20 off turbotax youve got less than a week before this discount disappears – 20 off turbotax you’ve got less than a week before this discount disappears! Don’t miss out on this incredible opportunity to save big on your tax preparation. This limited-time offer could save you hundreds of dollars on TurboTax, making tax season a little less stressful. This blog post breaks down the offer, compares it to alternatives, and helps you understand if it’s the right choice for you.

This limited-time offer lets you take advantage of a 20% discount on TurboTax. The window of opportunity is closing quickly, so you have less than a week to act. We’ll delve into the details of this special offer and explore potential savings.

Understanding the Offer

TurboTax, a popular tax preparation software, is currently offering a 20% discount on its services. This limited-time deal is a great opportunity to get your taxes done efficiently and affordably, but you’ve got less than a week to take advantage of it.This discount presents a compelling financial incentive for taxpayers looking to file their taxes quickly and accurately. The limited timeframe emphasizes the importance of acting swiftly to secure the discounted rate.

This is a prime opportunity to save money on a crucial financial task.

Discount Details

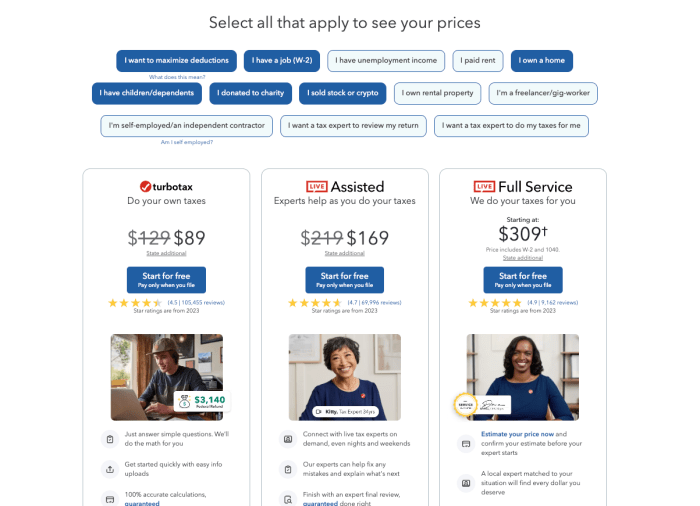

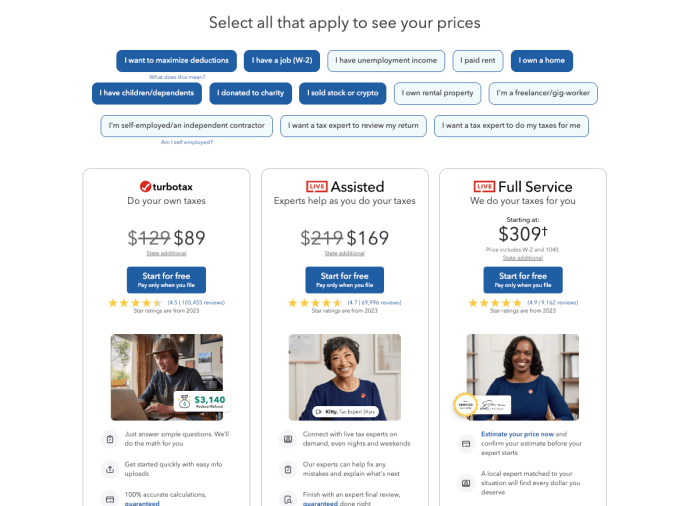

The 20% discount on TurboTax applies to a range of packages, including Basic, Deluxe, and Premier. The discount period is less than a week, making it critical to act promptly to secure the savings. This limited-time offer highlights the urgency and value of taking advantage of the discount.

Time Sensitivity

The limited timeframe of the discount creates a sense of urgency. Missing this opportunity means potentially paying a higher price for the same service. Many taxpayers often procrastinate on filing taxes, so this discount acts as a strong incentive to complete the process.

