android Pay’s UK service needs to comply with local regulations and industry standards. This includes specifications related to transaction limits, payment types supported, and the handling of various currencies. The system must be compatible with a wide array of mobile devices and operating systems to cater to a diverse user base.

Security Measures

User data protection is paramount. Android Pay’s security infrastructure must incorporate robust encryption techniques to safeguard sensitive information. These techniques must be regularly audited and updated to keep pace with evolving threats. Multi-factor authentication and secure tokenization are essential components to prevent fraudulent activities. Strong authentication protocols, like biometric verification, enhance security further.

Merchant Integration

Businesses need a straightforward and efficient integration process to accept Android Pay. This involves the provision of clear documentation, support resources, and technical assistance to ensure a smooth implementation. A user-friendly interface for merchants is vital for their acceptance of the payment method. The process should minimize the technical burden on businesses, allowing them to focus on their core operations.

- Simplified APIs: User-friendly Application Programming Interfaces (APIs) for seamless integration with existing point-of-sale (POS) systems.

- Detailed Documentation: Comprehensive and easily understandable documentation to guide businesses through the integration process.

- Technical Support: Dedicated technical support teams to address merchant queries and resolve integration issues.

The above elements are essential to minimize integration hurdles for businesses.

Infrastructure Overview

The infrastructure must support high transaction volumes and low latency for real-time processing. A robust network infrastructure, capable of handling a significant influx of transactions, is crucial. This network needs to be highly available and resilient to maintain smooth operation. Scalability is also critical to accommodate future growth.

- Secure Network: A secure and reliable network infrastructure to handle transactions efficiently.

- Data Centers: High-performance data centers strategically located for optimal network latency.

- Scalable Architecture: A scalable architecture to accommodate future growth and increased transaction volume.

These factors are vital for the system’s reliability and performance. The system should also be designed to meet regulatory compliance requirements in the UK market.

Payment Network Integration

The system must be compatible with major payment networks in the UK. This involves integration with Visa, Mastercard, and other relevant payment providers. Supporting various payment types (e.g., debit, credit) is also crucial. This integration ensures that Android Pay transactions are processed efficiently and reliably across different payment networks.

Potential Challenges and Opportunities

Android Pay’s UK launch presents a compelling opportunity, but also faces hurdles. Navigating the UK’s diverse retail landscape and complex regulatory framework is crucial for success. This section explores the potential pitfalls and pathways to market dominance.

Regulatory Environment and Impact

The UK’s financial regulatory landscape, particularly concerning payment systems, is intricate. Compliance with regulations like the Payment Services Regulations and the Consumer Rights Act is paramount. Failure to adhere to these regulations could lead to significant penalties and reputational damage. Additionally, the evolving nature of these regulations necessitates continuous monitoring and adaptation to maintain compliance.

Potential Obstacles for Android Pay

Several obstacles could hinder Android Pay’s UK market penetration. Competition from established payment systems, like Apple Pay and Google Pay, is fierce. Consumer adoption and awareness of the service are also key factors. Furthermore, the need to build trust with UK consumers and retailers is essential. Ensuring seamless integration with existing payment infrastructure and POS systems is another significant challenge.

Finally, security concerns, a critical aspect of any payment service, must be addressed proactively.

Opportunities for Growth and Expansion, Android pay uk announced

Despite the challenges, numerous growth opportunities exist. Focusing on partnerships with UK retailers and banks can enhance the service’s reach and adoption. Furthermore, emphasizing the service’s security features and ease of use can attract new users. Implementing innovative features, such as contactless payment functionality and integration with loyalty programs, could provide a competitive edge. Leveraging emerging trends, like mobile wallets and digital payments, can position Android Pay favorably.

Improving the Service

Several strategies can enhance Android Pay’s UK presence. Introducing tailored features for UK-specific retail sectors, like grocery stores or high street fashion, could increase appeal. Furthermore, continuous improvements to the app’s user interface and functionality will attract and retain users. Developing robust customer support channels and addressing concerns promptly are essential. Lastly, promoting the service through targeted marketing campaigns will increase awareness and adoption.

This could include collaborations with popular UK influencers or participating in major retail events.

