WhatsApp cryptocurrency payments US are gaining traction, but what’s the current reality? This post delves into the evolving landscape of crypto payments on WhatsApp in the US, examining its history, technical aspects, user adoption, market trends, potential use cases, and the hurdles that lie ahead. We’ll explore the legal and regulatory framework, the security considerations, and ultimately, whether this integration is truly viable.

The integration of cryptocurrencies into messaging platforms like WhatsApp presents a unique opportunity to revolutionize financial transactions. However, the current regulatory landscape, coupled with the inherent volatility of cryptocurrencies, creates both potential benefits and significant challenges. This in-depth look will analyze the complexities and potential impact on the US market.

Overview of WhatsApp Cryptocurrency Payments in the US

WhatsApp, a ubiquitous messaging platform, has not yet integrated cryptocurrency payment functionalities in the US. While the platform has explored such integration globally, there’s currently no active service for cryptocurrency transactions within the US WhatsApp ecosystem. This lack of integration reflects a complex interplay of technological, regulatory, and security considerations.The history of cryptocurrency payment integration attempts on WhatsApp is largely one of exploration and eventual shelving of specific projects.

Several factors, including regulatory uncertainty and the inherent complexities of managing cryptocurrencies within a messaging platform, have played significant roles in these decisions.

Current State of Cryptocurrency Payments on WhatsApp in the US

Currently, WhatsApp does not support any cryptocurrency payments within the US. Users cannot send or receive cryptocurrencies through the platform. This absence contrasts with WhatsApp’s broader global reach, where some experimentation with cryptocurrency integration has occurred.

History and Evolution of Cryptocurrency Payment Integration Attempts on WhatsApp

WhatsApp’s exploration of cryptocurrency integration has been limited and largely confined to pilot programs and research phases. There have been no publicly announced or implemented cryptocurrency payment services within the US WhatsApp ecosystem. This contrasts with other messaging platforms and financial services companies that have explored similar avenues.

Key Players and Stakeholders Involved

The key players in the cryptocurrency payment space within the US, including WhatsApp, are affected by various stakeholders. These include regulatory bodies like the SEC and FinCEN, which have oversight over financial transactions, including those involving cryptocurrencies. Cryptocurrency exchanges and wallets, along with their respective stakeholders, are also key players. WhatsApp, as a platform, is also impacted by these factors.

Comparison of Supported Cryptocurrency Payment Methods

| Cryptocurrency | WhatsApp Support |

|---|---|

| Bitcoin (BTC) | No |

| Ethereum (ETH) | No |

| Tether (USDT) | No |

| Other Cryptocurrencies | No |

No cryptocurrency payment methods are currently supported on WhatsApp within the US.

Legal and Regulatory Landscape Surrounding Cryptocurrency Payments on WhatsApp in the US

The legal and regulatory landscape surrounding cryptocurrency payments in the US is complex and evolving. Regulations are not always clear or consistent, and the specific application of these regulations to a messaging platform like WhatsApp adds another layer of complexity. The US Securities and Exchange Commission (SEC) and the Financial Crimes Enforcement Network (FinCEN) have significant roles in shaping the legal framework for cryptocurrency transactions.

| Regulatory Body | Impact on WhatsApp |

|---|---|

| SEC | SEC regulations on securities and investment products can affect the type of cryptocurrencies that might be handled through a platform like WhatsApp. |

| FinCEN | FinCEN regulations on money laundering and KYC/AML (Know Your Customer/Anti-Money Laundering) compliance are likely to impact the way any cryptocurrency transaction through WhatsApp would be handled. |

| Other Regulatory Bodies | Various other state and federal regulations will also play a role, but these would be secondary in nature to the SEC and FinCEN. |

The absence of WhatsApp cryptocurrency payments in the US reflects the need for clearer regulatory guidance and the technological challenges involved in securely integrating cryptocurrency transactions into a messaging platform.

Technical Aspects of WhatsApp Cryptocurrency Payments

Integrating cryptocurrency payments into WhatsApp presents a complex array of technical challenges. While the potential for widespread adoption is significant, overcoming these hurdles will be crucial for success. The existing WhatsApp infrastructure, optimized for text and voice communication, requires substantial modification to handle the complexities of crypto transactions. This includes robust security measures, efficient transaction processing, and seamless user experience.

