Lucid auto industry startup price hikes supply chain are creating ripples in the luxury EV market. Lucid Motors, a relatively new entrant, is navigating a complex landscape of rising costs and supply chain disruptions. This in-depth look explores the factors driving these price increases, the impact on Lucid’s market position, and the company’s strategies for managing these challenges.

From its founding and key milestones to its current product portfolio, this analysis delves into Lucid’s business model, competitive landscape, and potential solutions for these evolving industry trends. We’ll examine the impact on profitability and market share, and consider consumer reactions to the adjustments. A detailed comparison with competitors will shed light on Lucid’s unique position within the luxury EV segment.

Lucid Auto Industry Startup

Lucid Motors, a relatively young entrant into the luxury electric vehicle (EV) market, has quickly carved a niche for itself. Its ambitious goals and innovative approach have drawn significant attention, but also faced challenges. This overview will delve into Lucid’s history, current standing, and future plans.Lucid Motors, founded in 2007, initially focused on developing clean energy technologies. The company transitioned to the automotive sector in 2016, with the goal of producing high-performance, sustainable vehicles.

This shift marked a significant departure from its early work, and the company’s commitment to this new direction has been central to its success and challenges.

Founding and Key Milestones

Lucid Motors emerged from a background in clean energy technologies. The company’s transition to the automotive industry in 2016 marked a significant strategic shift. This transition, coupled with its commitment to sustainability and performance, has been a defining characteristic of its journey. Key milestones, such as the unveiling of the Air sedan in 2021, are indicative of its progress.

Current Market Standing

Lucid Motors competes in the high-end luxury EV segment. Its vehicles are positioned against established brands like Tesla and Porsche, offering a unique blend of technology, performance, and design. Lucid’s market standing is evolving rapidly, influenced by its product offerings, marketing efforts, and the broader EV market dynamics.

Business Model and Strategies

Lucid’s business model emphasizes high-quality materials, advanced technology, and a premium price point. The company focuses on attracting a discerning customer base that values luxury, performance, and sustainability. This strategy, while ambitious, carries the risk of being overly dependent on affluent customers. Their approach is to focus on the luxury and high-performance segments of the market.

Product Portfolio and Future Plans

Lucid currently offers the Air sedan, a high-performance EV known for its advanced technology and luxurious interior. Future plans include expanding its product lineup, potentially with SUVs and other models, aiming to capture a larger market share. The introduction of additional models will be crucial for sustained growth and market penetration.

Price Hikes

Lucid Motors, a relatively new entrant in the luxury electric vehicle (EV) market, has recently experienced price increases. These adjustments, while common in the automotive industry, warrant careful analysis to understand the driving forces and potential impact on the company’s trajectory. The decision to raise prices demands a critical examination of the market dynamics, competitive landscape, and consumer response.The rising cost of raw materials, particularly in the semiconductor sector, and global supply chain disruptions have significantly impacted production costs for automakers.

This is a common factor affecting many industries, not just the EV sector. Escalating production costs often necessitate price adjustments to maintain profitability.

Factors Contributing to Price Increases

Several factors have contributed to the recent price hikes at Lucid. The ongoing global chip shortage has significantly hampered production, leading to increased manufacturing costs. In addition, raw material prices, including metals like nickel and cobalt crucial for battery production, have seen substantial increases. These price fluctuations, compounded by geopolitical uncertainties and inflationary pressures, have forced Lucid to adjust its pricing strategy.

Logistics and transportation costs have also risen, further adding to the burden on the company.

Impact on Market Share and Profitability

Price increases can have a complex impact on a company’s market share and profitability. While higher prices can potentially boost profitability, they may also lead to a decline in sales volume, thereby affecting market share. Lucid’s strategy in adjusting prices will determine how these competing forces play out. A delicate balance must be struck between maintaining profitability and remaining competitive.

Comparison with Competitors

Lucid’s pricing strategy is crucial for success in the luxury EV segment. A comparative analysis with competitors is essential to understand how Lucid is positioned in the market. Direct competitors such as Tesla, Rivian, and Porsche have also experienced price adjustments in recent times. Comparing Lucid’s current pricing with these competitors can help us assess its competitive positioning.

