Starlink just got cheaper again, opening up exciting possibilities for satellite internet access. This price reduction promises a ripple effect across the consumer market, potentially influencing demand, competition, and even the long-term future of satellite internet. We’ll explore the potential impact on consumers, Starlink’s finances, technological advancements, market competition, infrastructure, customer experience, and more.

The new pricing structure presents a fascinating case study in how technological advancements can drive down costs and expand access to high-speed internet. We’ll delve into the details, analyzing potential strategies Starlink might employ to maintain profitability while offering lower prices, and comparing its current pricing to historical data and competitors.

Impact on Consumer Market

Starlink’s recent price reduction is poised to significantly impact the consumer market for satellite internet. This move, strategically timed and likely in response to competitor activity, could dramatically alter the landscape of home internet access, especially in underserved rural areas. The anticipated consumer response, varying across demographics and usage patterns, will be crucial in determining the overall success of this price adjustment.The reduction in Starlink’s subscription costs will likely stimulate demand, particularly in regions where traditional internet options are limited or expensive.

This is especially relevant for rural areas and underserved communities, where Starlink’s low-latency connectivity is already a significant advantage. The impact will also be felt by those who are already Starlink subscribers, potentially incentivizing them to increase their usage.

Potential Consumer Response

The price reduction will likely attract a wider range of consumers. Younger demographics, often early adopters of new technologies, are likely to be particularly responsive. Those in rural areas, where reliable broadband is often a significant challenge, will also be a major target audience. The expected increase in demand is likely to translate into a rise in subscription rates, at least in the short term.

Anticipated Changes in Demand and Subscription Rates

Increased demand will likely translate to higher subscription rates for Starlink. Historical data from similar price adjustments in the telecommunications industry provides insight into the potential magnitude of this increase. A notable example is the initial launch of mobile phone services; the price reductions spurred increased adoption and widespread market penetration.

Potential Competitive Responses

Other satellite internet providers, like HughesNet and Viasat, will likely respond to Starlink’s price cut. These competitors may lower their prices to maintain market share or introduce new promotions to attract customers. This dynamic pricing competition will create a more competitive market environment.

Influence on Starlink Market Share

The price reduction could significantly influence Starlink’s market share. By making its service more accessible and affordable, Starlink stands to gain a larger portion of the satellite internet market. This effect will likely be pronounced in regions where Starlink is not yet a dominant force.

Comparison to Historical Data and Competitor Offerings

Starlink’s current pricing structure, post-reduction, needs to be compared with historical data and competitor offerings. Looking at the past pricing trends for Starlink and the current pricing of its competitors (HughesNet, Viasat) is crucial to assessing the long-term implications. This comparison will help understand whether the price cut represents a sustainable strategy or a short-term promotional tactic.

Long-Term Implications on the Satellite Internet Market

The price reduction has the potential to significantly impact the overall satellite internet market. Increased competition and reduced prices might drive more consumers towards satellite internet, which could potentially alter the market dynamics for terrestrial internet providers. Furthermore, the price cut may encourage further innovation and investment in the satellite internet sector.

Financial Implications for Starlink

Starlink’s recent price reduction, while a boon for consumers, presents a complex set of financial implications for the company. Understanding these implications is crucial for assessing the long-term viability and strategy of the satellite internet provider. The shift in pricing necessitates a careful evaluation of potential revenue changes, profit margin impacts, and the company’s future investment plans.The lower price point will inevitably affect Starlink’s revenue stream.

A direct correlation exists between the price of a service and the volume of subscribers. The lower price could incentivize more users to subscribe, but the reduction in revenue per subscriber needs careful consideration. Maintaining profitability while offering a more affordable service is a challenge that requires strategic planning.

Starlink just got cheaper again, which is awesome news for satellite internet users. This is particularly exciting considering the recent Tesla Model 3 preorder update, Elon Musk’s tweet about the potential changes, which you can check out at tesla model 3 preorder update elon musk tweet. Hopefully, this means even more affordable options for getting connected, especially given the recent price drop for Starlink.

Projected Revenue Impact

The reduced price will likely lead to a significant increase in the number of subscribers. However, this increase might not offset the decrease in revenue per subscriber. Historical data from similar price reductions in the telecom industry shows a correlation between lower prices and higher subscriber counts, but the exact impact on Starlink’s revenue will depend on the magnitude of the price cut and consumer response.