Technical Challenges and Limitations

Implementing cryptocurrency payments within WhatsApp’s existing framework presents numerous technical obstacles. These challenges stem from the decentralized nature of cryptocurrencies, the need for secure storage and transfer of sensitive data, and the varying technical capabilities of different users. Interoperability between different cryptocurrencies and existing payment systems is also a critical consideration. The need to ensure compatibility across various devices and operating systems adds further complexity.

Security Considerations and Risks

Security is paramount in any cryptocurrency payment system. Integrating crypto payments into WhatsApp necessitates robust security measures to protect user funds and personal information. Potential risks include unauthorized access to user accounts, fraudulent transactions, and vulnerabilities in the underlying cryptographic protocols. Protecting against these risks requires sophisticated security measures, including multi-factor authentication, encryption protocols, and regular security audits.

Architecture of a Potential Cryptocurrency Payment System

A potential cryptocurrency payment system on WhatsApp would require a layered architecture. The first layer would involve a secure wallet integration within the WhatsApp application. This wallet would facilitate secure storage and management of cryptocurrencies. The second layer would encompass a transaction processing engine. This engine would be responsible for verifying transactions, ensuring compliance with the underlying blockchain protocol, and executing the transfers.

A third layer would connect to external cryptocurrency exchanges and networks to facilitate transactions and settlements. This layered approach ensures a secure and efficient payment system.

Required Technical Infrastructure

The technical infrastructure for facilitating cryptocurrency transactions on WhatsApp would be extensive. This includes secure servers to handle transaction processing, robust communication channels for secure data transfer, and mechanisms for handling large volumes of transactions. Scalability is a critical factor, ensuring the system can handle increasing user demand without compromising performance or security. Integration with existing payment infrastructure and blockchain networks would also be crucial for a seamless user experience.

Security Protocols and Encryption Methods

Implementing a secure cryptocurrency payment system necessitates robust security protocols and encryption methods. A table outlining potential options is provided below.

| Security Protocol | Encryption Method | Description |

|---|---|---|

| TLS/SSL | AES-256 | Provides secure communication channels between the WhatsApp application and the payment system servers. |

| Blockchain-specific cryptography | ECDSA, EdDSA | Ensures secure transaction verification and prevents double-spending. |

| Multi-factor Authentication (MFA) | One-time passwords, biometrics | Adds an extra layer of security to user accounts, mitigating unauthorized access. |

Implementing these protocols and methods will be crucial for ensuring the security and reliability of cryptocurrency payments on WhatsApp. The choice of specific protocols should be based on factors such as transaction volume, security requirements, and regulatory compliance.

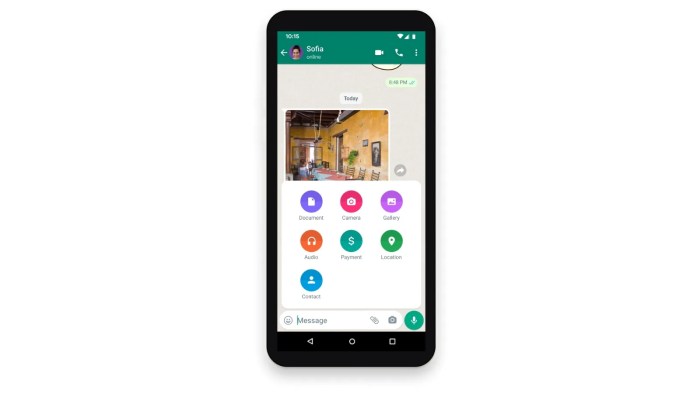

User Experience and Adoption

WhatsApp’s potential integration of cryptocurrency payments in the US presents a unique opportunity and a set of challenges for user experience and adoption. Successfully navigating these factors will be crucial for the platform’s success in this burgeoning market. This section explores the anticipated hurdles and advantages, focusing on user needs and pain points, comparing experiences with similar features, and outlining potential use cases and user personas.The ease of use and security of cryptocurrency transactions will significantly influence user adoption.

Understanding user needs and addressing potential pain points is vital for a smooth transition. A well-designed user interface and comprehensive support system are essential to ensure users feel comfortable and confident using this new feature.

Potential User Experience Challenges

The complexity of cryptocurrency, including concepts like wallets, transaction fees, and different cryptocurrencies, could pose a significant barrier for some users. Explaining these concepts clearly and concisely within the WhatsApp interface is essential. A user-friendly interface is crucial to make the feature accessible to a broader range of users, including those unfamiliar with cryptocurrency.