Examples of Development and Improvement

A successful example is Apple Pay’s integration with various UK public transport systems, enabling contactless payments for fares. Similarly, Google Pay’s integration with loyalty programs can enhance the user experience. This demonstrates the potential for Android Pay to offer similar integrations to build user loyalty and drive adoption. Another approach is focusing on providing a smooth and intuitive user experience, free of technical glitches, which builds user trust and encourages repeat use.

Finally, clear and easily accessible information regarding Android Pay’s security protocols, particularly regarding data protection and fraud prevention, can reassure users.

Future Outlook and Predictions

Android Pay’s UK launch presents a compelling opportunity for significant growth within the mobile payments landscape. Early adoption and user acceptance will be key factors in shaping its trajectory. The success will depend on the service’s ability to provide a seamless, secure, and user-friendly experience that resonates with the diverse UK consumer base.The projected growth of Android Pay in the UK hinges on several crucial elements.

A robust infrastructure, coupled with strategic partnerships and marketing campaigns, is essential to drive adoption. The service’s ability to integrate seamlessly with existing payment habits and offer compelling value propositions compared to existing options will significantly influence user uptake.

Projected Growth in the UK Market

The UK mobile payments market is rapidly expanding, driven by factors like increasing smartphone penetration and consumer comfort with digital transactions. Android Pay’s entrance into this market is poised to accelerate this growth. Market analysts predict a substantial increase in the adoption of mobile payment solutions over the next few years. Success hinges on user-friendliness, ease of use, and a clear value proposition.

Android Pay’s UK launch is a big deal, offering a convenient mobile payment option. However, recent news about the FCC investigating Hilton’s wifi blocking practices, raises interesting questions about the future of public wifi and mobile payments. This kind of controversy, as seen in the fcc hilton wifi blocking investigation , could potentially impact the adoption of Android Pay, as consumers might become more cautious about using public wifi for transactions.

Regardless, the UK launch of Android Pay looks promising.

The ability to offer a frictionless checkout experience will be crucial in driving adoption.

Potential Impact on Other Payment Methods

Android Pay’s arrival in the UK is likely to impact other payment methods, particularly contactless cards and other mobile payment solutions. Increased competition could lead to a reevaluation of existing payment methods, forcing them to adapt or risk losing market share. The focus on a comprehensive, secure, and integrated experience will be vital to attract and retain users.

Consumers may increasingly gravitate towards seamless and convenient options, potentially leading to a shift in the market’s balance.

Future Features and Enhancements

Android Pay’s future roadmap likely includes enhancements to cater to evolving user needs and preferences. Expect features such as support for a wider range of retailers, improved integration with loyalty programs, and potentially the inclusion of additional financial services like bill payments. This strategic expansion would broaden the service’s appeal and solidify its position within the UK market.

The seamless integration of NFC technology and its compatibility with various devices will also be crucial.

Android Pay’s UK launch is exciting news, but while we wait for more details, there’s a whole other world of entertainment to enjoy. Check out the latest trailers for movies like Serpent, Infinity Train, and the new Marvel/Disney+ releases, including the Falcon and Winter Soldier, on Netflix, Disney+, and HBO Max. new trailers serpent infinity train vanquish falcon winter soldier netflix marvel disney hbo It’s a great distraction while we eagerly await Android Pay’s full UK roll-out and how it’ll impact our mobile payments.

Evolution of Mobile Payments in the UK

The future of mobile payments in the UK is expected to involve a continuous evolution of the existing systems. Enhanced security measures, greater user privacy protections, and the integration of new technologies like biometrics are likely to be integral components. The seamless integration of mobile wallets into daily routines, similar to the integration of Apple Pay in the US, is also expected.

Increased user adoption of mobile payments is predicted, driven by factors like convenience, security, and the need for efficient transactions. As the technology evolves, mobile payments are expected to play an increasingly important role in the UK economy.

Content for Visual Representation

Visual representations are crucial for conveying complex information about Android Pay’s UK launch effectively. Infographics, tables, and diagrams help simplify data, making it easier for the target audience to understand the key aspects of the service and its potential impact. They will be particularly valuable in engaging a broader audience, including both tech-savvy individuals and those new to mobile payments.

