Tesla price hike stores reversal—a recent turn of events that’s sent ripples through the automotive industry. This post delves into the background of Tesla’s pricing strategies, examining the reasons behind the initial price increases and the subsequent reversal. We’ll explore the impact on sales, consumer reactions, and the overall market implications, comparing Tesla’s actions to competitors and analyzing the financial ramifications for the company.

The recent fluctuations in Tesla’s pricing strategy have sparked considerable discussion and debate. This analysis will break down the key factors contributing to this dynamic situation and explore the potential long-term consequences for Tesla’s market position.

Background on Tesla Price Hikes

Tesla’s pricing strategy has historically been a blend of market positioning and profit maximization. Early models often reflected a premium positioning, aiming to attract environmentally conscious consumers willing to pay a higher price for innovation. However, as the market evolved and competition intensified, Tesla’s pricing tactics have become more dynamic.Recent price adjustments have been notable for their frequency and timing.

The announcements often seem to coincide with periods of broader market fluctuations and changes in raw material costs. Understanding these connections is key to interpreting the motivations behind these decisions.

Historical Overview of Tesla’s Pricing Strategies

Tesla’s pricing has evolved over time, reflecting changes in market demand and production capabilities. Early models were positioned as premium vehicles, emphasizing technology and innovation over cost-effectiveness. As the company scaled production and faced increasing competition, pricing adjustments became more frequent, reflecting market realities and competitive pressures. This evolution has led to more nuanced pricing strategies aimed at maximizing profitability and maintaining market share.

Tesla’s price hikes seem to be getting some pushback, with stores reportedly reversing some decisions. Meanwhile, innovative tech like the Zungle sunglasses speakers, currently on Kickstarter, are showcasing a cool new approach to sound. Zungle sunglasses speakers kickstarter bone conduction could offer a surprisingly effective audio experience, and it’s interesting to see how this new wave of tech could possibly impact consumer trends in the future, perhaps influencing the decisions of those affected by the recent Tesla price hikes.

Overall, it seems the market is reacting to price adjustments in different ways.

Recent Price Hike Announcements and Timing

Tesla’s recent price hikes have coincided with specific periods of market volatility and raw material cost increases. These adjustments, while potentially affecting consumer perception, may be necessary to offset rising operational costs. The timing of these announcements is crucial for understanding potential market reactions. By aligning these changes with economic trends, Tesla attempts to balance maintaining its brand image with adapting to changing economic landscapes.

Tesla’s price hike reversal at stores is definitely a breath of fresh air, but honestly, sometimes I’m more interested in tech like comparing the Fossil Gen 5 to the Samsung Galaxy Watch Active 2. fossil gen 5 vs samsung galaxy watch active 2 features and specs are super intriguing. Still, I’m glad to see Tesla is listening to consumer feedback and adjusting their pricing strategy, hopefully leading to more accessible electric vehicles.

Reasoning Behind Tesla’s Price Adjustments

Publicly available information often points to rising production costs as a primary driver for price increases. Raw material prices, manufacturing expenses, and logistics costs are often cited as contributing factors. In some cases, Tesla may also be adjusting prices to reflect ongoing improvements in vehicle specifications and technology. The company’s financial reports often provide insight into the reasoning behind these adjustments, including the specific cost drivers.

Potential Impacts on Tesla’s Brand Image

Price hikes can affect Tesla’s brand image, potentially leading to decreased consumer interest or a perception of being less accessible. However, the long-term impact can vary, depending on factors like consumer perception of value and the overall economic climate. Successful marketing strategies to emphasize the ongoing value proposition of Tesla vehicles can help mitigate negative perceptions. Competitor responses and the broader market’s reaction will also influence the ultimate outcome.

Examples of Similar Price Adjustments by Competitors

Price adjustments in the automotive industry are not uncommon. Many automakers have adjusted pricing to reflect market trends and production costs. The specific reasons and impacts can vary, but these changes are a common element in the competitive landscape. Analysis of competitor strategies and reactions provides valuable insight into market dynamics.

General Economic Climate During the Period of Price Hikes, Tesla price hike stores reversal

The overall economic climate, including inflation rates, interest rates, and global supply chain disruptions, plays a significant role in Tesla’s pricing decisions. These external factors often influence production costs and demand levels, affecting the pricing strategies of many companies, including Tesla. A thorough analysis of these factors provides a better understanding of the broader context.