Potential Consumer Reactions

Consumer reactions to price adjustments can vary widely. Some consumers may be willing to pay the increased price for the perceived value and prestige associated with Lucid vehicles. However, others may seek alternatives from competitors offering similar features at a more affordable price point. The luxury EV market is sensitive to price changes, as consumers are often willing to consider other options if the price becomes too high.

Maintaining customer loyalty will depend on Lucid’s ability to effectively communicate the value proposition behind its products and demonstrate their continued leadership in the sector.

Pricing Comparison Table

| Model | Lucid | Tesla | Rivian | Porsche |

|---|---|---|---|---|

| Air Pure | $89,900 | Model S ($79,990 – $130,000+) | R1T ($70,000 – $100,000+) | Taycan ($70,000 – $100,000+) |

| Air Grand Touring | $110,000 | Model S Plaid ($130,000 – $160,000+) | R1S ($75,000 – $110,000+) | Taycan Turbo S ($100,000 – $160,000+) |

| Air Dream Edition | $130,000+ | (No direct equivalent) | (No direct equivalent) | (No direct equivalent) |

Note

* Pricing varies based on specific trim levels and options. Data is current as of [Date] and is subject to change. This table provides a general comparison; precise pricing should be verified directly with each manufacturer.

Supply Chain Disruptions

Lucid Motors, like other electric vehicle (EV) manufacturers, is grappling with the global supply chain crisis. These disruptions are impacting production timelines and potentially affecting the overall success of the company. The ripple effects are evident in the rising costs of materials and the challenges in securing necessary components for the manufacturing process. Understanding the specific impacts and Lucid’s strategies for mitigation is crucial for assessing the company’s long-term prospects.

Impact on Lucid’s Production Capabilities

Supply chain disruptions have significantly hampered Lucid’s production capabilities. Delays in receiving critical components, such as batteries, semiconductors, and specialized metals, have led to production slowdowns and reduced output. This directly translates to missed delivery targets and a potential decrease in profitability. Furthermore, the volatility in component pricing exacerbates the financial strain on the company.

Lucid Motors’ price hikes are a bit of a head-scratcher, given the current supply chain issues. It’s all about balancing production costs with consumer demand. Perhaps the inspiration for their innovative approach can be found in the latest Oppo Find X7 series camera specs and design, as detailed here. These advancements in smartphone technology might offer some insights into how Lucid can approach its pricing strategies in the face of these challenges.

Overall, the Lucid auto industry startup price hikes are likely a complex interplay of supply chain difficulties and market positioning.

Specific Components and Materials Affected

Several key components and materials are affected by the supply chain issues. The most notable include:

- Batteries: The increasing demand for lithium-ion batteries, crucial for EV power, has outstripped supply, leading to price hikes and delays in battery deliveries.

- Semiconductors: The global semiconductor shortage continues to affect the production of electronic control units (ECUs) and other critical components, impacting the performance and functionality of Lucid’s vehicles.

- Specialized Metals: Rare earth metals, used in electric motors and other vehicle parts, face supply constraints due to geopolitical factors and environmental regulations. This affects the production of high-performance components.

- Raw Materials: Fluctuations in the prices of raw materials like aluminum, copper, and steel impact the cost of manufacturing the vehicle body and chassis.

Lucid’s Management and Mitigation Strategies

Lucid has implemented several strategies to manage and mitigate these supply chain challenges. These include:

- Diversification of Suppliers: Lucid is actively diversifying its supplier base to reduce reliance on any single entity, thereby minimizing the risk of disruptions caused by a single supplier’s issues.

- Strategic Partnerships: Collaboration with strategic partners allows Lucid to gain access to specialized components and materials that are in high demand. This includes working with battery manufacturers and semiconductor companies.

- Inventory Management: Lucid is implementing sophisticated inventory management systems to anticipate and mitigate potential shortages of critical components. This involves forecasting demand and procuring components proactively.

- Technological Advancements: Lucid is exploring innovative technologies to reduce its reliance on certain components. This could include developing alternative materials or technologies to enhance efficiency and lower costs.

Comparison with Other EV Manufacturers

Lucid’s approach to supply chain management is similar to other EV manufacturers. All are facing the same challenges, and are actively pursuing strategies like diversification, strategic partnerships, and advanced inventory management. However, the severity and specific components impacted may differ depending on the manufacturer’s product portfolio and production scale.