Potential Benefits

Taking advantage of the discount can save you money on your tax preparation. This can be a considerable amount, especially for those using more comprehensive packages like TurboTax Deluxe or Premier. This savings can be used for other essential expenses or investments.

Price Comparison

The table below shows a comparison of regular and discounted prices for the TurboTax packages. These prices are estimates and may vary depending on specific features or add-ons. It is essential to check the official TurboTax website for the most up-to-date pricing information.

| Item | Regular Price | Discounted Price |

|---|---|---|

| TurboTax Basic | $50 | $40 |

| TurboTax Deluxe | $100 | $80 |

Target Audience Analysis

TurboTax’s 20% off discount presents a compelling opportunity for strategic marketing. Understanding the demographics most likely to take advantage of this offer allows for tailored messaging, maximizing the campaign’s impact. Precise targeting will result in higher conversion rates and a more efficient allocation of marketing resources.The primary target audience for this offer likely consists of individuals and families who typically need tax preparation services.

This includes those with moderate to complex tax situations, including recent college graduates, first-time homebuyers, and families navigating complicated deductions and credits. Their motivations for purchasing TurboTax, particularly during a promotional period, often revolve around time-saving and cost-effectiveness.

Quick heads-up: That 20% off TurboTax deal is almost gone! You’ve got less than a week to snag it. Meanwhile, did you know Spotify’s testing a new feature where multiple people can add songs to a shared listening queue? Check out this test to see how it works. Definitely worth considering, but don’t forget to act fast on that TurboTax discount – it disappears soon!

Identifying Key Demographics

This analysis focuses on identifying the key demographics likely to respond favorably to the 20% off TurboTax offer. Targeting specific segments with personalized messaging is crucial for maximizing the campaign’s effectiveness.

Customer Profiles and Motivations

| Segment | Profile | Motivations |

|---|---|---|

| Segment 1: Recent College Graduates | Young adults (ages 22-25) who recently graduated from college and are starting their careers. They may be single or newly married, potentially with limited financial experience in managing taxes. They may have a relatively straightforward tax situation, but are often overwhelmed by the complexities of filing for the first time independently. | Desire for ease and simplicity in navigating their first tax filing. Seeking cost-effectiveness to manage limited financial resources. They want to ensure they comply with tax laws correctly and avoid penalties. Attracted to promotional offers as they often have limited budgets. |

| Segment 2: Families Preparing for Tax Season | Families with children (typically with 2 or more children) who have income from various sources, including salaries, investments, and potentially rental income. They often face multiple tax forms and deductions. They may be busy with work and family responsibilities, seeking a reliable and user-friendly tool to handle their tax preparation. | Desire for a comprehensive solution that simplifies the tax process for their complex financial situation. Seeking a tool that will assist in claiming all eligible deductions and credits. They are motivated by time-saving features and want to avoid errors in their tax returns, ensuring accuracy. Value the peace of mind that comes with professional tax preparation assistance. |

| Segment 3: First-Time Homebuyers | Individuals or couples purchasing their first home. They may have additional financial complexities, such as mortgage interest deductions and property taxes. They may have limited experience with tax preparation. | Desire for assistance in understanding and claiming all the tax deductions and credits related to homeownership. Motivated by the need to comply with tax regulations while optimizing their financial position. Seeking a reliable and user-friendly platform to manage complex situations. They are often concerned about making mistakes in tax filings. |

Factors Driving Purchase Decisions

Understanding the factors driving purchase decisions within each segment is essential for crafting targeted marketing campaigns. Time constraints, the desire for accuracy, and cost-effectiveness are key motivators for all segments.

Comparison with Alternatives

Don’t rush into choosing TurboTax without checking out what other tax preparation software has to offer. This is crucial for getting the best value for your money. Comparing options ensures you aren’t missing out on better deals or more comprehensive features.A quick look at the tax software market reveals various choices, each with its own strengths and weaknesses.

