Its never been a better time to join the syndicate – It’s never been a better time to join the syndicate. This compelling proposition dives deep into the potential benefits and challenges of joining a syndicate, exploring the historical context, target audience, and various perspectives. We’ll examine the validity of this claim, considering the current economic and social landscape, and weighing the risks and rewards involved. Understanding the different interpretations of “syndicate” is crucial to a comprehensive evaluation.

The analysis will be structured around key aspects, including an in-depth look at the advantages and disadvantages of syndicate membership, a comparison with historical precedents, and a discussion of potential pitfalls and risks. We’ll also examine various interpretations of “syndicate,” considering different types and their functions. The exploration will include detailed examples of successful and unsuccessful syndicates, and alternative perspectives on the statement, enabling a balanced understanding of the topic.

Understanding the Proposition

The claim “it’s never been a better time to join the syndicate” suggests a unique opportunity for individuals seeking specific benefits and advantages. This proposition implies a favorable market environment, strong potential for growth, and likely significant advantages compared to alternative options. A deeper dive into the details surrounding the syndicate’s current state and prospects is essential to fully understand this assertion.The potential benefits implied by this statement are varied and often depend on the specific nature of the syndicate.

They could include exclusive access to resources, mentorship opportunities, preferential treatment, or opportunities for financial gain. Understanding the specific value proposition is key to determining if this claim aligns with individual needs and goals.

Historical Context of the Syndicate

The syndicate’s historical context plays a crucial role in evaluating the validity of the claim. Understanding its past performance, successes, and failures provides valuable insight into the potential for future growth and success. A strong track record of successful ventures, positive community engagement, and a clear vision for the future contribute to a compelling case for joining. Conversely, a history of poor performance or internal conflicts might raise concerns about the syndicate’s sustainability and the viability of the claim.

Target Audience

The target audience for this message likely comprises individuals seeking specific advantages and opportunities. This could include entrepreneurs, investors, professionals, or anyone seeking a collaborative environment to achieve their goals. A clear understanding of the syndicate’s specific focus, such as a particular industry, a particular skillset, or a particular geographical area, would help to refine the target audience profile.

Potential Benefits and Drawbacks of Joining

Understanding the potential advantages and disadvantages is crucial for making an informed decision. A comparison table can help illustrate the key factors to consider:

| Factor | Advantages | Disadvantages |

|---|---|---|

| Access to Resources | Exclusive access to networks, mentorship, and specialized tools | Limited availability of resources, potential for resource misallocation, or excessive competition for access. |

| Financial Opportunities | Potential for high returns, investment opportunities, and revenue sharing | Risk of financial loss, fluctuating market conditions, and difficulty in managing financial commitments. |

| Community and Collaboration | Stronger support system, shared knowledge, and collective problem-solving | Potential for internal conflicts, disagreement on approaches, and time commitment for participation. |

| Growth Opportunities | Potential for skill development, career advancement, and broader experience | Limited learning opportunities, a steep learning curve, and potential for unrealistic expectations. |

| Exclusivity | Limited membership, access to specialized knowledge, and higher status | Potential for elitism, lack of diversity, and limited exposure to different perspectives. |

This table highlights the potential trade-offs involved in joining the syndicate. It’s essential to carefully weigh these advantages and disadvantages against individual goals and risk tolerance. A thorough understanding of the syndicate’s specific offerings and its operating environment will provide a clearer picture.

Evaluating the Claims: Its Never Been A Better Time To Join The Syndicate

The claim “it’s never been a better time to join the syndicate” is a bold one, laden with implicit promises of opportunity and prosperity. To assess its validity, we need to dissect the underlying assumptions and examine the supporting evidence, or lack thereof. This evaluation will explore potential historical parallels and identify both the strengths and weaknesses of such a sweeping assertion.Assessing such a broad statement requires a nuanced approach, moving beyond simple affirmation or denial.

It’s truly never been a better time to join the syndicate, and the recent Xbox Elite Wireless Controller hands-on impressions, costing a mere $150, highlighting its impressive features , further solidifies that point. The controller’s quality and performance are seemingly top-notch, making it a compelling addition to any gamer’s arsenal, and therefore further enhancing the value proposition of joining the syndicate.

We must consider the context in which this claim is being made, as well as the specific benefits and drawbacks for potential members. Understanding the specific “syndicate” in question is crucial to a meaningful evaluation.