Major Supply Chain Disruptions Affecting the Industry

| Disruption Category | Description | Impact |

|---|---|---|

| Global Semiconductor Shortage | Reduced availability of semiconductors impacting the production of electronic control units (ECUs) and other vehicle components. | Production delays and reduced output. |

| Lithium-Ion Battery Supply Constraints | High demand for lithium-ion batteries outstrips supply. | Increased costs and delivery delays. |

| Geopolitical Tensions | Increased trade tensions and geopolitical instability affect the supply of materials. | Uncertainty in the supply chain and potential price increases. |

| Raw Material Price Volatility | Fluctuations in the prices of raw materials such as aluminum, copper, and steel. | Increased manufacturing costs and potential price adjustments. |

Industry Trends and Outlook

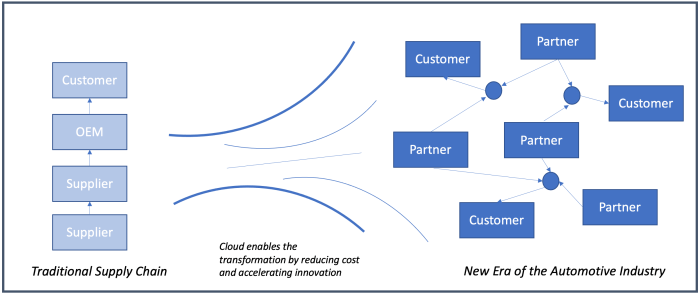

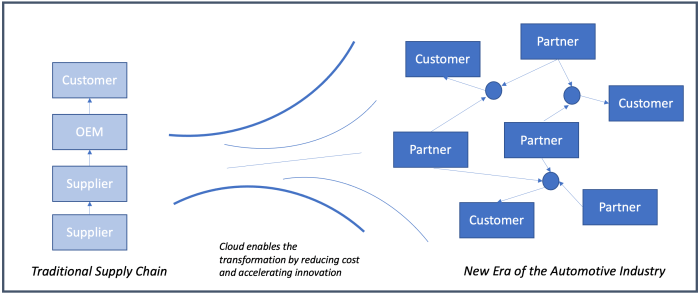

The electric vehicle (EV) market is experiencing rapid growth, driven by consumer demand, government incentives, and technological advancements. Lucid, as a high-end EV manufacturer, faces a complex landscape of evolving trends and challenges. This analysis examines current and future trends, focusing on pricing strategies, supply chain management, and macroeconomic factors impacting the industry and Lucid’s position within it.Understanding the forces shaping the EV market is crucial for Lucid’s continued success.

The interplay of pricing strategies, supply chain resilience, and broader economic conditions will significantly influence Lucid’s ability to compete and achieve its long-term goals.

Pricing Strategies in the EV Market

Pricing strategies are critical for EV manufacturers to attract customers and maintain profitability in a competitive market. Different approaches exist, ranging from premium pricing to competitive pricing. Lucid, positioned as a luxury EV brand, currently employs a premium pricing strategy. However, the market is evolving, and competitors are introducing EVs at various price points. This dynamic environment necessitates careful monitoring of competitor pricing and adjusting strategies as needed.

Supply Chain Management Challenges and Opportunities

Supply chain disruptions have been a significant concern across the automotive industry, impacting EV production. Scarcity of critical materials like lithium and nickel, coupled with increased demand, has driven up costs and production delays. Lucid needs to implement robust supply chain management strategies to ensure consistent access to materials and minimize the impact of future disruptions. Diversifying sourcing and establishing strong relationships with suppliers are essential steps to mitigate risk.

Future Developments and Implications for Lucid

Several factors are poised to shape the future of the EV market. These include advancements in battery technology, increasing charging infrastructure, and evolving consumer preferences. Lucid needs to adapt its product roadmap to meet these developments. For example, advancements in battery technology could lead to increased range and reduced costs, impacting Lucid’s pricing strategy and production decisions.