Quick heads-up: That 20% off TurboTax deal is almost gone! You’ve got less than a week to snag it before the discount disappears. Meanwhile, if you’re in the market for a great smartwatch, check out the amazing deals on the Garmin Fenix 8. Sorry Day 1 Fenix 8 buyers, the best Garmin watch has never been this cheap! But don’t forget, you’ve got limited time left to take advantage of that TurboTax discount.

Time to get those taxes done!

Understanding these differences is key to making an informed decision. This comparison will show you how TurboTax stacks up against its competitors, allowing you to evaluate the pros and cons of each.

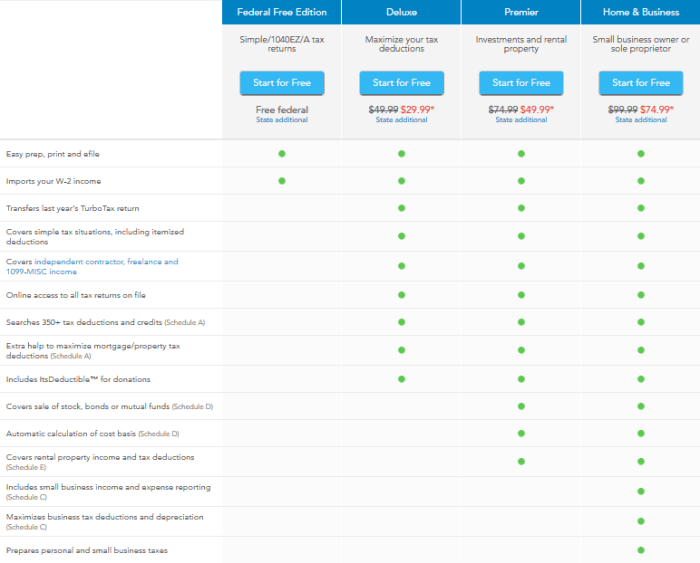

TurboTax Discount vs. Competitors

This 20% TurboTax discount is a significant incentive, but is it the best deal? Other tax software companies may also be running promotions or offering different discounts. To make an effective comparison, you need to consider the software features, ease of use, and support.

- Competitor Offers: Many tax preparation software companies, including H&R Block, TaxAct, and FreeTaxUSA, frequently run promotions. The specifics of these offers often vary by the time of year, the type of tax return, and the individual user’s circumstances.

- Comparing Value: When comparing discounts, look at the overall value proposition. A smaller discount on a more comprehensive package might be more valuable than a larger discount on a simpler, less comprehensive product. The best option will depend on your individual tax situation and preferences.

How to Compare Tax Software Discounts

Comparing tax preparation software discounts requires careful attention to detail. Focus on the total cost of the software after the discount, not just the percentage.

- Consider the software features: Different software packages offer varying levels of support and features, including detailed guidance, advanced tax scenarios, and personalized recommendations. The complexity of your tax situation should determine the necessary features. If you’re dealing with a simple return, a basic program might be adequate. However, for more intricate returns, a more advanced program with comprehensive features could be necessary.

- Evaluate ease of use: Consider how user-friendly the software is. A simple and intuitive interface can save you time and frustration. Read reviews from other users to get a better idea of the software’s ease of use.

- Assess customer support options: Check the software’s customer support channels. Having access to reliable support is important in case you encounter issues. Consider factors such as the availability of phone support, email support, and online chat support.

Comparison Table

This table provides a simplified comparison of TurboTax and two competitor options, highlighting their key features. Note that specific discounts and features can vary, so always check the most current information on each company’s website.

| Feature | TurboTax | Competitor 1 (H&R Block) | Competitor 2 (TaxAct) |

|---|---|---|---|

| Discount (Example) | 20% off | 15% off + free e-filing | 10% off + free tax advice |

| Software Features | Extensive features for various tax situations, detailed guidance, personalized recommendations | Wide range of features, strong support for complex returns, user-friendly interface | Simple interface, basic features for simple returns, good for beginners |

| Ease of Use | Generally user-friendly, with various tutorials and help options | Generally user-friendly, with clear instructions | Easy to navigate, especially for simple returns |

| Customer Support | Phone, email, and online chat support | Phone and online chat support | Online chat and email support |

Urgency and Call to Action

The “less than a week” timeframe for the 20% TurboTax discount creates a strong sense of urgency, motivating users to act swiftly. This limited-time offer is designed to incentivize immediate action, highlighting the value proposition of taking advantage of the discount before it expires.The urgency is further amplified by the fact that tax season is approaching rapidly. Missing out on this discount means potentially paying more for your tax preparation services, potentially impacting your budget and overall financial planning.