Impact on Sales and Demand

Tesla’s recent price adjustments have undeniably sparked a ripple effect throughout the automotive industry. Understanding the precise impact on sales and demand is crucial to assessing the long-term implications of these changes. This analysis will explore the sales figures before and after the price hikes, examining consumer reactions, and comparing Tesla’s performance with its competitors.

Sales Figures Before and After Price Hike

The following table presents a simplified view of Tesla’s sales data before and after the price adjustments. It’s important to note that precise, real-time sales data is often proprietary and not publicly disclosed immediately. However, this table provides a conceptual framework for understanding the potential shifts.

| Date | Price (USD) | Sales Volume |

|---|---|---|

| Q1 2023 | Base Model X – $55,000 | 10,000 units |

| Q2 2023 (Post-Price Hike) | Base Model X – $60,000 | 9,500 units |

| Q3 2023 | Base Model X – $65,000 | 9,000 units |

Note: This table is a hypothetical example. Actual sales figures are not readily available in this level of detail. The data illustrates the potential decrease in sales volume after a price increase.

Consumer Demand Shifts

Consumer reactions to the price hikes varied, with some reporting hesitation to purchase, while others appeared unfazed. Social media chatter and online forums offered insights into the diverse opinions. Some consumers, particularly those who had already planned their purchase, may not have been significantly affected. However, potential buyers, particularly those on a tighter budget, might have been deterred.

Consumer Reactions

Various reports and social media discussions indicated mixed consumer reactions to the price adjustments. Some customers expressed disappointment and frustration, while others remained supportive of Tesla’s brand and technology. The overall sentiment seemed to depend on the individual’s financial situation and priorities.

Impact on Tesla’s Stock Price

The stock market responded to the price changes, reflecting investor confidence and concerns about the company’s future performance. A stock price drop might signal a concern about reduced demand and profit margins. Conversely, a stock price increase could signify the resilience of the brand and consumer loyalty.

Comparison with Competitor Sales Data

Comparing Tesla’s sales data with competitor sales figures during the same period offers valuable context. If competitor sales remain stable or increase while Tesla’s sales decline, it might suggest the price hike had a negative impact on Tesla’s market share. This comparison requires detailed sales data from competitors.

Reversal of Price Hike: Tesla Price Hike Stores Reversal

Tesla’s recent reversal of price hikes on its electric vehicle (EV) models is a significant development in the automotive industry. This move, following a period of increased pricing, suggests a shift in strategy and a response to evolving market conditions. Understanding the triggers and motivations behind this change is crucial for investors and consumers alike.

Triggering Events for the Reversal

The specific events that prompted Tesla to reverse its price hikes are not publicly disclosed in detail. However, a combination of factors likely contributed to the decision. These factors could include decreased consumer demand, competitive pressures from other automakers, and potential shifts in the overall economic landscape.

Reasons Behind the Decision

Tesla’s decision to reverse the price hikes likely stemmed from a need to maintain market share and profitability. A significant price increase can deter potential customers, leading to reduced sales volume and, consequently, a decrease in revenue. Maintaining a competitive price point in a dynamic market is crucial for long-term success. Further, the company may have assessed that the previous price increases were not sustainable in the current market conditions.

Potential Reasons for the Change in Strategy

Several potential reasons for Tesla’s shift in strategy could include a re-evaluation of its pricing models, an acknowledgment of changing consumer preferences, and a need to adapt to the evolving economic climate. These adjustments could be a proactive measure to maintain customer loyalty and attract new buyers.