Macroeconomic Factors Influencing the EV Industry

Broader macroeconomic factors such as inflation, interest rates, and geopolitical events can significantly impact the EV market. Inflationary pressures increase production costs, potentially affecting pricing and profitability. Interest rates influence consumer borrowing capacity, which in turn affects EV sales. Geopolitical events can disrupt global supply chains and create uncertainties. Lucid must consider these factors in its long-term planning and adapt to changing economic conditions.

Lucid Motors, that electric vehicle startup, is facing some serious price hikes. Supply chain issues are a major factor, and it’s a common theme across the industry. This isn’t entirely surprising, considering the recent flurry of activity in the tech world, like the potential Twitter and TikTok acquisition by a company like Microsoft (check out the details here ).

The ripple effects of these major deals are likely to impact many sectors, and Lucid’s price adjustments seem to be a direct consequence of those broader market shifts. Hopefully, these supply chain issues will resolve themselves soon, so Lucid can continue to deliver on its promise of innovative electric vehicles.

Comparison of Lucid with Other Major EV Players

Lucid competes with established luxury automakers and emerging EV start-ups. Competitors like Tesla, Porsche, and others are vying for market share. Lucid’s differentiation lies in its focus on luxury features and performance. However, Tesla’s strong brand recognition and established charging network pose a considerable challenge. Understanding the strengths and weaknesses of competitors is crucial for developing effective strategies.

Predicted Future of the EV Market

The future of the EV market is characterized by continued growth, evolving pricing models, and increasing supply chain complexities. The market will likely see a wider range of pricing strategies, with both premium and more affordable options. The emergence of new battery technologies and charging infrastructure will influence consumer preferences. Lucid’s ability to adapt to these changes, particularly in its supply chain management and pricing strategies, will determine its success in the long term.

A clear example is the rising cost of raw materials for batteries, like lithium, impacting the pricing and production of all EV manufacturers.

Lucid’s Competitive Landscape: Lucid Auto Industry Startup Price Hikes Supply Chain

Lucid Motors, a relatively new entrant in the electric vehicle (EV) market, faces a formidable competitive landscape. Established players like Tesla, along with emerging competitors like Rivian and others, offer a diverse range of models, pricing strategies, and technological approaches. Understanding Lucid’s position within this competitive environment is crucial to assessing its future prospects.Lucid’s pricing strategy, while aiming for a premium positioning, is directly compared with the pricing strategies of its key competitors.

This comparison reveals both opportunities and challenges for the brand. The competitive landscape includes not just price points, but also factors like brand reputation, technological advancements, and overall customer experience. Lucid’s competitive advantages and disadvantages are significant factors in determining its market share and future success.

Lucid’s Pricing Strategies Compared to Competitors

Lucid’s pricing strategy positions its vehicles in the luxury segment, aiming for a premium price point. This approach differentiates it from some other EV manufacturers. However, this strategy needs to be carefully calibrated to compete with other luxury brands and existing competitors in the EV market. The starting prices of Lucid’s models are often comparable to or slightly higher than those of top-tier vehicles from competitors like Tesla’s high-end models.

For example, the Lucid Air Dream Edition, the highest-end model, frequently carries a price tag significantly above comparable models from other manufacturers.

Key Competitors and Their Pricing Models

Tesla, a dominant force in the EV market, employs a multifaceted pricing strategy. Their vehicles, spanning various models and price points, generally offer competitive pricing, often with a range of options that can significantly influence the final cost. Rivian, a newer player, also targets the premium market with a focus on luxury and features, often with a comparable or slightly lower price point than Lucid.

Other luxury automakers, such as Porsche and BMW, offer electric vehicles with a luxury image and price. These competitors present significant challenges for Lucid in maintaining its premium positioning and attracting customers.

Competitive Landscape Overview

The EV market is highly competitive, with established players and new entrants vying for market share. Lucid, as a new brand, needs to establish a strong brand identity and reputation to compete effectively. Factors such as manufacturing efficiency, supply chain stability, and technological advancements influence pricing and availability. The overall competitive landscape for EVs is constantly evolving, requiring continuous adaptation and innovation from all players.

Lucid needs to effectively communicate its value proposition to differentiate itself and build customer loyalty.