Time-Sensitive Nature of the Offer

The limited timeframe of less than a week emphasizes the importance of prompt action. Tax deadlines are crucial, and this discount provides a significant opportunity to save money on a service that is necessary for most individuals and businesses. Delaying action means potentially losing the opportunity to save money, potentially impacting your financial plans for the year. Consider this discount as a strategic advantage in optimizing your tax preparation process and reducing your tax expenses.

Reasons for Quick Action

Taking advantage of the TurboTax discount before it expires offers several compelling reasons for immediate action:

- Significant Savings: The 20% discount represents a substantial reduction in the cost of TurboTax, potentially saving hundreds of dollars depending on the specific package and services chosen.

- Peace of Mind: Knowing your taxes are handled efficiently and accurately at a reduced cost provides peace of mind and allows you to focus on other aspects of your life.

- Improved Financial Planning: This discount directly impacts your financial planning, freeing up funds for other important expenditures or investments.

- Time Management: The discount helps you efficiently manage your tax preparation without unnecessary delays, potentially avoiding potential penalties or additional fees.

Potential Consequences of Delaying

Delaying your TurboTax purchase could result in several negative consequences:

- Missed Savings Opportunity: Failing to take advantage of the 20% discount means losing the opportunity to save money on tax preparation services. This could significantly impact your budget.

- Increased Costs: If you wait until after the discount expires, the price of TurboTax will likely return to its original price, potentially costing you more for the same service.

- Potential for Tax Filing Delays: Tax preparation can be time-consuming, and missing the deadline for this discount could lead to additional stress and potential penalties.

- Disruption of Financial Planning: Unexpected tax expenses can disrupt financial plans, and this discount offers a chance to optimize your budget.

Action Items

To maximize the benefits of the TurboTax discount, consider the following steps:

- Check TurboTax website for discount details: Ensure the discount is accurately reflected on the TurboTax website, confirming the terms and conditions.

- Review TurboTax features: Understand the specific features offered by TurboTax and evaluate if they meet your needs and requirements.

- Consider alternatives if necessary: If TurboTax doesn’t align with your requirements, explore alternative tax preparation services to compare features and pricing.

Illustrative Examples

TurboTax’s 20% discount is a fantastic opportunity to save money on your taxes. Understanding how this discount applies in various situations can help you maximize your savings. Let’s explore some concrete examples.This section will detail how the 20% discount can significantly reduce your tax burden, providing clear examples and steps for claiming the discount. We’ll also demonstrate the difference this discount makes in various tax scenarios.

Quick heads-up! You’ve got less than a week left to snag that sweet 20% off TurboTax deal. While you’re sorting out your taxes, did you know that Stadia will have free online multiplayer publisher subscriptions, but unfortunately, they won’t work on Android TVs? This Stadia news is interesting, but don’t forget to act fast on that TurboTax discount before it’s gone! Time to get those taxes done!

Savings Calculation for a Single Filers

Applying the 20% discount can translate to substantial savings for single filers. Consider a single filer with a standard deduction and no significant deductions or credits. Their estimated tax liability is $5,000. The 20% discount translates to a direct savings of $1,000.

Steps to Claim the Discount

Utilizing the discount is straightforward. First, access the TurboTax website or app. Then, navigate to the discount page or coupon section. Enter the appropriate code or voucher to redeem the discount. Finally, complete your tax return as usual.