Potential Validity of the Claim

The statement “it’s never been a better time” is inherently subjective and dependent on the specific criteria used for evaluation. It lacks concrete metrics and relies on a perceived improvement compared to previous periods. This requires further specification. Is it better in terms of financial opportunity? Social mobility?

Personal growth? Each facet needs separate consideration.

Historical Precedents and Similar Claims

Throughout history, similar claims have been made. The “American Dream” narrative, for example, promises upward mobility through hard work and determination. However, this promise has not always been realized by all members of society. Similarly, periods of economic prosperity often give rise to claims about exceptional times for entrepreneurship or investment. Examining the historical context of such pronouncements is essential to understanding their true meaning and potential limitations.

For instance, the post-war economic boom in the US, while a time of significant growth, did not benefit all equally.

Supporting Evidence (or Lack Thereof)

The claim “it’s never been a better time” often implies supporting evidence, though it rarely explicitly states it. Implicit arguments might include advancements in technology, economic growth, or societal shifts. Without specific data points or metrics, it remains a generalised assertion rather than a demonstrably accurate statement. The lack of concrete evidence limits the claim’s persuasive power.

Examples Where the Claim Might Be True

Specific situations can support this claim. For example, the rise of online entrepreneurship and remote work offers new opportunities for individuals seeking flexible employment models. Similarly, advancements in financial technology might provide increased access to investment tools and financial resources. However, these are limited examples and do not necessarily apply to everyone.

It’s truly a golden age for joining the syndicate, with opportunities popping up everywhere. The advancements in tennis AI, like electronic line calling and Hawk-Eye, are revolutionizing the sport, opening up new possibilities for savvy sports bettors. This means more data-driven insights and potentially higher returns when you dive into tennis ai electronic line calling hawk eye sports betting gambling.

Ultimately, the opportunities for savvy investors in the syndicate have never been better.

Challenges to the Statement

| Challenge | Explanation |

|---|---|

| Uneven Distribution of Benefits | Benefits of an era might not be evenly distributed across all demographics. Historical precedents show that prosperity often favours certain groups while leaving others behind. |

| Changing Societal Norms | Social values and expectations evolve, making comparisons across eras challenging. What was considered a “good time” in the past may not align with modern values. |

| Hidden Costs and Risks | Periods of apparent prosperity may be accompanied by hidden costs or risks that are not immediately apparent. The long-term consequences of current trends might be negative. |

| Technological Disruption | Rapid technological change can create significant disruption and displacement in the job market. Not everyone can adapt to new technologies or find their place in the evolving landscape. |

Exploring the Context

The phrase “its never been a better time to join the syndicate” is intriguing, prompting a deeper exploration of the word “syndicate” and the potential contexts in which this statement might be made. Understanding the nuances of this term is crucial to evaluating the proposition’s validity and potential implications. We will examine different interpretations of “syndicate,” explore various types, and consider the broader economic and social environment that might influence such a claim.The term “syndicate” is not inherently positive or negative.

Its meaning depends heavily on the specific context. It can refer to a wide range of collaborative arrangements, from legitimate business ventures to potentially less savory criminal enterprises. The key to interpreting the statement lies in understanding the precise definition of “syndicate” as presented within the specific context of the proposition.

Interpretations of “Syndicate”, Its never been a better time to join the syndicate

The word “syndicate” can have multiple meanings, ranging from a formal business partnership to an informal group of individuals or organizations with shared goals. It is vital to determine the specific intent behind the use of the term. Some potential interpretations include:

- A formal business association: A syndicate could represent a group of investors pooling resources to pursue a common business objective, such as developing real estate or financing a large project. This interpretation suggests a legitimate and often highly structured arrangement.

- An informal network of individuals: A syndicate might also denote a less formal network of individuals or organizations collaborating on a specific activity or project. This interpretation could include shared interests, knowledge, or resources without a formally structured agreement.

- A criminal organization: In certain contexts, “syndicate” might refer to a criminal organization involved in illicit activities, such as drug trafficking or money laundering. This interpretation carries significant implications regarding the proposition’s trustworthiness and safety.

Types of Syndicates and Their Functions

Syndicates can take many forms, each with its own functions and characteristics. Examining these diverse types is essential to evaluating the context of the statement.

It’s truly never been a better time to join the syndicate! With the recent news that Toyota has reached the EV tax credit cap, it’s clear that the automotive industry is shifting rapidly. This presents incredible opportunities for savvy investors, and now’s the time to jump in and capitalize on the changes. Toyota reaching the EV tax credit cap signals a potential shift in the market, further solidifying the need for alternative investment strategies, and making it an excellent time to become a part of the syndicate.