Lucid’s Competitive Advantages and Disadvantages

Lucid’s strengths often lie in its innovative technology, such as advanced battery technology and interior design. However, these advantages might be offset by production challenges, supply chain issues, and the already established brand recognition of competitors. This necessitates a strong marketing strategy to highlight Lucid’s unique selling points. Competitors’ existing dealer networks and extensive service infrastructure can also provide a substantial competitive edge.

Comparison Table of Lucid Features vs. Competitors

| Feature | Lucid | Tesla | Rivian | Porsche |

|---|---|---|---|---|

| Range (miles) | Varying by model | Varying by model | Varying by model | Varying by model |

| Charging Speed | Fast charging capability | High-speed charging network | Fast charging capability | Fast charging capability |

| Interior Design | Luxury and innovative design | Modern and functional design | Modern and functional design | Luxury and high-end design |

| Technology Features | Advanced driver-assistance systems | Advanced driver-assistance systems and Autopilot | Advanced driver-assistance systems | Advanced driver-assistance systems |

| Price | Premium pricing | Competitive pricing | Premium pricing | Premium pricing |

Potential Solutions for Price Hikes and Supply Chain Issues

Lucid Motors, like many other automotive manufacturers, faces significant challenges navigating fluctuating global markets. Rising raw material costs and supply chain disruptions are impacting profitability and potentially affecting pricing strategies. Addressing these issues requires a multifaceted approach that combines strategic sourcing, operational efficiency improvements, and innovative solutions.Lucid must actively mitigate these risks to maintain its competitive edge and ensure long-term viability.

A proactive approach that focuses on resilience and adaptability is critical in the face of ongoing global economic uncertainties.

Alternative Sourcing Strategies

Diversifying supply chains and exploring alternative sourcing options for critical components is paramount. This approach reduces reliance on single suppliers and geographical regions, creating a more robust and resilient supply network. Companies like Apple have successfully diversified their component sourcing to mitigate risks associated with global events and political instability. By establishing relationships with multiple suppliers across various regions, Lucid can hedge against potential disruptions.

- Expanding Supplier Base: Identifying and engaging with multiple suppliers for key components like batteries, semiconductors, and other critical parts. This approach reduces vulnerability to disruptions with one supplier. This also allows for negotiation of better prices and terms. Examples of successful diversification strategies can be seen in the electronics industry.

- Regional Sourcing: Evaluating the feasibility of procuring components from different regions to reduce reliance on specific geographical areas. This approach helps to reduce transportation costs and potential geopolitical risks associated with concentrated sourcing. The success of this strategy depends on factors like production capabilities and quality control standards in alternative regions.

Optimizing Supply Chain Efficiency

Streamlining the supply chain to reduce lead times and inventory holding costs is crucial for managing fluctuating market conditions. Lean manufacturing principles and advanced logistics technologies can improve efficiency and reduce operational costs.

Lucid Motors’ price hikes are a real head-scratcher, especially given the current supply chain woes. It’s a bit like the disappointment of the iPhone 5, where certain features were absent , except instead of missing features, it’s about missing affordability. Ultimately, these price increases in the electric vehicle market seem to reflect broader supply chain challenges, mirroring the tech industry’s struggles.

- Demand Forecasting and Planning: Implementing sophisticated demand forecasting models to anticipate future demand fluctuations. This enables more accurate production planning and minimizes the risk of overstocking or understocking. Data-driven insights and predictive analytics play a crucial role in this aspect.

- Inventory Management: Implementing advanced inventory management systems to optimize inventory levels and minimize holding costs. Just-in-time inventory management, for instance, can significantly reduce holding costs. Real-time tracking of inventory levels allows for better responsiveness to demand fluctuations and reduces the risk of stockouts.

Innovative Approaches to Managing Fluctuating Supply Chain Conditions

Implementing technologies like AI-powered supply chain management systems can improve responsiveness and adaptability to dynamic market conditions.

- Predictive Analytics: Using predictive analytics to forecast potential supply chain disruptions based on historical data and real-time market information. This proactive approach allows for better mitigation of risks and ensures timely adjustments to supply chain strategies. Companies like Amazon use advanced algorithms to predict demand and optimize inventory levels.

- Technology Integration: Leveraging technology like blockchain to enhance transparency and traceability across the supply chain. This improves efficiency and reduces the risk of fraud and counterfeiting. This also fosters greater trust among supply chain partners.