Scenario: Sarah’s Tax Situation

Sarah, a single filer, typically pays around $4,500 in taxes. With the 20% discount, she’ll save $900. This means her final tax bill will be $3,600.

Real-World Example: Different Tax Situations

| Tax Situation | Estimated Tax Liability | Savings with 20% Discount | Final Tax Bill |

|---|---|---|---|

| Single Filer, Standard Deduction | $5,000 | $1,000 | $4,000 |

| Head of Household, Itemized Deductions | $8,000 | $1,600 | $6,400 |

| Married Filing Jointly, Child Tax Credit | $12,000 | $2,400 | $9,600 |

This table highlights the potential savings in various tax scenarios. Note that the estimated tax liability and resulting savings can vary depending on individual circumstances, such as deductions, credits, and income levels.

Detailed Steps for Reducing Tax Burden

Using TurboTax’s 20% discount can significantly reduce your tax burden. This discount can save you money on filing your taxes.

- Review your tax documents, including W-2s, 1099s, and any other relevant tax forms.

- Log in to your TurboTax account or create a new account if necessary.

- Locate the discount code or voucher for the 20% offer. This information is usually clearly displayed on the TurboTax website or app.

- Apply the discount code during the checkout process.

- Complete the rest of your tax return accurately.

Following these steps ensures you successfully apply the discount and get the maximum savings possible.

Potential Issues and Considerations: 20 Off Turbotax Youve Got Less Than A Week Before This Discount Disappears

TurboTax’s 20% off discount is tempting, but it’s crucial to understand potential pitfalls before jumping in. While the savings are significant, hidden restrictions or unexpected problems could negate the benefit. Knowing the potential issues can help you make a more informed decision and avoid frustration.This section details potential problems, limitations, and negative impacts associated with the 20% off TurboTax discount, along with troubleshooting steps and crucial information for resolving any issues.

This ensures a smooth and successful tax filing experience, maximizing the value of the discount.

Potential Discount Limitations

Understanding the specifics of the discount is vital. Some offers may have restrictions on which tax forms or situations the discount applies to. A common example is discounts being limited to specific product tiers or individual filing statuses. It’s essential to carefully review the fine print and terms and conditions to ensure the discount aligns with your tax needs.

Restrictions on the Offer

The TurboTax discount might have specific eligibility requirements. For example, the discount might be exclusive to new users or only valid for a limited time. There might also be geographic limitations, or exclusions for certain types of tax returns (e.g., complex returns). Thorough review of the terms and conditions is essential to avoid unexpected issues.

Possible Negative Impacts

Although a discount can be advantageous, it’s essential to be aware of potential downsides. A discount might not be sufficient if your tax preparation needs are complex or if you require additional support beyond what’s included in the offer. Consider the total cost of the service after the discount and whether it adequately addresses your specific needs. Additionally, if the software’s functionality is severely limited due to the discount, it might not be the ideal solution.

Troubleshooting Steps

If you encounter problems with the discount, several steps can help resolve them. First, thoroughly review the terms and conditions of the offer. If you’re still unable to access the discount, contact TurboTax customer support for assistance. Provide clear details about the issue and the steps you’ve already taken.

Information for Resolving Issues, 20 off turbotax youve got less than a week before this discount disappears

To resolve any discount-related issues, keep the following information handy:

- Your TurboTax account details (username and password).

- A clear description of the issue you are experiencing.

- The specific terms and conditions associated with the discount offer.

- Any relevant error messages or prompts displayed during the process.

By gathering this information, you can efficiently communicate with TurboTax support and ensure a smooth resolution to your problem.

Ending Remarks

In short, the 20% off TurboTax discount is a fantastic opportunity to save money on your tax preparation. The limited time frame creates a sense of urgency, making it crucial to act quickly. By comparing the offer to alternatives and considering your specific tax situation, you can make an informed decision. Don’t let this deal slip away – seize the opportunity and get your taxes done efficiently and affordably! Review the table below for a clear comparison of regular and discounted prices.