Potential User Experience Benefits

Simplified cryptocurrency transactions within a familiar platform like WhatsApp can significantly improve user experience. The seamless integration with existing messaging features will likely boost user adoption. This approach can also foster broader adoption of cryptocurrency payments in the US.

Potential User Needs and Pain Points

Users may need clear and concise explanations of cryptocurrency concepts within the app. A dedicated support system for resolving technical issues is essential. Users might also need help understanding different cryptocurrency types and their value fluctuations. Providing clear information about transaction fees and security measures is paramount.

Comparison with Similar Payment Features on Other Platforms

Analyzing the adoption patterns of similar payment features on other platforms, such as peer-to-peer payment apps, reveals key insights. The success of these features often hinges on intuitive interfaces, robust security measures, and clear educational resources. These factors can influence the design and implementation of WhatsApp’s cryptocurrency payment feature.

Potential Use Cases in the US Market

In the US market, cryptocurrency payments on WhatsApp could be particularly useful for peer-to-peer transactions, online marketplaces, and small business transactions. A seamless payment experience could facilitate quick and secure transactions between individuals, potentially fostering greater financial inclusion.

User Personas for WhatsApp Cryptocurrency Payment Users

| User Persona | Description | Needs | Potential Challenges |

|---|---|---|---|

| Tech-Savvy User | Comfortable with technology and cryptocurrency concepts. | Intuitive interface, advanced options, quick transactions. | May require minimal support. |

| Intermediate User | Familiar with technology but needs clear explanations of crypto concepts. | Easy-to-understand explanations, step-by-step guides, secure platform. | Requires comprehensive educational resources and support. |

| Crypto-Curious User | Interested in cryptocurrency but lacks in-depth knowledge. | Basic explanations of crypto, clear tutorials, low-barrier entry. | Requires basic, easily accessible information about crypto. |

| Traditional Payment User | Preferring traditional payment methods, but open to new options. | Simple integration with existing systems, security assurances, clear fee structure. | Requires strong security guarantees and ease of use. |

Market Trends and Competition

The cryptocurrency and mobile payment sectors are experiencing rapid evolution, driven by factors like increased adoption, technological advancements, and regulatory changes. WhatsApp’s foray into cryptocurrency payments introduces a compelling new player to the already dynamic landscape. Understanding the current trends and competitive environment is crucial for assessing WhatsApp’s potential success.The cryptocurrency market is characterized by volatility and rapid innovation, while mobile payment systems are evolving from basic transactions to encompass a wider range of financial services.

This intersection presents both opportunities and challenges for WhatsApp, as it must navigate the complexities of integrating cryptocurrencies with its existing mobile platform.

Current Market Trends

The cryptocurrency market has seen significant growth in recent years, attracting both institutional and individual investors. Adoption of cryptocurrencies for everyday transactions, though still limited, is increasing, especially among younger generations. Mobile payment platforms are increasingly offering integrated cryptocurrency functionalities, highlighting the growing demand for seamless crypto transactions. The trend towards decentralized finance (DeFi) is also shaping the landscape, as users seek more control over their financial assets.

Competitive Landscape

The competitive landscape for cryptocurrency payments in the US is highly fragmented, with numerous players vying for market share. Established mobile payment providers like Venmo, Zelle, and PayPal already offer limited cryptocurrency support, while specialized crypto platforms like Coinbase and Gemini cater to a more focused user base. The entry of a large platform like WhatsApp into this arena will undoubtedly reshape the dynamics, as it leverages a vast user base and established infrastructure.

WhatsApp cryptocurrency payments in the US are gaining traction, but navigating the complexities of digital finance requires careful consideration. With the recent addition of a fact-checking label to Bing search results, bing fact check label added search results users can hopefully better discern credible information from potentially misleading content. This development could ultimately impact how users approach information related to cryptocurrency transactions on WhatsApp, encouraging a more discerning approach to these financial instruments.

Emerging Trends and Innovations

Emerging trends include the development of stablecoins, which aim to mitigate the volatility of cryptocurrencies. The growing interest in decentralized exchanges (DEXs) allows users to trade cryptocurrencies directly without intermediaries. Moreover, the integration of blockchain technology into existing financial systems is steadily gaining momentum.