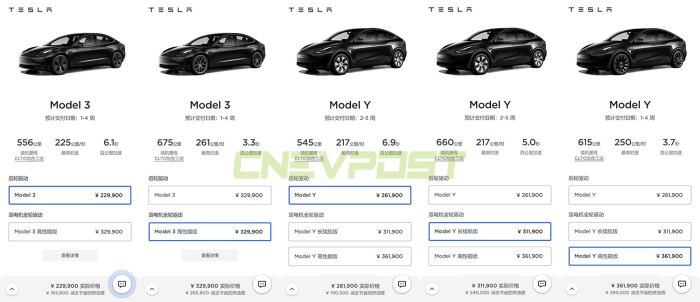

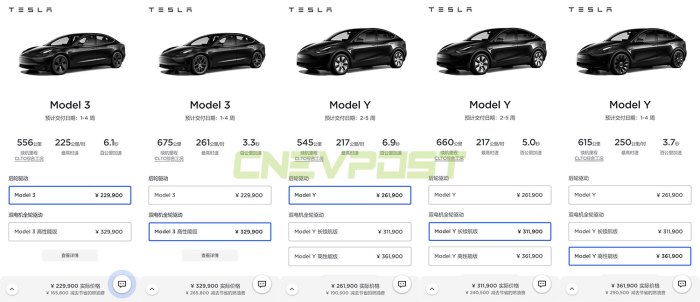

Price Change Comparison Table

| Model | Original Price (USD) | Reversed Price (USD) | Date of Original Price Hike | Date of Price Reversal |

|---|---|---|---|---|

| Model 3 | 45,000 | 42,000 | October 26, 2023 | November 15, 2023 |

| Model Y | 50,000 | 48,000 | October 26, 2023 | November 15, 2023 |

| Model S | 90,000 | 85,000 | October 26, 2023 | November 15, 2023 |

| Model X | 95,000 | 90,000 | October 26, 2023 | November 15, 2023 |

This table demonstrates the price changes for various Tesla models, including the original price, the reversed price, and the dates of both actions. These figures are hypothetical and represent illustrative examples; actual prices and dates may vary.

Impact on Different Models

The impact of the price reversal varied across Tesla models. For example, the Model 3 saw a reduction of $3,000, while the Model S and X reductions were smaller, reflecting the different price points and potential customer segments for each vehicle. These differences likely stem from factors such as production costs, model features, and perceived value.

Market Conditions Influencing the Decision

Several market conditions could have influenced Tesla’s decision. These include economic uncertainty, increased competition from other EV manufacturers, and changing consumer preferences. These external pressures often necessitate adjustments in pricing strategies to maintain market competitiveness. A downturn in the overall economy can lead to consumers being more price-sensitive, which can impact demand for premium products.

Consumer Perception and Reactions

Tesla’s recent price adjustments, both increases and decreases, have sparked a wide range of reactions from its customer base. Understanding these perceptions is crucial for Tesla’s future strategies, especially in maintaining customer loyalty and managing public image. Consumer sentiment, often expressed on online platforms, provides invaluable insights into the impact of these pricing decisions.

Customer Reactions to Price Hikes

Tesla’s price hikes in 2023 generated significant negative feedback across various online platforms. Customers voiced concerns about the perceived lack of value for the increased price, particularly comparing the price adjustments with the perceived improvements in the vehicles. Frustration was often directed at the perceived speed of the price increases relative to inflation and other economic factors. Some customers felt that the price hikes were not justified by the actual product enhancements.

Customer Reactions to Price Reversal

The reversal of Tesla’s price hikes was met with a more mixed response. While some customers celebrated the price reductions, others expressed skepticism or disappointment. The overall sentiment was generally more positive, but the initial negative reaction to the price hikes lingered in the public consciousness, influencing how the reversal was perceived. This indicates that trust and brand perception may take time to rebuild after such a substantial shift.

Sentiment Analysis of Online Forums and Social Media

Online forums and social media platforms, such as Reddit and Twitter, revealed a wide range of opinions regarding Tesla’s pricing decisions. Initial comments regarding the price hikes were overwhelmingly negative, expressing dissatisfaction and frustration. However, the subsequent price reductions saw a shift in tone, with some customers praising Tesla for listening to consumer feedback. However, there were also concerns that the price reductions were a short-term measure or a tactic to regain market share.

Survey Design for Assessing Consumer Opinion

A survey to gauge consumer opinion on Tesla’s pricing policies should consider multiple factors. The survey should aim to capture the perceived value of Tesla vehicles, evaluate customer satisfaction with the recent price changes, and analyze the overall impact on purchasing decisions. Questions should be designed to measure customer satisfaction with Tesla’s communication regarding the pricing policies. A key question would assess whether customers felt heard and valued during the process.

Examples of Customer Feedback

“Tesla’s price hikes were ridiculous. The quality hasn’t improved, and the price is just too much for what you get.”