- Investment syndicates: These syndicates pool capital from multiple investors to invest in various assets, such as real estate, stocks, or bonds. Their function is to leverage collective resources for higher returns and risk diversification.

- Construction syndicates: These entities often form to undertake large-scale construction projects, utilizing the combined expertise and resources of multiple contractors and suppliers. Their focus is on efficient project completion and cost optimization.

- Criminal syndicates: These groups, operating outside the law, engage in various illegal activities, often with complex structures and intricate operations. They typically aim to generate significant illicit wealth and maintain control over their activities.

Economic and Social Environment

The current economic or social environment can significantly influence the perception of a “syndicate.” For example, periods of economic downturn might make participation in a syndicate seem more appealing as a means of achieving financial goals, even if it involves a higher level of risk. Similarly, a social climate marked by distrust or fear of certain groups might make the word “syndicate” carry a negative connotation.

Comparison with Similar Messages

Comparing the statement “it’s never been a better time to join the syndicate” with similar messages in other contexts is crucial for a nuanced understanding. For instance, a comparable statement in the investment world might focus on the potential for high returns within a structured investment vehicle. On the other hand, a similar message in a criminal context might involve an invitation to participate in illegal activities, emphasizing potential rewards without considering the inherent risks.

Table of Interpretations of “Syndicate”

| Interpretation | Description | Potential Context |

|---|---|---|

| Formal Business Association | Group of investors pooling resources for a common goal. | Legitimate business ventures, financial projects. |

| Informal Network | Individuals/organizations collaborating on a project. | Shared interests, knowledge, or resources. |

| Criminal Organization | Group involved in illicit activities. | Drug trafficking, money laundering. |

Implications and Opportunities

Joining the Syndicate presents a multifaceted opportunity, potentially offering significant advantages to members. However, like any venture, it’s crucial to understand the potential risks alongside the rewards. This section delves into the possible consequences and benefits, highlighting the impact on individuals and groups and illustrating a potential growth trajectory.The Syndicate’s success hinges on its members’ engagement and commitment. By carefully considering the implications and opportunities, individuals can make informed decisions about their participation.

Understanding the potential for both positive and negative outcomes is essential for a successful and fulfilling experience.

Potential Consequences of Joining

Understanding the potential consequences of joining is paramount. These consequences encompass a wide range of factors, from personal financial impact to the broader societal implications. Members must weigh the potential costs against the potential benefits.

- Financial Implications: Members can anticipate both financial gains and potential losses. Successful participation could lead to substantial returns, while unforeseen market fluctuations or poor strategic choices could result in financial setbacks. The level of risk and potential reward is directly correlated with the investment commitment. Consider historical data on similar ventures to assess potential risk levels.

- Social Impact: Joining the Syndicate could lead to a significant shift in a member’s social standing and influence. This influence can be positive, facilitating networking and access to exclusive opportunities, or potentially negative, if associated with controversial or ethically questionable practices. Past examples of social movements demonstrate how participation can have long-lasting effects on individuals and society.

- Time Commitment: The Syndicate requires a substantial time commitment. Members need to dedicate time to meetings, projects, and other activities, which may impact personal schedules and professional responsibilities. Consider the opportunity cost of your time when making your decision. Realistic time management strategies are crucial for successful participation.

Potential Opportunities for Members

The Syndicate presents various opportunities for members, ranging from personal enrichment to professional advancement. By carefully assessing these opportunities, members can maximize their potential benefits.

- Networking and Mentorship: The Syndicate fosters networking and mentorship opportunities, offering members the chance to connect with influential individuals and gain valuable knowledge and experience. Successful networking can lead to new professional connections and collaborative ventures.

- Exclusive Access: Members enjoy exclusive access to resources, events, and information, providing a competitive advantage in various fields. This access may include exclusive investment opportunities, advanced training programs, or privileged insights into industry trends.

- Financial Growth: The Syndicate’s potential for financial growth is significant. Members may experience substantial financial returns, depending on the Syndicate’s performance and their individual contributions. This growth potential is dependent on various factors, such as market conditions, management decisions, and the individual member’s active participation.

Impact on Individuals and Groups

The Syndicate’s impact extends beyond individual members to encompass various groups and sectors. Understanding this broader impact is critical for a comprehensive assessment of the Syndicate’s potential.