Predicting the precise revenue impact requires careful market analysis and forecasting.

Profit Margin Implications

Lower prices directly affect profit margins. A reduction in revenue per subscriber, even with a substantial increase in subscribers, could put pressure on Starlink’s profit margins. The company may need to explore cost-cutting measures to maintain profitability at the new price point.

Strategies for Maintaining Profitability

Starlink can implement various strategies to maintain profitability despite the lower price. One strategy could involve optimizing its operational efficiency by reducing overhead costs. Another strategy could be to renegotiate contracts with suppliers to lower the cost of equipment and components. The company may also need to focus on optimizing its production processes to improve manufacturing efficiency and lower the cost of production.

Starlink just got cheaper again, which is fantastic news for anyone looking to get high-speed internet. Thinking about upgrading my laptop, I’ve been researching the battery life of 2-in-1 tablets, like the HP Envy x2 Qualcomm 2 in 1 tablet running Windows 10. A great resource for comparing battery performance is this article on HP Envy x2 Qualcomm 2 in 1 tablet Windows 10 battery life.

Hopefully, with the lower Starlink price, I can finally afford that upgrade and enjoy a seamless online experience!

Increased efficiency can translate to improved margins.

Impact on Future Investments

The financial implications of the price cut will undoubtedly impact Starlink’s future investments in infrastructure and technology. The company may need to prioritize investments in areas that offer the most significant return on investment. Reduced profits may mean less funding for future expansions and research and development.

Comparison of Pricing and Revenue

| Pricing Period | Previous Price (USD) | New Price (USD) | Estimated Revenue Change (USD) |

|---|---|---|---|

| Q1 2023 | $110 | $95 | Potential decrease of $15 per subscriber |

| Q2 2023 | $110 | $95 | Potential decrease of $15 per subscriber |

Note: Revenue changes are estimates and will vary based on subscriber growth.

Potential Cost-Saving Measures

To absorb the lower pricing and maintain profitability, Starlink may implement various cost-saving measures. These measures could include streamlining administrative processes, reducing marketing costs, and optimizing supply chain management. Another strategy could be reducing costs related to satellite manufacturing and launching.

- Streamlining Administrative Processes: Automating tasks, reducing staff, or implementing efficient project management techniques can result in significant cost savings. The company may also consider optimizing its internal communication channels.

- Reducing Marketing Costs: Focusing on targeted marketing campaigns and leveraging digital marketing tools can lead to cost-effective customer acquisition.

- Optimizing Supply Chain Management: Negotiating better deals with suppliers, streamlining logistics, and reducing inventory costs can lead to significant savings.

Technological Advancements

Starlink’s recent price drop is exciting news for consumers, but what exactly has changed behind the scenes? The reduction likely stems from significant advancements in satellite technology, manufacturing processes, and operational efficiency. These improvements are not isolated occurrences but rather part of a broader trend in space exploration and communications. Understanding these advancements is key to predicting future developments in the satellite internet market.

Potential Technological Advancements

Several key technological areas have likely contributed to the cost reduction. Improved satellite miniaturization, enhanced manufacturing techniques, and more efficient operational protocols are all probable factors. The overall goal of these improvements is to lower production costs while maintaining or enhancing performance. The impact of these advancements will be felt not only in the pricing of Starlink but also in the development of other satellite communication systems.

Satellite Technology Improvements

The design of Starlink satellites themselves has likely evolved. Potential advancements include increased efficiency in solar panels, more robust antenna systems for improved signal reception, and lightweight materials to reduce overall mass. These innovations can contribute to lower launch costs, reducing the overall expenditure required for placing the satellites into orbit. For example, lighter satellites require less fuel for deployment, which in turn directly translates into lower launch costs.

This also contributes to reduced operational costs over time.

Manufacturing Process Enhancements

Optimizing the manufacturing process is crucial for cost reduction. Automation, standardization, and the use of advanced materials could all be factors. These processes can lead to faster production times, lower waste, and higher yields. Consider how a shift to automated assembly lines in manufacturing could streamline production, significantly reducing labor costs. Similarly, the use of more cost-effective materials for the construction of satellite components could lead to a dramatic drop in the overall manufacturing cost.