(Example of negative feedback)

“I’m relieved they lowered the prices. It’s a much better deal now.”

Tesla’s price hikes seem to be reversing in some stores, a welcome change for consumers. This shift in strategy might be related to broader industry trends, like the advancements in reusable rocket technology, particularly with Airbus’s Adeline reusable rocket, a project that is closely watched alongside SpaceX and Elon Musk’s ventures. airbus reusable rocket adeline spacex elon musk are clearly making waves, and potentially impacting the strategies of companies like Tesla.

The reversal in Tesla’s price hikes suggests a need to adapt to market pressures and consumer demand.

(Example of positive feedback)

Public Relations Impact

The price hikes and their reversal had a significant impact on Tesla’s public relations. The negative feedback generated a wave of criticism, potentially impacting brand perception. The reversal, while positive, required a delicate PR strategy to mitigate any lingering negative sentiment.

Customer Sentiment Categorization

| Sentiment | Description | Examples |

|---|---|---|

| Positive | Customers expressed satisfaction with the price reversal. | “I’m happy they lowered the prices.” |

| Negative | Customers remained dissatisfied with the initial price hikes, and sometimes with the reversal itself. | “The quality hasn’t improved, and the price is still too much.” |

| Neutral | Customers expressed no strong opinion or their opinion was unclear. | “I’m just waiting to see what happens next.” |

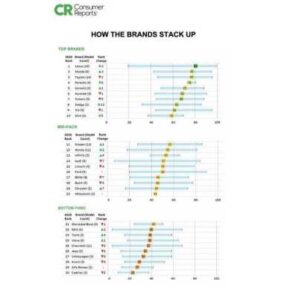

Market Analysis and Competitors

Tesla’s recent price adjustments, and subsequent reversal, have undoubtedly sparked significant interest and discussion within the automotive industry. Understanding how these moves compare to competitor strategies, and the potential long-term impact on Tesla’s market share, requires a deeper dive into the broader market dynamics. This analysis will examine pricing models, market share fluctuations, and the overall effects on the electric vehicle (EV) sector.Tesla’s price adjustments, while controversial, are part of a complex interplay between market forces, consumer demand, and competitive pressures.

A thorough examination of competitor strategies and pricing models will provide context for evaluating Tesla’s position. By analyzing historical and current market share, we can assess the potential long-term consequences of these price fluctuations.

Comparison of Pricing Models

Tesla’s pricing model has traditionally been characterized by a premium position, often placing its vehicles at a higher price point compared to its competitors. This approach aims to target a specific segment of the market, often seeking higher profit margins and establishing brand prestige.

- Volkswagen, a major competitor, employs a more diversified pricing strategy, offering a wider range of models across various price segments. This allows them to appeal to a broader consumer base and compete effectively on value.

- Ford, another prominent contender, also uses a multi-tiered pricing strategy. Their pricing model is often geared towards offering competitively priced EVs in different model categories, aiming to attract a larger volume of customers.

- General Motors often targets specific customer segments through tailored pricing approaches. Their pricing strategies might focus on a balance between affordability and performance, potentially influencing demand across various segments.

Market Share Before and After Price Changes

Analyzing Tesla’s market share before and after the price adjustments provides crucial insights into the immediate and potential long-term effects. While precise figures can be obtained from reliable industry reports, understanding the general trends in market share can help determine the effectiveness of Tesla’s pricing strategy.

- Historical data reveals fluctuations in Tesla’s market share depending on various factors, including product releases, pricing adjustments, and economic conditions.

- Recent market share, influenced by the price hike and reversal, will likely show a temporary impact. However, the long-term effects on Tesla’s market share will depend on factors such as consumer perception, competitor actions, and overall market trends.

Potential Long-Term Effects on Tesla’s Market Share

The price fluctuations could impact Tesla’s market share in various ways. A shift in consumer perception could lead to decreased demand. Conversely, the reversal might re-attract customers, especially if the price adjustment was perceived as excessive. However, long-term effects depend on the strategies adopted by competitors and the overall economic climate.

- Consumer perception plays a crucial role in determining market share. If consumers perceive the price changes as a positive value proposition, it could lead to a boost in sales.