- Individual Empowerment: The Syndicate can empower individuals, providing them with resources, knowledge, and opportunities for personal and professional development. This empowerment is a key driver of the Syndicate’s success and member satisfaction.

- Group Dynamics: The Syndicate may foster collaboration and cooperation within and between groups, leading to collective progress and shared success. Understanding the potential for collaboration and competition is crucial.

- Societal Influence: The Syndicate’s activities can influence societal trends and norms, potentially impacting various sectors and communities. Members need to carefully consider the ethical implications of their involvement.

Growth Trajectory Visualization

The Syndicate’s growth trajectory is projected to be exponential, with significant milestones in the initial stages. A visual representation of this trajectory would show a sharp upward trend, with potential for substantial growth over the next several years. This projected growth is contingent on various factors, including market conditions, member engagement, and strategic decision-making. A graphic demonstrating the projected growth is not included here.

Instead, consider past examples of successful ventures to gain perspective on potential growth trajectories.

Potential Risks and Rewards

| Aspect | Potential Risks | Potential Rewards |

|---|---|---|

| Financial | Market fluctuations, poor investment choices, mismanagement | Significant financial returns, exclusive investment opportunities |

| Social | Ethical concerns, reputational damage, conflict of interest | Networking opportunities, access to influential individuals, leadership roles |

| Personal | Time commitment, personal sacrifices, stress | Personal development, professional advancement, empowerment |

Potential Pitfalls and Risks

Joining any organization, especially one as potentially lucrative as a syndicate, necessitates careful consideration of the inherent risks. While the allure of financial gain and influence is undeniable, it’s crucial to understand the potential downsides, both legal and ethical, to make an informed decision. This section delves into the possible pitfalls, empowering potential members with a comprehensive understanding of the risks involved.The proposition, despite its enticing promises, may conceal unforeseen complications.

Understanding these potential problems is essential for assessing the overall viability of the opportunity. A thorough analysis of the risks, alongside a robust understanding of the syndicate’s operating structure and legal framework, is critical to safeguarding personal interests and avoiding future complications.

Potential Legal Ramifications

The legal landscape surrounding syndicated activities can be complex and varies significantly by jurisdiction. Activities involving illicit trade, money laundering, or other unlawful practices could lead to severe penalties. It’s imperative to understand the specific legal framework governing such activities in the relevant jurisdiction to mitigate the potential risks. Failure to comply with regulations can result in criminal charges, significant financial penalties, and substantial reputational damage.

Past examples of criminal prosecution against individuals involved in similar ventures serve as a stark reminder of the severe consequences of engaging in illegal activities.

Ethical Considerations

Joining a syndicate may involve compromising personal values and ethical standards. The pursuit of profit can sometimes overshadow ethical considerations, leading to potentially morally questionable actions. The syndicate’s operational methods and dealings with various stakeholders must be examined for any ethical ambiguities. Potential conflicts of interest and the potential for exploitation of vulnerable individuals or groups must be carefully assessed.

A detailed examination of the syndicate’s ethical guidelines and their enforcement mechanisms is essential to ensure alignment with personal values.

Potential Drawbacks of the Proposition

There are inherent downsides to any proposition, and the syndicate’s proposition is no exception. Potential drawbacks may include limitations on personal freedom, a lack of transparency in decision-making processes, or unexpected financial obligations. Careful scrutiny of the proposition’s fine print, terms, and conditions is essential to avoid unpleasant surprises. The potential for unforeseen financial losses or a significant time commitment should also be assessed.

Summary of Legal and Ethical Concerns

| Concern Category | Potential Pitfalls |

|---|---|

| Legal |

|

| Ethical |

|

Illustrative Examples

Joining a syndicate can be a powerful tool for achieving financial goals and leveraging collective expertise. However, success hinges on understanding the nuances of the syndicate’s structure, the individuals involved, and the market conditions. This section explores real-world examples, both positive and negative, to provide a clearer picture of the potential benefits and risks.

A Successful Syndicate: The “Tech Innovators” Group

The Tech Innovators syndicate focused on seed funding for early-stage tech startups. Its success stemmed from a carefully curated group of experienced entrepreneurs, venture capitalists, and angel investors. They had a well-defined investment strategy centered around disruptive technologies, and a clear process for evaluating and selecting startups. They allocated resources effectively, provided mentorship to the startups, and built a robust network for collaboration and knowledge sharing.