Operational Efficiency Improvements

The way Starlink manages its satellite constellation and ground stations is likely to have undergone improvements. Optimization of launch schedules, enhanced satellite tracking and management software, and more efficient ground infrastructure are all possible advancements. These improvements contribute to a more streamlined and cost-effective operational system. For instance, optimizing the launch schedules can minimize the fuel required for each launch, which is a direct cost saving.

Comparison of Technical Specifications

| Specification | Current Model | Previous Model |

|---|---|---|

| Number of Satellites in Orbit | (Estimated value) | (Estimated value) |

| Satellite Size (Approximate) | (e.g., 1.2 meters) | (e.g., 1.5 meters) |

| Payload Capacity (Approximate) | (e.g., 100 kg) | (e.g., 80 kg) |

| Solar Panel Efficiency | (e.g., 35%) | (e.g., 30%) |

| Data Transmission Rate (Mbps) | (e.g., 100 Mbps) | (e.g., 50 Mbps) |

Note: Exact figures are not publicly available. The table above represents potential improvements, not necessarily specific data points.

Market Analysis and Competition

Starlink’s recent price reduction has injected a new dynamic into the satellite internet market, prompting a crucial analysis of the competitive landscape. The move signals a potential shift in market share and necessitates a deep dive into how competitors are responding and adapting to this new pricing strategy. This section will examine the competitive landscape, compare Starlink’s price cuts to competitor strategies, and predict potential reactions and future market shifts.The satellite internet market is becoming increasingly competitive, with various providers vying for market share.

Existing players like HughesNet and Viasat are constantly evolving their offerings, and new entrants are emerging, making the market a complex ecosystem. Starlink’s aggressive pricing strategy has the potential to significantly alter the balance of power in this sector, influencing consumer choices and forcing competitors to re-evaluate their strategies.

Competitive Landscape Overview

The satellite internet market is currently dominated by a few key players, each with unique strengths and weaknesses. Starlink, with its focus on constellation-based coverage and speed, stands out. HughesNet and Viasat have established customer bases and broader infrastructure, leveraging experience to maintain their position. Smaller players often target niche markets or specific geographic areas. This competitive landscape is highly dynamic, constantly adapting to technological advancements and market demands.

Comparison of Starlink’s Price Reduction to Competitor Strategies

Starlink’s price reduction represents a significant shift in its pricing strategy. While competitors have previously offered promotions or discounts, Starlink’s move is more substantial, potentially attracting a larger customer base. Other providers may respond with similar price cuts or by focusing on value-added services, such as bundled packages or enhanced customer support, to maintain competitiveness.

Potential Reactions of Competitors

Competitors’ responses to Starlink’s price cut will vary. Some might match the price reduction to retain their customer base. Others may focus on specific market segments, emphasizing factors like higher speeds, better customer support, or more favorable contract terms. The reactions will likely depend on the financial health, operational capacity, and long-term strategies of each competitor. For example, Viasat, with its established infrastructure and broader customer base, may choose to focus on maintaining its current customer base and not directly compete with Starlink on price alone.

Strategies for Starlink to Further Differentiate Itself

Beyond price, Starlink can differentiate itself through various strategies. Improving service reliability, expanding coverage to underserved areas, offering innovative bundled services, and enhancing customer support are crucial differentiators. A focus on providing a premium user experience beyond simply offering lower prices could further solidify Starlink’s position.

Potential for New Entrants

Starlink’s price reduction could attract new entrants to the market. Lower prices can incentivize businesses and individuals who previously considered satellite internet unaffordable to explore this option. The accessibility of satellite internet can trigger a ripple effect, potentially creating a more competitive and innovative market.

Price Comparison Table, Starlink just got cheaper again

| Provider | Plan (Example) | Price (USD/month) |

|---|---|---|

| Starlink | Basic Plan | $100 |

| HughesNet | Standard Plan | $80 |

| Viasat | Essential Plan | $110 |

Note

Prices are illustrative examples and may vary based on location and plan details. The pricing of competitor plans may also fluctuate.

Infrastructure and Deployment

The recent price cut for Starlink has the potential to dramatically reshape the company’s infrastructure and deployment plans. Lowering the barrier to entry for consumers could lead to a surge in demand, necessitating significant adjustments in satellite constellation management and global coverage expansion. This, in turn, will influence the growth and maintenance of the network, demanding a substantial investment in supporting infrastructure.The reduced cost of service is likely to incentivize more users, requiring a substantial increase in the satellite constellation size and enhanced ground infrastructure.