Strategies for Maintaining Profitability

Lucid needs to maintain profitability while keeping prices competitive. This involves scrutinizing every aspect of its production process to find cost-saving opportunities.

- Cost Reduction Initiatives: Identifying and implementing cost-reduction strategies across the entire production process, from raw material sourcing to manufacturing and logistics. This could involve negotiating better deals with suppliers, automating processes, and optimizing manufacturing workflows.

- Pricing Strategy Adjustments: Carefully evaluating the impact of rising costs on pricing strategies. This involves assessing the price sensitivity of customers and making necessary adjustments to maintain profitability while remaining competitive. Pricing strategies should consider market dynamics, competitor pricing, and cost pressures.

Consumer Perspective on Price Hikes

Lucid Motors, like many luxury automakers, is facing headwinds in the form of rising material costs and supply chain disruptions. These factors are directly impacting the pricing of their vehicles, leading to inevitable increases. Understanding how consumers perceive these price adjustments is crucial for the company’s continued success. Consumer reaction to price increases varies significantly, and the luxury vehicle market is especially susceptible to shifts in demand.Consumers, particularly those already in the market for a high-end electric vehicle, are closely scrutinizing pricing strategies.

Their decisions are often influenced by factors beyond just the sticker price, such as perceived value, brand reputation, and the overall market climate. This analysis delves into the potential impacts of Lucid’s price hikes on consumer demand and explores strategies to mitigate potential concerns.

Consumer Perception and Reaction to Price Adjustments

Consumers in the luxury vehicle market are acutely aware of price increases and often have a well-defined understanding of the factors driving them. Their reaction ranges from acceptance to outright rejection, depending on their individual circumstances and perceived value proposition. Negative perception can lead to a decrease in demand, especially if the increase is perceived as disproportionate to the improvements in the vehicle.

Lucid needs to effectively communicate the reasons behind the price adjustments, highlighting any advancements in technology, design, or features that justify the cost.

Potential Impacts on Consumer Demand

Price hikes can have a significant impact on consumer demand, particularly in a competitive market. Consumers may postpone purchases, opt for less expensive alternatives, or simply abandon the market entirely. This is especially true for Lucid, as their vehicles are still relatively new to the market. The perceived value of the Lucid brand will be crucial in determining consumer willingness to pay the higher price.

Strategies for Addressing Consumer Concerns About Price, Lucid auto industry startup price hikes supply chain

Addressing consumer concerns regarding price increases requires a multi-faceted approach. Transparency and clear communication are essential. Lucid can highlight the unique features and benefits of their vehicles, emphasizing the technological advancements and luxury experience that justify the higher price point. Demonstrating exceptional customer service and building brand loyalty through consistent quality and performance can also help mitigate consumer concerns.

Comparison Across Luxury Vehicle Segments

Consumer responses to price increases vary across luxury vehicle segments. In the high-end electric vehicle market, consumers may be more sensitive to price hikes if they perceive similar vehicles from competitors offering comparable features at a lower price. For instance, if a rival EV model provides similar performance and luxury features but with a lower price tag, consumers might opt for that instead.

This highlights the importance of differentiating Lucid’s offerings to maintain its competitive edge.

Industry Expert Quotes on Consumer Perception

“Consumers in the luxury market are price-sensitive, but they are also driven by perceived value. Lucid needs to clearly articulate the premium aspects of their vehicles that justify the price.”

Industry Analyst, Automotive News

“The current economic climate plays a significant role in consumer decision-making. Price increases, even in the luxury sector, can lead to a more cautious approach to purchasing.”Automotive Market Expert, Global Insight.

Closure

In conclusion, Lucid Motors faces significant challenges in the luxury EV market. Rising prices and supply chain disruptions are putting pressure on the company’s profitability and market share. While Lucid has implemented strategies to mitigate these issues, the future success of the company hinges on its ability to adapt to these shifting dynamics and effectively navigate the evolving competitive landscape.

The industry outlook for Lucid, and the electric vehicle market as a whole, is complex, with both opportunities and obstacles emerging. The interplay between pricing strategies and supply chain management will be crucial to the company’s long-term success.