WhatsApp cryptocurrency payments in the US are definitely gaining traction, but imagine a future where instant, secure transactions are as simple as using a Google Star Trek communicator. That futuristic vision might not be too far off, and the potential for seamless digital transactions, like those offered by WhatsApp, is certainly exciting. Ultimately, the accessibility and speed of these new payment methods could revolutionize the way we handle money.

Comparison of Mobile Payment Platforms

| Feature | Venmo | Zelle | PayPal | Coinbase | Gemini |

|---|---|---|---|---|---|

| Cryptocurrency Support | Limited | Limited | Limited | Extensive | Extensive |

| Transaction Speed | Fast | Very Fast | Fast | Variable | Variable |

| Transaction Fees | Low | Low | Low (often) | Variable | Variable |

| User Base | Large | Large | Very Large | Large | Medium |

| Security Measures | Robust | Robust | Robust | Robust | Robust |

The table above provides a snapshot of the features offered by prominent mobile payment platforms in the US. Note that features and fees can vary, and specific functionalities may differ based on user location and account types.

Potential Impact of Regulatory Changes, Whatsapp cryptocurrency payments us

Regulatory changes in the cryptocurrency market can significantly impact the competitive landscape. Clarity on the legal status of cryptocurrencies and the regulations surrounding their use in payments will influence adoption rates and business models. For example, if stricter regulations emerge regarding cryptocurrency transactions, this could affect the accessibility and usage of cryptocurrencies through mobile platforms. The impact of such changes will be felt across the entire sector, shaping the future of cryptocurrency payments.

Potential Use Cases and Benefits

WhatsApp cryptocurrency payments in the US hold significant potential for revolutionizing how people and businesses interact financially. This innovative feature could streamline transactions, fostering greater accessibility and efficiency across various sectors. By leveraging the widespread adoption of WhatsApp, the platform can unlock new possibilities for cryptocurrency transactions.Integrating cryptocurrency payments into WhatsApp could significantly enhance the user experience, making financial transactions more seamless and accessible.

This feature could also potentially drive significant economic growth by encouraging broader participation in the cryptocurrency market.

WhatsApp cryptocurrency payments in the US are definitely a hot topic right now. Thinking about securely storing your crypto wallet details is crucial. If you’ve lost access to your Gmail account, remember that gmail accounts lost forgotten recovery how to can be a real lifesaver if you need to recover your wallet’s access information. Ultimately, robust security measures are key for any cryptocurrency transactions, especially when using them through WhatsApp.

Retail and E-commerce

Integrating cryptocurrency payments into WhatsApp could dramatically improve the customer experience for retail and e-commerce businesses. Customers could easily send and receive payments for goods and services directly within the app, eliminating the need for separate payment platforms. This streamlined process could reduce friction and increase transaction volumes. For example, a local artisan could accept cryptocurrency payments for handcrafted goods, expanding their reach to a broader customer base.

Peer-to-Peer (P2P) Payments

WhatsApp cryptocurrency payments could redefine peer-to-peer (P2P) transactions. Remittances, which are a crucial aspect of many cultures, would become significantly faster and cheaper, eliminating the often-high fees associated with traditional methods. This is particularly relevant for migrant workers sending money home.

Micro-payments and Subscriptions

The ability to conduct micro-payments and subscriptions within WhatsApp could have a profound impact on various sectors. Content creators could receive micro-payments for their work directly through the platform, allowing for greater monetization of content. This could lead to more accessible and engaging content for users. Similarly, subscription services, like online courses or premium content, could be facilitated, streamlining the payment process.

Real Estate Transactions

Cryptocurrency payments could potentially enhance the real estate sector by providing a secure and efficient method for handling transactions. The reduced processing time and lower transaction fees compared to traditional methods could make the process more attractive to both buyers and sellers. This could lead to a more dynamic and accessible market for property transactions.

Table: Potential Use Cases and Estimated User Benefits

| Use Case | Estimated User Benefit |

|---|---|

| Retail and E-commerce | Increased customer convenience, expanded reach for businesses, reduced transaction fees. |

| P2P Payments | Faster, cheaper remittances, greater accessibility for international transactions. |

| Micro-payments and Subscriptions | Improved monetization for content creators, easier access to subscription services. |

| Real Estate Transactions | Faster and cheaper transactions, reduced processing time, greater accessibility. |

Benefits for Businesses and Consumers

For businesses, WhatsApp cryptocurrency payments offer a lower-cost and faster alternative to traditional payment systems. This can lead to increased sales, reduced operational costs, and improved customer satisfaction. Consumers, on the other hand, benefit from the convenience and speed of transactions, lower fees, and increased accessibility to a broader range of payment options.