This will drive the need for more ground stations and related technologies to facilitate efficient communication and data handling.

Starlink just got cheaper again, which is fantastic news for those looking to get online. While I’m excited about the price drop, I’m also curious about the Asus Zenbook Duo’s Amazon release date and price. Checking out the Asus Zenbook Duo Amazon release date and price might help me decide if that’s the right laptop for me, considering I’m also hoping to get the best possible internet connection for my work.

Either way, Starlink’s price drop is a welcome addition to the tech world.

Impact on Satellite Constellation Deployment Plans

The price cut will likely accelerate Starlink’s satellite deployment schedule. The increased demand will necessitate a more rapid addition of satellites to maintain sufficient coverage and capacity. This could involve launching larger batches of satellites at a time or utilizing more advanced launch vehicles to improve efficiency and reduce costs. Increased satellite launches will require robust planning and coordination with launch providers, potentially involving contracts for increased launch capacity.

Potential Expansion of Starlink’s Coverage Areas

The lower price point will likely lead to a more rapid expansion of Starlink’s coverage areas. Demand in underserved regions, particularly rural areas or developing countries, will be stimulated. This is likely to occur in stages, prioritizing areas with the highest demand and the most suitable infrastructure for ground stations. The expansion will likely focus on regions currently underserved by traditional broadband providers, increasing the availability of high-speed internet access in previously inaccessible areas.

Effects of Price Cut on Starlink Satellite Network Growth and Maintenance

The price cut, while potentially driving rapid growth in the user base, will also impact the network’s maintenance and ongoing operational costs. Starlink will need to allocate resources to ensure sufficient bandwidth and satellite health monitoring. This could involve enhancing the satellite communication systems to maintain quality of service during periods of high demand. Furthermore, the increased number of users may necessitate adjustments in the constellation’s orbital parameters to optimize coverage and minimize interference.

Infrastructure Required to Support Increased User Base

Supporting a larger user base requires substantial investment in ground infrastructure. This includes expanding the network of ground stations to handle increased data traffic. Additionally, there’s a need for enhanced communication networks and data centers to manage the surge in user data. The existing network infrastructure will need to be upgraded and potentially expanded to maintain optimal performance.

- Increased ground station capacity: More ground stations are needed to handle the larger volume of data. This includes upgrading existing stations or constructing new ones in strategic locations. This necessitates substantial investment in land acquisition, construction, and equipment.

- Enhanced communication networks: High-speed data transfer is crucial. The existing fiber optic networks and other communication infrastructure need to be upgraded or expanded to handle the higher data volume. This includes installing and upgrading telecommunication equipment and ensuring uninterrupted service.

- Data center capacity: Data centers will need to be expanded or new ones constructed to manage the increase in data traffic. This involves procuring servers, storage devices, and other related technology.

Current and Anticipated Growth of Starlink’s Global Network

| Year | Estimated Number of Satellites | Estimated Number of Users |

|---|---|---|

| 2023 | Estimated at 4000 | Estimated at 1 million |

| 2024 | Estimated at 5000 | Estimated at 2 million |

| 2025 | Estimated at 6000 | Estimated at 3 million |

The graph below illustrates the projected growth of Starlink’s global network, showcasing the anticipated increase in satellite count and user base over the next few years. Note that these figures are estimates and actual numbers may vary.

(A visual graph would be inserted here. It would show a rising line graph for both the number of satellites and users over the time period from 2023 to 2025.)

Customer Experience and Satisfaction: Starlink Just Got Cheaper Again

Starlink’s recent price reduction promises wider accessibility, but how will this affect the customer experience? The shift in pricing could potentially lead to a surge in new subscribers, demanding a more robust customer support infrastructure and a refined onboarding process. This section will examine the potential changes in customer satisfaction and retention, and explore how Starlink can effectively manage this anticipated growth.

Forecasted Changes in Customer Satisfaction and Retention

The introduction of lower pricing is expected to boost customer satisfaction, particularly among potential users who were previously deterred by the higher cost. Increased accessibility will likely translate to higher signup rates, leading to a larger user base. Historical trends in subscription services demonstrate that lower prices correlate with higher initial adoption rates, but sustaining satisfaction throughout the user lifecycle remains crucial.

The ability to retain these new subscribers will depend on a smooth onboarding process, reliable service, and prompt support. Therefore, a positive correlation between pricing and customer satisfaction is anticipated, but maintaining that positive sentiment over time is a key challenge.