Potential Infographic: UK Mobile Payment Growth

This infographic would visually illustrate the growth of mobile payments in the UK over the past five years. It would use a combination of stacked bar charts and line graphs to showcase the increasing market share of mobile payment systems like Apple Pay, Google Pay, and others. Data points should be clearly labelled, showing the percentage increase of mobile transactions each year.

The infographic would include a compelling visual representation of the projected growth over the next three years, highlighting the potential market for Android Pay. Key milestones and statistics regarding user adoption and transaction volumes would be included. A visual depiction of the current market landscape, showing the dominance of existing players, would be useful in understanding Android Pay’s market positioning.

Comparison Table: Mobile Payment Systems

This table would compare the key features of different mobile payment systems in the UK. The comparison would focus on factors such as security measures, payment methods supported, transaction fees, rewards programs, and user experience. Each system’s unique strengths and weaknesses will be highlighted, facilitating an understanding of how Android Pay differentiates itself from the competition.

| Feature | Apple Pay | Google Pay | Android Pay |

|---|---|---|---|

| Security | Secure encryptions, tokenization | Advanced fraud detection, encryption | Strong security measures, tokenization |

| Payment Methods | Credit/debit cards, Apple Pay Cash | Credit/debit cards, Google Pay Cash | Credit/debit cards, contactless payments |

| Transaction Fees | Usually low, potentially variable | Usually low, potentially variable | Usually low, potentially variable |

| Rewards Programs | Partnerships with retailers | Partnerships with retailers | Partnerships with retailers, potential loyalty programs |

| User Experience | Intuitive, user-friendly interface | User-friendly, seamless experience | Intuitive, seamless integration |

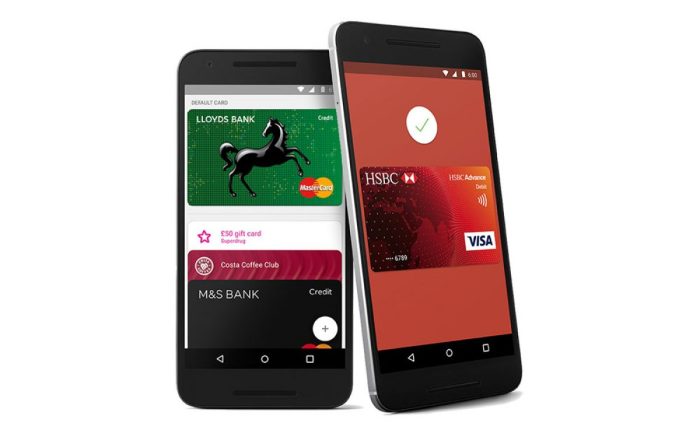

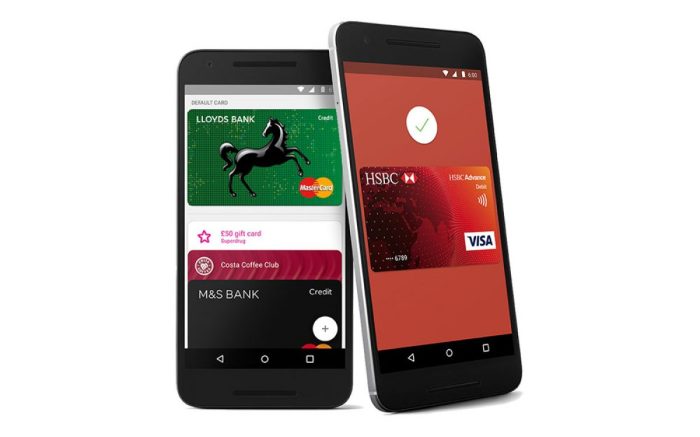

Android Pay UK App UI Mockup

The Android Pay app in the UK would have a clean and modern interface. The primary screen would display a list of linked payment cards. A clear button would allow users to add or remove cards. The app would be visually intuitive and easy to navigate. The layout would be adaptable to different screen sizes.

Specific design elements such as colours and fonts would reflect the brand identity of Android Pay. Users would easily see transaction history, making management and tracking simple. A section for quick access to support resources or FAQs would also be integrated.

Transaction Flow Diagram for Android Pay

The diagram would illustrate the step-by-step process of a transaction using Android Pay. It would begin with the user selecting Android Pay at a merchant’s point of sale terminal. Then, it would show the secure authentication process. Finally, it would illustrate the completion of the transaction and confirmation to the user. Each step would be visually represented with a clear and concise label.