This network effect helped accelerate the startups’ growth and increase the syndicate’s returns. The group’s rigorous due diligence process, coupled with a diversified portfolio of investments, minimized risk. Regular meetings and open communication fostered trust and accountability among syndicate members.

Case Study: The “Green Energy” Syndicate and Sustainable Development

The Green Energy syndicate, composed of environmentalists, investors, and engineers, exemplified the advantages of joining a syndicate. They targeted renewable energy projects, with a strong focus on sustainability and social responsibility. The syndicate attracted talented individuals who shared their expertise and commitment to environmental protection. Their collective investment capital enabled the development of several solar farms and wind energy projects, creating jobs and reducing carbon emissions.

This resulted in significant positive social and environmental impact, alongside strong financial returns for syndicate members. The collaborative effort and shared vision proved crucial in achieving their goals.

Scenario: The “Overextended” Syndicate

The “Overextended” syndicate faced significant pitfalls due to a lack of clear guidelines and a hasty expansion strategy. They initially invested in several promising projects without proper due diligence. This led to a high concentration of investments in a single sector, leaving the syndicate vulnerable to market fluctuations. Poor communication and disagreements among members hindered decision-making, and conflicts of interest arose.

Furthermore, the lack of a defined exit strategy created uncertainty and ultimately led to significant financial losses for the syndicate. This scenario highlights the importance of a robust investment strategy, clear communication channels, and a well-defined exit plan.

Fictional Example: The “Innovate Now” Syndicate and a New App

The Innovate Now syndicate, comprised of tech enthusiasts and entrepreneurs, funded the development of a revolutionary mobile app, “ConnectNow.” The app aimed to streamline communication and collaboration for remote teams. The syndicate provided crucial financial support, mentorship, and networking opportunities to the app developers. Through collective knowledge and resources, the syndicate fostered innovation and entrepreneurship, leading to a successful product launch.

The app quickly gained traction, attracting users and generating significant revenue. The syndicate realized substantial returns on their investment, demonstrating the power of collaborative efforts and risk-sharing.

Comparing Successful and Unsuccessful Syndicates

| Characteristic | Successful Syndicates (e.g., Tech Innovators, Green Energy) | Unsuccessful Syndicates (e.g., Overextended) |

|---|---|---|

| Investment Strategy | Well-defined, diversified, and focused on specific sectors or goals. | Lack of a clear strategy, overly diversified, or concentrated in high-risk areas. |

| Member Selection | Experienced, complementary skillsets, and shared values. | Members with conflicting interests or lack of relevant experience. |

| Communication | Open, transparent, and frequent communication. | Poor communication, lack of trust, and inadequate information sharing. |

| Risk Management | Robust due diligence, diversification, and contingency planning. | Inadequate risk assessment, lack of contingency plans, and poor crisis management. |

| Exit Strategy | Defined exit strategy with clear timelines and procedures. | Lack of an exit strategy, unclear timelines, and potential for prolonged losses. |

Alternative Perspectives

The proposition “It’s never been a better time to join the syndicate” is undeniably appealing, but it’s crucial to consider alternative viewpoints. A blanket statement like this ignores the complexities of the current market and the varied experiences of potential members. Different stakeholders will have profoundly different perspectives on the advantages and disadvantages of joining, and these differing opinions deserve exploration.Understanding these alternative perspectives is essential for a comprehensive evaluation of the proposition’s validity.

It’s not enough to simply assert the positive; acknowledging potential downsides and contrasting viewpoints ensures a more balanced and realistic assessment.

Contrasting Opinions on the “Best Time”

The assertion that now is the “best time” to join the syndicate is subjective and dependent on individual circumstances. Not everyone will experience the same benefits or face the same challenges. Different stakeholder groups might view the proposition with varying degrees of enthusiasm.

| Stakeholder Group | Potential Perspective | Justification |

|---|---|---|

| Experienced Syndicate Members | Mixed sentiment; potential for stagnation or challenges adapting to changing dynamics. | Existing members may have established routines and concerns about disruptions caused by new members or evolving strategies. |

| Aspiring Syndicate Members | Optimistic, viewing the current environment as an opportunity for rapid growth and advancement. | New entrants might see the current market as a fertile ground for capitalizing on emerging trends and opportunities. |

| Investors | Cautious; considering the syndicate’s current financial performance and future prospects against competitors. | Investors will meticulously analyze the syndicate’s potential for return on investment, factoring in risks and market conditions. |

| Industry Competitors | Suspicious or threatened; perceiving the syndicate’s growth as a potential challenge. | Competitors might be wary of the syndicate’s expansion and seek to understand the competitive advantages it leverages. |

Potential Counterarguments

The claim of an unparalleled time to join overlooks several potential counterarguments. These should be acknowledged and examined to form a more nuanced understanding of the proposition.