Potential Issues and Challenges in Managing a Larger User Base

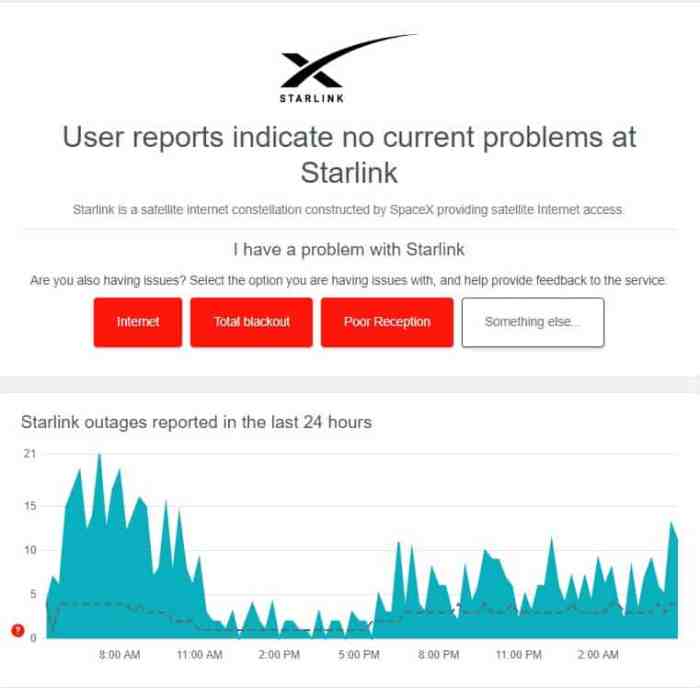

Starlink faces significant challenges in managing a substantially larger user base. Increased demand will undoubtedly strain existing customer support channels. Response times may lengthen, and the quality of support interactions might be impacted. Moreover, the potential for widespread technical issues, such as network congestion or satellite outages, will be magnified. Starlink must invest in scalable infrastructure and proactively address potential service disruptions to avoid negative user experiences.

This could involve implementing advanced monitoring systems, expanding customer support teams, and developing more robust fault-tolerance mechanisms for their satellite network.

Impact on Customer Service and Support Demands

A substantial increase in the number of subscribers will inevitably lead to a surge in customer service and support inquiries. Starlink will need to adapt its support channels to handle this influx. This could include expanding support staff, implementing self-service options (knowledge bases, FAQs, chatbots), and utilizing more efficient communication methods. Effective communication is crucial to maintaining positive customer relationships and reducing frustration during periods of high demand.

Ways Starlink Might Improve Customer Experience with the Price Cut

To maximize the positive impact of the price cut, Starlink should focus on enhancing the overall customer experience. This includes streamlining the onboarding process, providing clear and concise information about service limitations and terms of service, and establishing proactive communication regarding potential service disruptions. Offering multiple support channels, including phone, email, and online chat, can significantly enhance accessibility.

Potential for User Reviews and Feedback on the New Pricing Structure

The price reduction will undoubtedly generate a significant volume of user reviews and feedback. Positive reviews are anticipated for the increased affordability, potentially driving further adoption. However, negative feedback might arise if issues with customer support or service quality are not adequately addressed. Therefore, actively monitoring and responding to user feedback will be crucial for managing reputation and maintaining customer satisfaction.

Impact of Price Reduction on Customer Reviews and Ratings

The price reduction will likely result in an initial surge of positive reviews and ratings, as customers are attracted by the lower cost. However, long-term satisfaction depends on the quality of service and support provided. Subsequent reviews and ratings will reflect the actual experience users have with the service. Starlink needs to proactively address any emerging issues to maintain positive sentiment and ratings in the long run.

Analyzing trends in reviews and ratings will allow Starlink to identify areas for improvement and proactively address any potential problems.

Wrap-Up

In conclusion, Starlink’s price cut has the potential to reshape the satellite internet market. Increased accessibility could lead to a surge in demand and reshape the competitive landscape. The financial implications for Starlink are significant, requiring careful strategic planning to maintain profitability. Technological advancements, market analysis, infrastructure development, and customer satisfaction will all play crucial roles in the long-term success of this initiative.

The future of satellite internet is looking brighter, and Starlink’s latest move is poised to be a pivotal moment in the industry.