The diagram would highlight the security protocols employed at each stage, showing the data encryption and verification procedures.

Structuring Information in Tables

Tables are invaluable for presenting data in a clear and concise manner, particularly when comparing different options or highlighting key features. This structured approach facilitates easy comprehension and comparison, making complex information more accessible. Visualizing data in tables is a powerful way to showcase the potential impact of Android Pay in the UK market.

Comparison of Mobile Payment Systems

Understanding the competitive landscape is crucial for evaluating Android Pay’s position. The following table provides a comparison of key mobile payment systems currently available in the UK market, considering user experience, security measures, and associated transaction fees.

| System Name | User Experience | Security | Transaction Fees |

|---|---|---|---|

| Apple Pay | Generally praised for ease of use and integration with Apple ecosystem. | Employs strong encryption and authentication protocols. | Typically low or no fees for merchants; however, some fees may apply depending on the specific transaction and bank involved. |

| Google Pay | Simple and intuitive interface, compatible with various devices and wallets. | Utilizes robust security measures, including tokenization and encryption. | Usually low or no fees for merchants; fees may vary depending on the bank and transaction. |

| Samsung Pay | Designed for seamless integration with Samsung devices. | Relies on advanced encryption and authentication for secure transactions. | Typically low or no fees for merchants; specific fees are subject to bank and transaction type. |

| Other Mobile Payment Systems (e.g., contactless cards) | Varying user experience based on the card provider and associated app. | Security depends on the card provider’s security protocols. | Transaction fees are generally low, and some cards may offer rewards programs. |

Potential Benefits for UK Businesses

This table Artikels potential advantages Android Pay can bring to UK businesses. It highlights the tangible benefits of adopting this mobile payment solution.

| Business Type | Increased Sales | Reduced Costs |

|---|---|---|

| Retail Stores | Potentially increased foot traffic and sales by providing a convenient payment option for customers. | Reduced costs associated with handling cash and maintaining physical point-of-sale equipment. |

| Restaurants and Cafes | Faster checkout times, potentially leading to higher customer throughput. | Lower operational costs and reduced risk of handling cash. |

| Service Businesses (e.g., salons, gyms) | Improved efficiency and streamlined transactions, potentially attracting more customers. | Reduced need for cash handling and associated administrative tasks. |

| Online Businesses | Expanded customer base and broader reach through mobile payment integration. | Potential cost savings through reduced fraud and increased transaction volume. |

Regulatory Framework for Mobile Payments in the UK

The UK’s regulatory environment for mobile payments is complex, requiring businesses to adhere to specific standards. This table summarizes the relevant framework.

| Regulatory Body | Specific Regulations |

|---|---|

| Financial Conduct Authority (FCA) | Oversees consumer protection and ensures fair treatment of customers regarding mobile payment services. |

| Payment Systems Regulator (PSR) | Focuses on the stability and integrity of the UK’s payment systems. |

| Other Relevant Authorities | Legislation and guidelines specific to data protection, consumer rights, and fraud prevention. |

Security Feature Comparison

This table directly compares the security features of Android Pay with other mobile payment services, offering a concise overview of the protections offered.

| Security Feature | Android Pay | Apple Pay | Samsung Pay |

|---|---|---|---|

| Tokenization | Utilizes tokenization to protect sensitive card information. | Employs tokenization for secure transaction processing. | Implements tokenization to safeguard customer data. |

| Encryption | Uses strong encryption protocols for data transmission. | Applies robust encryption standards for data protection. | Employs encryption techniques for secure communication. |

| Multi-factor Authentication | Supports multi-factor authentication for added security. | Integrates multi-factor authentication for enhanced security. | Offers multi-factor authentication for secure access. |

Last Recap

Android Pay’s UK launch marks a significant step in the evolution of mobile payments. While the initial buzz is high, the real test lies in adoption and user experience. Its success hinges on its ability to differentiate itself from competitors and offer compelling value propositions. We’ve explored the potential benefits and challenges, providing a comprehensive overview of the service.

Ultimately, Android Pay’s future success in the UK will depend on its ability to adapt to the market and user needs.