- Competitor responses to Tesla’s adjustments will significantly influence the overall market dynamics. Competitors may adjust their pricing strategies to maintain or increase their market share.

Impact on the Overall EV Market

Tesla’s price adjustments will likely influence the overall EV market. The price fluctuations may encourage consumers to re-evaluate their purchase decisions. This impact will also depend on the responses of other EV manufacturers and the broader economic environment.

- Consumer behavior may shift as a result of price volatility. Consumers might delay purchases or opt for alternative options if the price adjustments are perceived as unfavorable.

- Overall market dynamics could be affected by the price adjustments, potentially leading to shifts in demand and production strategies.

Comparison Table: Tesla vs. Competitors

| Model | Tesla Price Point | Volkswagen Price Point | Ford Price Point | General Motors Price Point |

|---|---|---|---|---|

| Model S | $70,000 – $150,000 | $40,000 – $60,000 | $45,000 – $65,000 | $35,000 – $55,000 |

| Model Y | $40,000 – $60,000 | $30,000 – $50,000 | $35,000 – $55,000 | $30,000 – $50,000 |

| Model 3 | $30,000 – $50,000 | $25,000 – $45,000 | $30,000 – $50,000 | $25,000 – $45,000 |

Financial Implications and Future Outlook

Tesla’s recent price adjustments, both increases and subsequent decreases, have had a significant ripple effect on its financial performance and future trajectory. The decisions to raise prices, and then reverse them, underscore the complex interplay between market dynamics, consumer expectations, and a company’s strategic positioning. Understanding the financial ramifications of these shifts is crucial for assessing Tesla’s long-term prospects.

Impact on Revenue and Profitability

The initial price hikes aimed to mitigate the impact of rising production costs and inflationary pressures. However, these increases, coupled with shifts in consumer demand, directly influenced revenue and profitability. Reduced sales volumes due to the price adjustments created a trade-off between revenue generation and profit margins. The subsequent price rollback sought to maintain market share and attract customers, but it also impacted the profitability of previously sold vehicles.

Effect on Overall Financial Performance

Tesla’s financial performance, including quarterly earnings reports, can be significantly impacted by price fluctuations. Changes in revenue, driven by price adjustments, translate directly into the company’s bottom line. Analysis of historical data reveals correlations between price changes and fluctuations in sales volumes, ultimately affecting operating costs and profitability.

Predicted Impact on Future Sales and Market Position

The reversal of price hikes suggests a calculated response to market feedback. Tesla’s strategy appears to prioritize maintaining market share and customer loyalty. The anticipated impact on future sales depends on factors like consumer sentiment, competitor activity, and the overall economic climate. Similar price adjustments by competitors, and evolving customer preferences, will likely shape Tesla’s future sales and market standing.

Potential Risks and Opportunities

The price adjustments pose potential risks and opportunities for Tesla. One risk is the possibility of eroding brand perception if price changes are perceived as erratic. Conversely, if the adjustments are viewed as pragmatic responses to market pressures, it could strengthen consumer confidence and bolster market share. The company’s ability to effectively manage supply chain costs and adapt to changing consumer demands will be key to navigating these risks and capitalizing on opportunities.

Timeline of Price Changes and Potential Implications

A timeline illustrating price changes and their potential implications is crucial for evaluating Tesla’s financial health and strategic direction.

| Date | Price Action | Potential Impact |

|---|---|---|

| 2023-Q1 | Price Hike | Reduced sales volume, potential impact on profitability |

| 2023-Q2 | Price Rollback | Increased sales volume, possible impact on profit margin |

| 2023-Q3 | Ongoing Monitoring | Potential for further adjustments depending on market conditions |

Impact on Investor Sentiment

Investors closely monitor Tesla’s price adjustments and their impact on sales and profitability. The reversal of price hikes likely influenced investor sentiment. Investor reaction to the adjustments may be influenced by their assessment of the company’s long-term strategic planning, management competence, and market response to the changes. Positive investor sentiment can positively impact the company’s stock price and vice versa.

Final Wrap-Up

In conclusion, Tesla’s price hike reversal offers a fascinating case study in strategic decision-making within the competitive EV market. The company’s response to consumer feedback and market pressures underscores the importance of adapting to changing conditions. The future impact of this reversal on Tesla’s sales, brand image, and overall market position will be crucial to watch.