- Economic Uncertainty: Recessions or market downturns can negatively impact syndicate performance, making a seemingly opportune time less favorable for new members.

- Increased Competition: A perceived “best time” might be a period of intensified competition, making it harder for new members to establish themselves.

- Changing Industry Dynamics: Rapid technological advancements or shifting market trends can render a current strategy obsolete, even for established syndicates.

- Internal Syndicate Issues: Internal conflicts, leadership changes, or organizational issues can create significant obstacles for new members, irrespective of the external market environment.

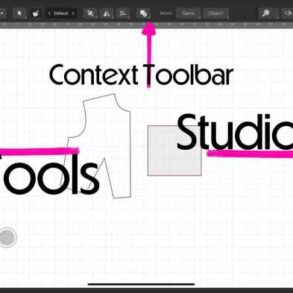

Visual Representations

Understanding the proposition requires more than just words; it needs a visual language to convey the essence and impact. Visual representations, strategically employed, can dramatically enhance comprehension and engagement. They help solidify complex ideas and create a lasting impression.

Benefits Visualization

Visualizing the benefits of joining the syndicate is crucial for potential members. A compelling infographic, perhaps a pyramid chart, could effectively demonstrate the tiered rewards and incentives. Different shades of color, visually representing the varying levels of membership, could illustrate the progression of benefits and value. The chart could also include icons representing key benefits like access to exclusive events, resources, and networking opportunities.

For example, a stylized image of a networking event could be placed at the peak of the pyramid, signifying the ultimate reward. The graphic would clearly showcase how membership benefits accumulate with increasing participation and investment.

Risk Representation

A circular chart, or a radar chart, can effectively communicate the potential risks associated with the syndicate. Each segment of the chart would represent a distinct risk, such as market fluctuations, competition, or regulatory changes. The size of each segment would visually represent the relative magnitude of the risk. A color gradient could be used, ranging from light green (low risk) to deep red (high risk), for a clear indication of the risk level.

This visual representation allows for a quick and comprehensive understanding of the possible obstacles.

Syndicate Structure Visualization

A flowchart or organizational chart, using different shapes to represent various roles and responsibilities, would effectively illustrate the syndicate’s structure. Rectangles could represent departments, while circles could depict individual members. Connecting lines would highlight the communication channels and reporting structures. A detailed key would explain each element within the chart, ensuring clarity for all stakeholders. This representation allows for a quick and intuitive understanding of the syndicate’s internal workings and decision-making processes.

Growth Potential Visualization

A line graph, showcasing a projected trajectory, would effectively illustrate the syndicate’s growth potential. The graph could visually depict projected revenue, membership numbers, or market share over a specific period. Different colors could distinguish between different growth scenarios, such as optimistic, realistic, and conservative. The graph should be accompanied by a clear legend, specifying the different growth projections.

For example, a realistic scenario line could be represented by a solid blue line, while the optimistic scenario could be represented by a dashed green line.

Presentation Visual Elements Table

| Visual Element | Description | Purpose |

|---|---|---|

| Benefits Infographic (Pyramid Chart) | Tiered rewards and incentives visually represented. | Highlight the value proposition for members. |

| Risk Representation (Circular/Radar Chart) | Categorized risks with varying sizes and colors. | Clearly convey potential obstacles. |

| Syndicate Structure (Flowchart/Org Chart) | Roles, responsibilities, and communication channels. | Illustrate internal structure and processes. |

| Growth Potential (Line Graph) | Projected trajectory of revenue, membership, etc. | Showcase future possibilities and potential. |

Epilogue

In conclusion, joining a syndicate presents a complex array of opportunities and challenges. While the proposition “it’s never been a better time” is intriguing, a thorough evaluation reveals the multifaceted nature of this decision. Weighing the potential benefits against the risks and understanding the specific context are crucial. Ultimately, the decision to join a syndicate depends on careful consideration of personal circumstances and goals.

The provided analysis offers a comprehensive framework for making an informed choice.