Potential Economic Impact

The introduction of WhatsApp cryptocurrency payments could have a positive impact on the US market by stimulating economic activity and fostering innovation. Increased accessibility to financial services could potentially benefit marginalized communities and individuals with limited access to traditional banking. The potential for growth in cryptocurrency adoption and use could also lead to a more dynamic and competitive financial landscape.

Potential Challenges and Concerns

Integrating cryptocurrency payments into WhatsApp presents a compelling opportunity but also introduces significant challenges. The decentralized nature of cryptocurrencies, coupled with the platform’s global reach, creates unique complexities regarding security, regulation, and user experience. Navigating these issues is crucial for successful implementation and widespread adoption.

User Fund Risks

The volatile nature of cryptocurrency markets poses a significant risk to user funds. Sudden price fluctuations can lead to substantial losses, particularly for users unfamiliar with the inherent risk of crypto investments. Furthermore, the potential for scams and fraudulent activities targeting WhatsApp users must be addressed. Security protocols must be robust and user education programs must be comprehensive.

Examples include the notorious cryptocurrency scams and the dangers of phishing attacks, where users are tricked into revealing private keys.

Data Security Concerns

WhatsApp’s handling of sensitive financial data, including cryptocurrency transaction details and user identities, is critical. Ensuring robust encryption and secure storage protocols is paramount to prevent unauthorized access and data breaches. A breach could expose users to identity theft, financial fraud, and reputational damage. The potential for malicious actors to exploit vulnerabilities in the system, similar to other platforms experiencing data breaches, must be considered.

Regulatory Hurdles and Compliance Issues

The regulatory landscape surrounding cryptocurrencies varies significantly across jurisdictions. Different countries have varying levels of clarity and regulation, creating complexities in compliance for WhatsApp. This presents a significant hurdle, as compliance requirements differ based on the legal frameworks of each user’s location. Moreover, evolving regulatory standards necessitate continuous monitoring and adaptation. Countries with stringent anti-money laundering (AML) regulations will pose particular challenges, requiring compliance measures to prevent illicit financial activity.

Impact on Financial Institutions

The integration of cryptocurrency payments into WhatsApp could disrupt traditional financial systems. Existing financial institutions may experience a loss of market share, particularly for peer-to-peer transactions. Competition from decentralized finance (DeFi) platforms could also increase. Financial institutions need to adapt and potentially explore partnerships with cryptocurrency platforms to remain competitive. The shift towards crypto-enabled payments could reshape the financial landscape, similar to the impact of online banking on traditional brick-and-mortar banks.

Potential Risks and Mitigation Strategies

| Potential Risk | Mitigation Strategy |

|---|---|

| Volatility of Cryptocurrency Prices | Provide clear disclosures about the risks associated with cryptocurrency investments. Offer educational resources to inform users about market volatility and potential losses. |

| Scams and Fraudulent Activities | Implement robust fraud detection systems. Educate users about common scams and provide support channels to report suspicious activities. Partner with law enforcement to combat fraudsters. |

| Data Security Breaches | Employ strong encryption protocols for all cryptocurrency transactions. Implement multi-factor authentication (MFA) for enhanced user security. Regularly audit security systems and conduct penetration testing. |

| Regulatory Compliance Issues | Establish a comprehensive compliance framework to address regulations in various jurisdictions. Maintain a close watch on evolving regulatory standards. Consult with legal experts to ensure compliance. |

| Disruption of Traditional Financial Systems | Collaborate with financial institutions to ensure a smooth transition and explore partnerships for mutual benefit. Develop user education programs to inform financial institutions and the public about the integration of cryptocurrencies. |

Conclusive Thoughts: Whatsapp Cryptocurrency Payments Us

In conclusion, WhatsApp cryptocurrency payments US represent a compelling, yet complex, proposition. While the potential for innovation and user-friendly transactions is undeniable, the practical implementation faces significant hurdles, particularly within the current regulatory climate. The future of this integration will depend heavily on regulatory clarity, robust security measures, and a smooth user experience that effectively addresses potential pain points. Ultimately, the success of WhatsApp cryptocurrency payments in the US hinges on navigating these challenges and building trust among users.